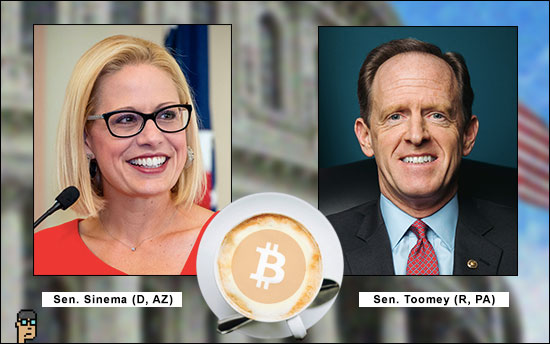

Purchasing a cup of coffee using Bitcoin triggers a capital gain whether crypto coffee drinkers care to admit it or not – and, that tiny transaction must be reported to the Internal Revenue Service (IRS). But recently, Senator Pat Toomey (R, PA), who is Ranking Member of the Senate Banking Committee, and Senator Kyrsten Sinema (D, AZ) sought to make things more equitable and efficient for consumers making small payments with cryptocurrency.

Known as the “Virtual Currency Tax Fairness Act” and rolled out on July 26, the law would create “a sensible de minimis exemption for gains of less than $50 on personal transactions and for personal transactions under $50 [sic],” according to a press release. The new law, if it passes, would update the tax code from 1986.

Sen. Sinema added the Arizona perspective in the release, “We’re protecting Arizonans from surprise taxes on everyday digital payments, so as use of digital currencies increases, Arizonans can keep more of their own money in their pockets and continue to thrive.” She is a member of the Senate’s Financial Innovation Caucus which promotes the use of blockchain tech and innovative technologies and includes Senator Cynthia Lummis (R, WY) whose RFIA bill looks to guide blockchain regulation in the US.

Back in February in the US House of Representatives, Reps. Suzan DelBene (D, WA) and David Schweikert (R, AZ) re-introduced a version of the legislation titled, “Virtual Currency Tax Fairness Act of 2022 – HR 6582.” Schweikert is a co-chair of the Congressional Blockchain Caucus – members of which participated as co-sponsors including Caucus co-Chair Rep. Tom Emmer (R, MN), co-Chair Rep. Darren Soto (D, FL), Rep. Donald Beyer (D, VA) and Rep. Byron Donalds (R, FL).

The bill has gone through previous iterations in the House led by Rep. Schweikert with the February version seeking a $200 exemption on capital gains for transactions using crytocurrency. Way back in 2017 when Schweikert introduced his original crypto de minimis exemption bill, the exemption was a buoyant $600. Nothing came of the bill.

Get the details of the Senate’s “Virtual Currency Tax Fairness Act”:

The chances for passage any time soon for either the House or Senate version of the de minimis exemption bill seem bleak as CoinDesk’s Jessie Hamilton notes, “The new legislation faces an uphill climb in a Congress on the verge of a lengthy August recess before the midterm elections.” Also impactful to any crypto-relate bill in Congress will be the departure of Senator Toomey whose term ends in January.

For the foreseeable future, accountants and their clients will likely remain busy tabulating every crypto decimal.