Rep. Mike Flood (R, NE), a freshman Member of the House Financial Services (HFS) Committee, has led a relentless charge in the 118th Congress to rescind the Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin 121. And, in spite of the recent veto override setback, he still sees opportunity.

“SAB 121,” as it is known, precludes traditional finance firms from offering custody services for crypto due to arguably, onerous reserve requirements courtesy of the SEC.

Put another way, the bulletin effectively prevents regulated banks from touching digital assets and, consequently, prevents digital assets from being under the U.S. financial system umbrella.

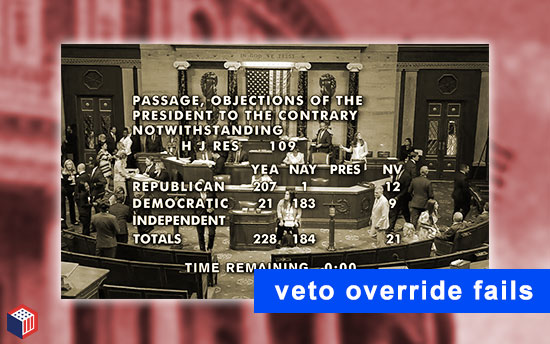

In May, Rep. Flood’s joint resolution [H.J.R.109] passed both Houses of Congress with bipartisan support in a watershed moment for digital assets only to be vetoed by President Biden. Earlier this month, the veto override vote in the House failed…

So now what?

Yesterday, blockchain tipsheet caught up with Congressman Flood on SAB 121:

-

- Initial reaction to the veto

- Efforts to increase Dem support, post-veto

- Next steps for rescinding SAB 121

- On the SEC working on one-off basis with TradFi companies

- House Appropriations line item on SAB 121

- State of bipartisanship in the 118th Congress

- The next Congress and digital assets legislation

- Flyover Fintech event on October 21

The interview has been lightly edited for clarity.

blockchain tipsheet: What was your reaction to the veto of House Joint Resolution 109 rescinding the SEC’s SAB 121?

Rep. Mike Flood: Well, I wasn’t surprised.

During the debate on the Floor, before we actually voted for it [on May 9], the White House put out a preemptive notice that they intended to veto it and Ranking Member Maxine Waters (D, CA) was waving that around during the debate and trying to remind our Members that the President intended to veto it.

Nevertheless, it got 21 votes from Democrats in the House and 12 votes in the Senate – one of them being Majority Leader [Chuck] Schumer (D, NY).

I think the support from Congressman Wiley Nickel (D, NC) and others shows that this does not need to be a partisan issue, and it clearly is NOT partisan.

There should be a path forward where Republicans and Democrats could agree on – not just repealing this – broader regulatory certainty for digital assets.

I think that during that debate, one of the criticisms that the Ranking Member had was, “Well, maybe this isn’t the right way to take down SAB 121 using the Congressional Review Act.”

Okay. Then, why isn’t my other bill moving? -I had a bill to change it in the Federal code and repeal it…

But, I wasn’t surprised with the veto. Continue reading “Rep. Mike Flood Reflects On Efforts To Rescind The SEC’s SAB 121, Next Steps”