Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

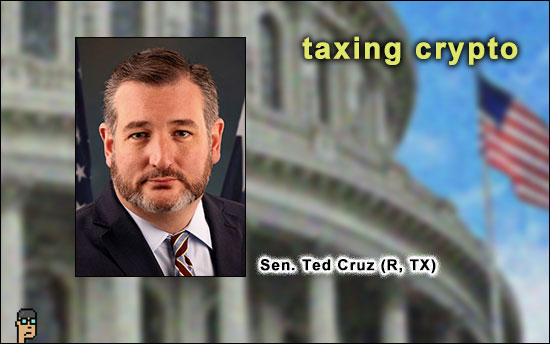

taxes – commodity vs security

The Biden Administration is planning on closing a tax loophole it perceives with cryptocurrencies and raising $24 billion according to The Wall Street Journal. “Currently… [crypto transaction sales] aren’t subject to the same so-called wash-sale rules that apply to stocks and bonds. That means people can sell their underwater crypto investments, take a tax-deductible loss and buy right back into the same investment.” Read more.

Tip: This potential taxation change all goes back to the “securities versus commodity” discussion and could be seen as a backdoor to regulating the digital assets industry by defining what is a commodity and what is a security.

taxes – bitcoin mining

A new tax embedded in the Biden Administration’s 2023 budget proposal wants to extract revenue from Bitcoin miners. “The U.S. Treasury Department has proposed a 30% excise tax on the cost of powering crypto mining facilities. (…) The tax would be phased in over the next three years, increasing 10% each year,” writes CoinDesk. Read more.

Gensler speaks

In an op-ed in The Hill, Securities Exchange Commission (SEC) Chair Gary Gensler returns to the media again with a defense of his position on cryptocurrencies and their need to be regulated (“come in and register, or else”). Responding to critics, Chair Gensler writes, “I find the talking point that there’s a lack of clarity in the securities laws unpersuasive. Some crypto companies might message that the laws are unclear rather than admitting that their platforms don’t have sufficient investor protection.” Read more.

Tip: Gensler’s tempo of crypto-related communications remains at a high intensity. Continue reading “Crypto Tax Change Proposed By Biden Administration; The Fed Speaks on Digital Assets”