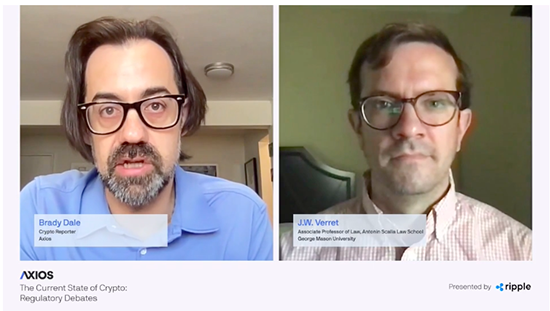

In today’s Axios live webcast, Axios crypto reporter Brady Dale asked law professor J.W. Verret of George Mason University, if the long-awaited spot ETF is ready for prime time.

Brady Dale: The argument against a Bitcoin ETF for allowing people in their brokerage accounts to own Bitcoin, through publicly traded instruments has mainly been the market is too small and it’s too easy to manipulate. But, the market is now three times bigger than it was when the Winklevoss brothers first proposed an ETF in 2017. How big do you think it needs to get before it’s big enough for a spot Bitcoin ETF?

J.W. Verret: I think it’s already big enough. And if the SEC were judging the Bitcoin spot ETF applications by the same metric they’ve used in the past for other ETF applications, they would have approved it already in the same way that Canada and Germany have and the same way I expect Australia will eventually. So I think we’re just behind other comparable nations. And it would be nice if the SEC said, ‘Look, here’s what’s required in order to obtain full approval.’ It’s also interesting to that the SEC recently approved a futures ETF application is based on the 33 Act and not the 40 act. In that way, SEC Commissioner Gary Gensler has already crossed the red line that he previously said he wouldn’t cross with respect to Bitcoin ETFs that gives a lot more wind behind the sails of folks like Grayscale and other applicants for Bitcoin ETFs. I think it’s just a matter of time.

Brady Dale: Can you explain the red line he crossed? Continue reading “Bitcoin Spot ETF ‘Hot Take’: It’s Time”