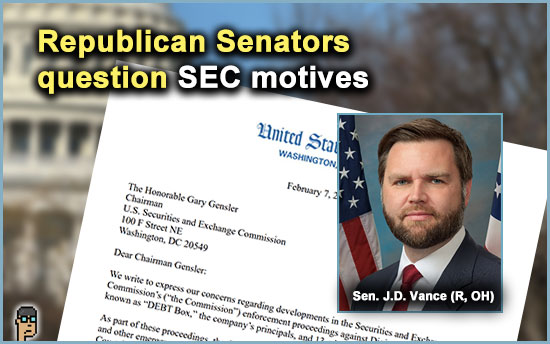

Politics and the SEC

When Securities and Exchange Commission (SEC) lawyers were pressing its case against crypto company DEBT Box late last year, many were surprised when the Agency’s counsel appeared to intentionally try and mislead a Federal court judge and thereby put themselves at risk of sanctions.

Now, Republican Senators Cynthia Lummis (WY), Bill Hagerty (TN), Katie Boyd Britt (AL), Thom Tillis (NC) and JD Vance (OH) want answers from SEC Chair Gary Gensler.

Fortune’s Leo Schwartz reports, “Wednesday’s letter from the Republican senators, led by Vance, reflects the heightened stakes of the otherwise inconsequential lawsuit. The lawmakers are using the episode to advance their complaints about Gensler’s administration, which critics argue is politically motivated, especially with crypto.” Read more.

more tips:

Letter to SEC Chair Gary Gensler regarding “enforcement proceedings against Digital Licensing Inc., also known as ‘DEBT Box'” – Vance.Senate.gov

what you should know: It’s still possible the Judge in the case could issue sanctions against the agency and its lawyers in spite of the fact the SEC has tried to have the case dismissed while it tries to wiggle out of a mess. Continue reading “Senator Vance Leads Charge Against Actions Of SEC Counsel; Crypto Criticism Is Pumping”