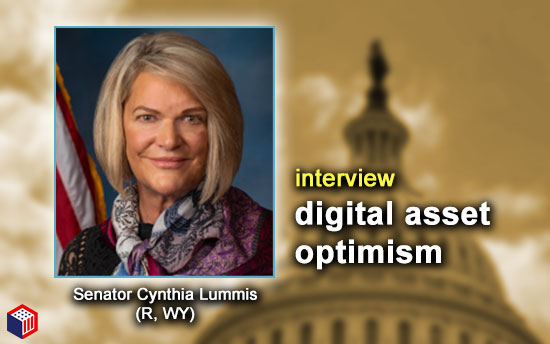

As Congress picks up speed this month in spite of election year hurdles, Senator Cynthia Lummis (R, WY) has been busy thinking about – and working on – next steps for digital assets legislation among the many initiatives and responsibilities she and her team oversee.

Her “Lummis-Gillibrand Responsible Financial Innovation Act” [S.2281] has been been a key, proposed framework for digital assets in the Senate and Congress.

The bill, first introduced in the 117th Congress, and updated for the 118th, is a comprehensive, digital assets regulatory framework co-sponsored by New York Democratic Senator Kirsten Gillibrand. “Lummis-Gillibrand,” as it is known, appears to have weathered the buffeting winds of FTX, a bear market, Congressional skepticism and the seemingly recalcitrant Securities and Exchange Commission (SEC) – to name a few.

Senator Lummis sat down with blockchain tipsheet at the Capitol today to discuss all things digital assets and Congress including:

-

- The Bitcoin ETF watershed moment

- State of digital assets legislation today

- Lummis-Gillibrand and funding regulation with “wash sale” rule

- Stablecoin bill update

- Reflections on the NDAA digital assets AML amendment

- Binance, Tether and illicit finance

- SAB 121 and next steps

The interview has been lightly edited for clarity.

blockchain tipsheet: Is the approval of Bitcoin spot market ETF’s a watershed moment for digital assets?

Senator Cynthia Lummis: I think it’s important because it gives consumers who are not ready to dive in with both feet – who are not ready to self-custody – exposure to Bitcoin through an exchange-traded fund, which is a very well known vehicle to get exposure to valuable assets.

It’s important for consumer assurance that this is an asset worth holding in a diverse asset allocation and that now they can have exposure to it without having to be an expert. [It also] helps integrate Bitcoin into the traditional asset management world. So, I do think it’s a watershed moment.

As it relates to Congress, is this perhaps a catalyst for Congress?

I hope so. I think it helps validate that Bitcoin is an asset that many Americans are going to hold, and that it’s time to have a regulatory framework that assures consumer protection and that the industry can remain in the United States and have a well-understood regulatory framework for those who wish to engage in digital asset commerce.

Any comment on the vote by SEC commissioners to approve the ETF applications? Chair Gensler voted in favor and the two Republican commissioners – does that 3-2 vote surprise you?

I’m not surprised about who voted for it. I am pleased that it received majority support. I have had conversations with Chairman Gary Gensler and Commissioner Hester Peirce. I know they’re working knowledge of Bitcoin, so I’m pleased that they chose to support it going forward as an asset worthy of investment and consumer protection and acknowledgement of the SEC. Clearly we have more work to do – both in Congress and at the SEC – to further develop understanding of digital assets and their utility.

One of the things that I hear from Members of Congress who are still skeptical but open-minded is that they don’t understand the use case for digital assets. I think that the Bitcoin ETFs will help flesh out the first, readily acknowledged, use case for digital assets among the traditional asset management world.

What is the state of digital assets legislation in Congress today?

The fact that the Lummus-Gillibrand bill has been out there, vetted, revised, and people on both sides of the aisle and Capitol have had exposure to it now, is helpful. There are other bills that take different approaches.

It now allows Members to begin to compare approaches. Lummis-Gillibrand is still the “gold standard” for legislative approaches because it is consistent with our traditional asset regulatory framework and just simply lays on top of it, so it’s familiar to people.

It incorporates the banking regulation AML (anti-money laundering), some KYC, anti-terrorism, finance, illicit funds – it’s a known quantity. It may be amended if other approaches want to integrate with our bill in a way that doesn’t disturb our fundamental approach of using the existing regulatory framework for assets and laying digital assets on top of it.

I see multiple possibilities.

One is breaking up Lummis-Gillibrand since it would have to be according to the jurisdictions of the committees that exist in the Senate and the House and pursue it à la carte. Or, it could be re-constituted so people can see it as one full piece as it moves through the system -and that remains to be seen.

