Speaker morass

With the Speaker role in limbo in the House (and an election(s) starting Wednesday says Roll Call), so too are the prospects for digital assets legislation.

From a pro-crypto perspective, a near-term slowdown with legislation in the United States may not be critical. “Macro” events such as approval of Bitcoin spot market ETFs could continue to drive retail and institutional interest. Favorable decisions in court cases (Coinbase, Ripple, etc.) could continue to push digital assets into the mainstream. And longer term, there are international efforts which could ultimately be seen as a threat to the U.S. dollar, its primacy and, therefore, national security – always a galvanizing force for Congress.

Meanwhile, anti-crypto advocates likely see a swing further right by Republicans with the House Speaker role as inhibiting the current digital assets agenda led by a House Republican leadership which has sought to build bipartisan momentum essential to law-making success in a divided government.

The House drama isn’t helping Democratic crypto advocates such as Senator Kirsten Gillibrand (D, NY) either. The Senator has openly expressed hope in growing her caucus’ interest in crypto legislation and remains a co-sponsor of the sole, comprehensive market structure bill in the Senate [S.2281] along with Senator Cynthia Lummis (R, WY).

Digital assets law will likely come in a negotiation between the House and Senate (especially stablecoins [H.R. 4766]), but not if the House becomes sidelined by politics and House Republicans render themselves impotent.

Overall, Republicans understand that the Speaker drama has been bad for business. Read one example on that topic from House Financial Services committee member Rep. Mike Flood (R, NE) in speaking to local media.

more tips:

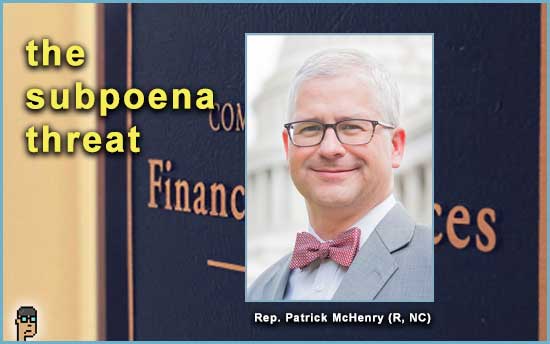

Temporary Speaker Patrick McHenry Steers House on the Fly – The Wall Street Journal

Continue reading “Speaker Morass And The Digital Assets Pendulum; Tokenizing Treasuries”