Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

bankers unite in DC

The American Bankers Association is producing its Washington Summit this week as its members glad-hand on Capitol Hill while pushing for various banking industry priorities. The agenda for today and tomorrow includes a powerful, bipartisan group of DC politicos involved in banking regulation and legislation. “Crypto” will inevitably come up even though the topic is not mentioned in the agenda.

Each day also includes its own live stream link (see below). You can register for the virtual show here, too.

Notable Speakers for Today, March 21 (All times are Eastern Time)

Livestream for Day 1 is here.

-

- 10 a.m. – Secretary of the Treasury Janet Yellen – Keynote plus conversation with ABA President and CEO Rob Nichols

- 10:30 a.m. – Sen. Steve Daines (R, MT) – Member of the Senate Banking Committee “and co-sponsor of the SAFE Banking Act”

Notable Speakers – Wednesday, March 22

Livestream for Day 2 is here.

-

- 9:00 a.m. – Sen. Sherrod Brown (D, OH), Senate Banking Ranking Member

- 9:40 a.m. – Rep. Maxine Waters (D, CA) – House Financial Services Committee Ranking Member

- 10:15 a.m. – Sen. Tim Scott (R, SC) – Senate Banking Ranking Member

- 11:00 a.m – Rep. Patrick McHenry (R, NC) – House Financial Services Committee Chair

is crypto banking dead?

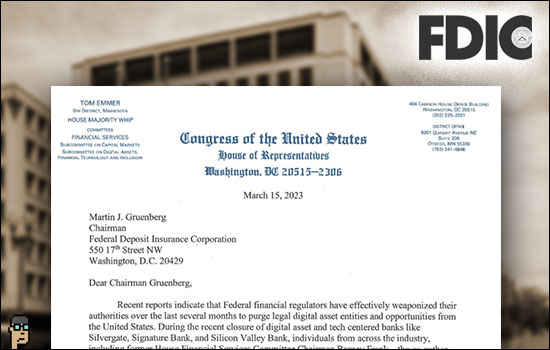

American Banker – no relation to ABA – asks the reader rhetorically, “Is crypto banking dead?” in the title of an article which provides evidence of a “Choke Point“-like operation going on in the U.S. government and at the Federal Deposit Insurance Corporation (FDIC), in particular.

“Hundreds of banks that were working with NYDIG, a New York technology company, to let consumers track their bitcoin purchases and sales through their mobile banking apps, have been told by the FDIC to slow down, according to people familiar with the matter,” reports Penny Crosman of American Banker. ” Adam Shapiro of Klaros Group tells Crosman, “Banks are going to read the tea leaves, read what does appear to be some quite visceral dislike of the sector from senior regulators.” Read more. Continue reading “Bankers Unite With Lawmakers; Digital Assets Sliced Off Signature Bank Sale”