We know that the Agriculture committees on the House and Senate sides are both interested in the commodities portion.

We know that the manner in which we have chosen to fund the regulatory personnel that will be necessary both to have Bitcoin and other compliant digital assets that fall into the definition of a commodity to be regulated at the Commodity Futures Trading Commission as well as those that are a security to be at the SEC. That will require additional personnel.

The means to fund it would be to change the “wash sale” rule that is currently used for digital assets to the rule that is used for traditional assets once again conforming to traditional asset frameworks. And people have been deferential in using that funding mechanism for the regulation of digital assets as is contemplated in Lummis-Gillibrand.

I think certain aspects of our bill have already been accepted, or at least adopted, in people’s minds as the appropriate way to go. We’re still negotiating on things like a stablecoin bill. I want to preserve the dual banking system model to roll out stablecoin legislation. So there is both a state banking regulator option and a federal charter option. So these are some of the things that we’re moving forward with.

Let’s dig into one of the offshoots of Lummis-Gillibrand -you’ve just mentioned one: stablecoins. Previously, Senator Gillibrand has talked publicly about the stablecoin bill that you all are working on. As you’ve referenced, it seems to come down to – as it did in the House Financial Services Committee – this pre-emptive versus parallel/”states rights” issue. There has been significant disagreement within the House Financial Services (HFS) Committee. Have you all found a solution to what HFS ran into?

We’re getting closer. Our staffs communicate on a regular basis and we remain very positive and hopeful that stablecoin legislation can move forward this year -in spite of it being an election year -and in spite of the abbreviated days in session that accompany election years. We think that so much progress was made at the end of last year, that there’s a very good chance for stablecoin legislation that has been thoroughly discussed on both sides of the Capitol and with both parties.

Another offshoot of Lummis-Gillibrand was what happened with NDAA and the digital assets AML amendment. Was it disappointing to not see that go through and what is the next step there with that initiative?

For me, it was very disappointing to see it not go through because it was a considerable step for Senator Gillibrand and I to have legislation that we could agree to with Senator [Elizabeth] Warren (D, MA) and Senator [Roger] Marshall (R, KS), and to get it incorporated into the NDAA.

We thought it was very appropriate that it was incorporated into the NDAA because we’ve seen examples of digital asset use in illicit finance. Binance and Tether were both identified as having a presence in funding Hamas, and although they’re not unique in that regard, there’s fiat currencies that play a much larger role in funding illicit finance efforts.

We want to make sure that the illicit finance laws apply to digital assets and that we have that tool available to our national security efforts to prevent illicit finance funding by digital assets.

It makes so much sense to regulate… and what I don’t understand, when I talk to my colleagues is, let’s regulate it so it’s not allowed to function offshore in an unregulated illicit manner. And that’s true whether we’re talking about FTX which was operating offshore to the detriment of consumer protection in the United States. That’s also true with regard to its use as a tool of illicit finance.

We need to regulate this. To say, “Hands off. This is bad,” is to ignore the reality of the ubiquitous use of digital assets around the world and the important role that the United States must play in our consumer protection and in keeping this asset class vibrant in the United States. That’s how we ensure that it is not used fraudulently and that it is not used to defraud consumers like FTX was. Regulate it, keep it on-shore and integrate it into a traditional economy.

You sent a letter on October 26 to Attorney General Merrick Garland on the Binance and Tether question on illicit finance. Did you hear back? Is there an outcome from that that you can share?

Binance – another offshore company – should be regulated. We did hear back from Tether. We’re working with Tether. They’re cooperative. Binance, as you know, was fined and its CEO removed from certain functions at Binance and may face incarceration – that was all appropriate. So I was very pleased, as was French Hill (R, AR) (who co-signed the letter) that the Justice Department acted expeditiously. And, and yet once again, I think that makes the case for why Lummis-Gillibrand is so important to pass.

On the Securities and Exchange Commission’s SAB 121, the GAO has said it was subject to Congressional review. What are next steps?

Yes, they’re absolutely correct. It has the qualities of a rule. So it should have gone through the APA rule-making process where it was publicly noticed, put out for public comment and adopted in accordance with rules.

We’ll be putting together a Congressional Review Act to conform to that point of view. And make sure that it goes through more formal rule-making. It’s incongruous in its result with the way the world functions – you don’t put a custodied asset on the custodians asset list. It belongs to the the person who owns the custodied asset.

To me, [SAB 121] is not even consistent with good practice. And so to have something inconsistent with good practice, adopted without compliance – with rule-making – is sort of “two strikes.”