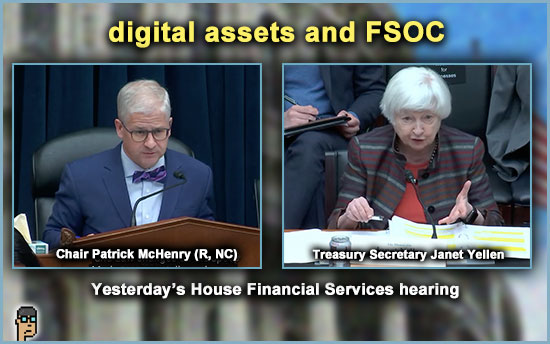

Today’s House Financial Services hearing, “The Annual Report of the Financial Stability Oversight Council (FSOC)” brought Treasury Secretary Janet Yellen (D) to Capitol Hill for a rare chance to hear directly from the Secretary on what may threaten the United States financial system.

Committee members spoke to issues important to their purview – including digital assets – during questioning of the Secretary. Republican members generally believe that FSOC has become a roving regulator unto itself.

Currently, FSOC is comprised of all the U.S. financial system regulators and fulfills the requirements of “Dodd-Frank,” a law which came out of the Great Financial Crisis and meant to ensure that the seeds of the 2008-2009 crisis would never happen again.

digital asset highlights

Though the hearing was broad in its FSOC scope – covering everything from artifical intelligence and its impact on the financial system to climate change to Basel III endgame – digital assets was a featured talking point.

There were no real “digital asset” surprises as Secretary Yellen reiterated the need for the “federal floor” for stablecoin legislation – meaning the Federal Reserve must have the last word on the issuance of any dollar-backed stablecoin and with no parallel state rights.

Also, overall, Yellen expressed a need for regulation of digital asset markets – though it wasn’t clear that she supported House Financial Services’ and House Agriculture’s digital asset market structure bill.

HFS Committee members who questioned the Secretary about digital assets included:

-

- HFS Chair Patrick McHenry (R, NC)

- HFS Vice Chair Rep. French Hill (R, AR)

- Rep. Brad Sherman (D, CA)

- Rep. Warren Davidson (R, OH)

- Rep. Ritchie Torres (D, NY)

Scroll down for more…

Chair Patrick McHenry (R, NC)

The question-and-answer session early in the hearing between Secretary Yellen and HFS Chair Patrick McHenry (R, NC) began the discussion on digital assets . (Read McHenry’s opening statement.)

on the need for digital assets legislation

Chair McHenry: “This committee has produced two bipartisan bills: one on stablecoins, one on market structure regulating the spot market of digital assets and provide this clarity between the CFTC and the SEC. You testified that FSOC’s view is that we need federal law and law changes on the spot market. Can you tell us why that’s FSOC belief?”

Secretary Yellen: “There are many areas with respect to digital assets where we do have clear regulatory authority, but we’ve identified some gaps where – for consumer investor protection and to address financial stability risk – it would be very useful for Congress to take action to fill those gaps.”

“And the CFTC, for example, doesn’t have supervisory or regulatory authority with respect to spot markets and commodities like Bitcoin. So that’s a regulatory gap. Furthermore, stablecoins pose risks to the financial system that both FSOC and the President’s Working Group on Financial Markets have identified as potentially becoming significant over time. We would very much welcome an effort by Congress to create a regulatory framework that would be appropriate to address those risks.”

on stablecoin legislation requirements

Chair McHenry: “So stablecoins are now being regulated by the states. New York has a very resilient regime. Are you suggesting something like the New York regime would be applicable to fix this problem?”

Secretary Yellen: “FSOC believes that it’s critical for there to be a federal regulatory floor that would apply to all states and that the federal regulator should have the ability to decide if a stablecoin issuer should be barred from issuing such an asset.”

“Also, we believe that because wallets are a critical part of the stablecoin ecosystem, and we’ve seen many instances in which there have been significant losses, that it’s critical to enact regulatory protections for holders of wallets.”

on market structure legislation

Chair McHenry: “So back to the spot market, though. In your report, you state clearly that we need to change law for us to have proper regulation of the digital asset spot market. Is that correct?”

