crypto bills update

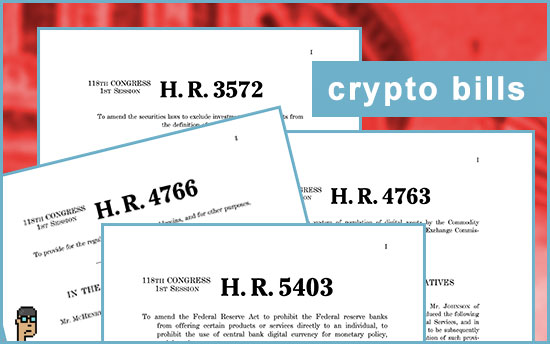

With the clock ticking on the 118th Congress, Politico’s Morning Money reported yesterday that a House floor vote – originally planned for Q4 2023 and interrupted by the Speaker switch – is now expected sometime in the current calendar quarter for the digital asset market structure bill [H.R.4763]. Majority Whip Tom Emmer (R, MN) is also trying to add elements of his “Securities Clarity Act” [H.R.3572] which Politico says “runs the risk of hurting what’s already proven to be narrow Democratic support for the underlying legislation.” And, the Whip’s “CBDC Anti-Surveillance State Act” [H.R.5403] may also complicate matters. Meanwhile, the stablecoin bill [H.R. 4766] is still in the same place it was last month -waiting for a “legislative vehicle.”

what you should know: Speaker Mike Johnson (R, LA) would appear to be a wild-card in the process. He’s not the technology advocate that former Speaker Kevin McCarthy (R, CA) was. Also, House Financial Services Chair Patrick McHenry (R, NC) has shared some criticism of Johnson which may create additional friction within the Republican caucus and with McHenry’s digital assets agenda. Continue reading “Crypto Bills Await House Floor Votes; Senators Tillis, Hagerty Intro AML Discussion Draft”