At last week’s DeFiCon in Brooklyn, New York, the most important blockchain issues currently pulsing in Washington were on full display as three congressional staffers who advise congressmen on the House Financial Services Committee talked digital assets.

Participants included:

-

- Francesco Casella, Senior Policy Advisor for Rep. Ted Budd (R, NC)

- Sruthi Prabhu, Senior Policy Advisor for Rep. Trey Hollingsworth (R, IN)

- Lizzie Fallon, Financial Services Policy Advisor for Rep. Tom Emmer (R, MN)

Joining the troika was Ron Hammond who may have pulled from his Rolodex to bring the experienced panel together. He served as a staffer for Rep. Warren Davidson (R, OH), who co-sponsored with Rep. Darren Soto (D, FL) such crypto legislation as the Token Taxonomy Act and Digital Taxonomy Act in 2018 and 2019. Mr. Hammond is currently Director of Government Relations at the Blockchain Association.

Dan Spuller, Head of Industry Relations at the Blockchain Association, guided the discussion.

Knowing the details of key crypto issues and legislation is the day-to-day job for a growing force of congressional staffers and there is no shortage of topics as the hour-long panel proved.

Quotes lightly edited for clarity.

Fixing the infrastructure bill

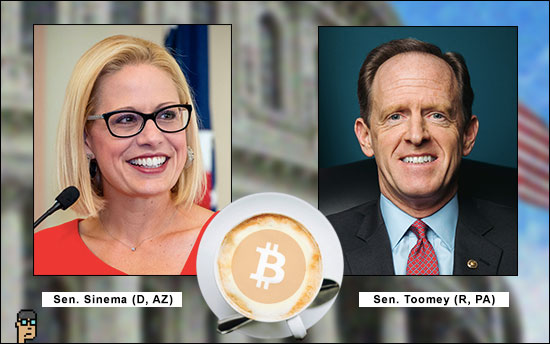

With an overly broad definition of what a broker is and egregious reporting requirements pushed on to decentralized finance, wallet providers, miners and others by last year’s Infrastructure Investment and Jobs Act, panelists agreed that changes are imminent as heralded by the recent digital assets reporting bill co-sponsored by Senators Portman (R, OH), Warner (D, VA), Sinema (D, AZ), Lummis (R, WY) and Toomey (R, PA)…

Francesco Casella (staffer for Rep. Budd – R, NC):

[Last year’s infrastructure bill debacle] was really when he saw the crypto industry come into its own in terms of getting its own voice and finding its power. Many of us can probably attest to the influx of calls, messages and emails that we were getting on this issue. And it’s funny to think that in this massive infrastructure package, crypto became the number one topic of discussion that no one thought of because of this one provision.

I know our office was leading a fight on trying to push for adoption and have one of the original amendments to fix that language. Unfortunately, it went for naught because of some unrelated issues that killed it…”

Congressional Blockchain Caucus expansion

Continue reading “House Staffers Talk Crypto Regulation at DeFiCon”