Secretary Yellen: “That’s a recommendation.”

on SIFI (systemically important financial institution) designation for non-banks

Chair McHenry: “Let’s go to the broader set, not the emerging issues, but in November FSOC issued its final guidance on non-bank designation. Are there firms that FSOC has identified that are being analyzed right now for designation?”

Secretary Yellen: “Well, I don’t think it’s appropriate for me to talk about individual firms. We’ve certainly not reached a stage at which the Council is taken any action or received recommendations with respect to designation.”

“We did put out, as you mentioned, revised guidance pertaining to non-bank designations and we published an analytic framework, but we wanted to make sure that our entire toolkit that Congress gave to FSOC is usable.”

“There are many tools in that toolkit. And the analytic framework recognizes that designation is only one of those tools. It’s not in any sense, the preferred tool. It really depends on the specifics of the financial stability risk.”

Chair McHenry: What many of us have highlighted is the fact that is such an opaque process that leads to greater instability greater uncertainty in the marketplace.”

HFS Vice Chair Rep. French Hill (R, AR)

on the need for digital asset legislation

Rep: Hill: “[Regarding] FSOC’s recommendations on stablecoins and the spot market, I was very pleased to hear your testimony on that, reiterating that Congress does need to take action there. And I’m proud to have worked with the chairman and my Democratic colleagues on bipartisan bills to do precisely that. With that said, Madam Secretary, as chair of FSOC, what have you done to encourage the SEC and the CFTC to work together in these areas to make these bills stronger and, you know, cooperate together to make our work here in Congress go more smoothly? Have you had a meeting with the chairman of the SEC about stablecoins and the digital assets regulatory framework?“

Secretary Yellen: “The President’s Working Group on Financial Markets produced a report…”

Rep. Hill: “Yes, Ma’am, we’ve read that report thoroughly, I’m talking about in recent months, since June and July last year, for example, when we marked up this bill in July, have you worked with the Chairman Behnam or Chairman Gensler on this legislation? Have you talked to them about it?”

Secretary Yellen: “I’ve talked to them often over the last couple of years about stablecoins. And I’m not sure if I’ve talked with them over the last couple of months on this topic, but we’ve had many, many conversations.”

on proposed rulemaking for crypto custody

Rep. Hill: “Another area that I think Chairman Gensler has stumbled is his proposal on custody, which the bank regulators like the Comptroller of the Currency and the Federal Reserve don’t support. Many of us on this committee are concerned about that. Do you support the SECs rule on custody as proposed?“

Secretary Yellen: “We have had some concerns about how it would impact banks, and that is something I’ve have discussed with the Chairman.”

on CFPB Director Rohit Chopra

Rep. Hill: “Thank you, Madam Secretary. Let me turn to the CFPB Director [Rohit] Chopra suggesting that FSOC use for the first time ever, Title 8 authority to address payment clearing and settlement activities. For example, he’s proposed considering designating certain non-bank payment platforms as systemically important do you support that?”

Secretary Yellen: “We have not taken a position on that. What what I’ve said is that I think it’s important for Congress to address this issue. We’ve made recommendations and we think that is by far the the preferred approach. And I’ve not looked into other alternatives. We stand ready to work on a bipartisan basis with you to take this on.”

Rep. Hill: “For example, would you agree with the Director that peer-to-peer payment activity or non-bank peer-to-peer payments represent financial stability risks to the financial system overall? Zelle, Venmo – do you think peer-to-peer payment systems present a financial stability risk to the system?”

Secretary Yellen: “I don’t believe that’s something that FSOC has highlighted…”

Rep. Hill: “What I want you to reflect on is… FSOC members may not be viewing the designation of a non-bank activity as really a last resort -that we have regulatory systems and other rules to handle that. And I think this is a particular case. For example. Do you think the Fed having been the Chair there has sufficient expertise, knowledge and supervisory authority to deal with companies in different industries like asset managers or cloud providers or big tech companies if they were to be designated under that sort of an idea?”

