Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

give up all the crypto

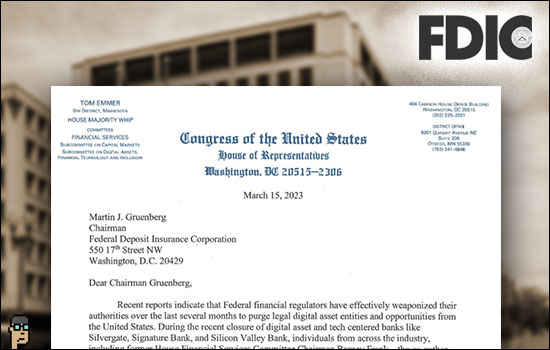

Majority Whip Rep. Tom Emmer (R, MN) continued to keep the focus on bank regulators yesterday after sending a letter to FDIC Chairman Martin Gruenberg, a Democrat, on Wednesday. Emmer tweeted a Reuters article and pulled the following quote: “Any buyer of Signature must agree to give up all the crypto business at the bank, the two sources added.” Read Reuters (subscription). And, read Decrypt.

Hearings seem inevitable in the House on the oft-alleged “Choke Point“-like initiative within the U.S. government. Hearings may be tempered with a bipartisan desire to successfully drive legislation (such as stablecoins) through Congress and to the President’s desk for signature.

On the other hand, Rep. Emmer tweeted later, “It’s clear the Biden administration is weaponizing market chaos to kill crypto.” See Emmer’s interview on Fox.

FedNow – this summer

“Instant” payments product FedNow developed by the Federal Reserve is expecting to roll out in July. See the announcement from Wednesday.

Axios covers the Federal Reserve’s imminent rollout of FedNow and suggests that it may go head-to-head with crypto: “Advocates of a central bank digital currency (CBDC) say adoption could, for one, facilitate faster payments. FedNow, at least domestically, may fill that gap – possibly removing a key part of the pitch for the U.S. to adopt a CBDC.” Read more. Continue reading “FedNow Versus Stablecoin Debate; Emmer Raises More FDIC-Crypto Concerns”