Secretary Yellen: “I do want to make clear that there’s no nothing about FSOC’s approach that places designation as a preferred approach. There are many tools and only certain situations in which it would be appropriate. Congress designated in Dodd-Frank that if a company whose material distress poses severe threats to financial stability, the Fed should be the regulator and I certainly remember from my time there when several insurance companies were designated…”

Rep. Brad Sherman (D, CA)

on digital assets and taxes

Later, Rep. Brad Sherman (D, CA) noted with the Secretary that digital asset taxation changes had not been made in the tax code. He was referring to the way in which a 30-day “wash sale” rule does not currently apply to digital asset transactions.

Rep. Warren Davidson (R, OH)

Rep. Warren Davidson (R, OH) spent much of his five minutes questioning the Secretary about digital assets.

on legislation

Rep. Davidson: “Do you believe it is appropriate for FSOC to list digital assets among its top priorities given the relative size of the market?”

Secretary Yellen: “The market is relatively small and I believe the Annual Report states that. The connections are not enormous to the banking system although ‘role’ involvement in digital assets does play some role in the banking problems we had last March -particularly with respect to Signature Bank and Silvergate. So, there are concerns along those lines. There is potential, for example, for stablecoins we’ve we’ve made recommendations to Congress requiring regulation. Stablecoins – there is no appropriate regulatory framework…”

Rep. Davidson: “We’ve certainly been working on that. Be great to get it across the finish line.”

Secretary Yellen: “I appreciate that. And we’ve tried to work on a bipartisan basis with the Committee to see legislation enacted.”

Rep. Davidson: “So, the concern would be that there’s some systemic risk to the market because of the introduction of digital assets and you referenced Silvergate. They posed a systemic risk to the market. In fact, they wound down in a very orderly fashion with no risk to the market, not true of Silicon Valley Bank. But that was interest rate risk, not digital assets. Signature [Bank] on the other hand… there was an FSOC meeting on Saturday and on Sunday, the assets of Signature Bank were seized. And former Congressman Barney Frank whose portrait hangs right there – former Chairman of this committee – said that it was because they were banking crypto not because they were insolvent. Is there a coordinated effort because there’s a disfavored industry like digital assets, or is there a coordinated effort because there’s actually systemic risk?”

Secretary Yellen: “FSOC has recommended to Congress, that stabecoins require a regulatory framework. No stablecoin at this point may yet have achieved the scale that would pose a systemic risk. But, certainly that could happen if a stablecoin were widely used for payments, and you have the classic run risk that’s associated with that if the stablecoin proceeds are not invested in a secure and utterly safe manner. We’ve seen this happen with similar types of… it’s essentially a banking type of [practice]…”

Rep. Davidson: “It’s not fractional reserve banking, and those banks are regulated. Stablecoins, certify that they have $1 of government backed securities for $1 of tokens issued.”

Secretary Yellen: “They don’t always certify that.”

Rep. Davidson: “The three that are regulated in the United States by the New York Department of Financial Services – or four actually – do certify that. They are state-regulated. The one that doesn’t – that the Treasury Department and others seem unwilling to address by providing clarity in our market – don’t certify that… Tether is a time bomb and it is offshore. And it’s the only thing functional frankly. Everyone is moving offshore because we can’t agree to regulate our own markets. And frankly, there are people that really would love to regulate the market. There just always seems to be an excuse not to.”

Rep. Ritchie Torres (D, NY)

on stablecoin regulation

During the 5 minutes of Q&A allotted to Rep. Ritchie Torres (D, NY), the Congressman asked one question about stablecoins.

Rep. Torres: “The [President’s Working Group] report proposes something resembling banking regulation for stablecoin issuers. Unlike a bank, a stablecoin issuer has no lending and no fractional reserves. And so if a stablecoin issuer operates differently from a bank, why not regulate it differently from a bank?”

Secretary Yellen: “Well, it perhaps it should be regulated differently from a bank, but, nevertheless, it’s necessary to regulate the risks to make sure that the deposits are channeled into safe assets. Perhaps the capital standard should be different and other features of its regulation should be appropriate and different. It’s something more like a narrow bank, but it should be regulated because it inherently has “run risk” very similar to a banking organization.