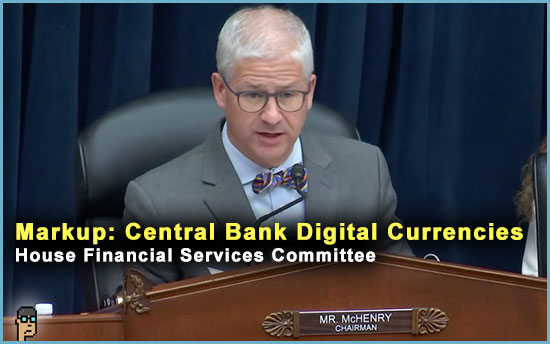

An ambitious markup of thirteen bills was on the docket for today’s markup by House Financial Services Committee led by Chair Patrick McHenry (R, NC) and Ranking Member Maxine Waters (D, CA).

The markup’s themes – led by the Republican majority but coordinated with Democrats – included protecting consumer privacy and preventing the overreach of government. There was also bipartisan legislation protecting United States’ national security interests particularly as it related to China.

Overall, most of the hearing’s tone was one of cooperation across the aisle and was reflected in unanimous passage of every bill not related to Central Bank Digital Currencies (CBDCs).

So, perhaps due to the expectation of extended debate, blockchain-related legislation containing various restrictions on a Central Bank Digital Currency (CBDC) were last on the Committee’s agenda.

With several CBDC bills to pursue, the Republican majority, led by Chair McHenry, apparently decided to solely pursue passage of H.R. 5403, the “CBDC Anti-Surveillance State Act” by Majority Whip Rep. Tom Emmer (R, MN). The bill bans the issuance of a CBDC (but the Fed can study it, as Republicans later emphasized).

See the post-hearing press release from the GOP.

tl;dr – the voting

The voting for H.R. 5403, the “CBDC Anti-Surveillance State Act” was approved along party lines with a vote of 27-20 which sends the bill to the House floor.

Ranking Member Waters and Rep. Stephen Lynch’s (D, MA) attempts to add amendments “softening” Rep. Emmer’s bill were both rejected along party lines in a votes of 27-20, as well.

Rep. Emmer announced the bills’ passage immediately after the hearing. Read it.

the CBDC markup

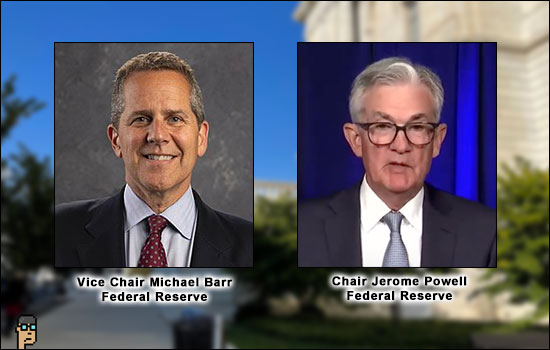

As the Central Bank Digital Currency (CBDC) portion of the markup arrived, it was clear that Democratic leadership wanted any digital currency associated with the U.S. Dollar in the hands of the Federal government. The mostly-unspoken implications for private stablecoins was that Democratic leadership was opposed.

After Chair McHenry’s opening statement (read it), Ranking Member Waters made her statement which criticized the Republican anti-CBDC view.

Waters said, “Nobody fully understands the potential benefits and challenges of CBDCs or how their implementation could affect the preeminence of the US dollar and global finance more broadly. That is why the Biden administration and the Federal Reserve are researching this. However, the Republican bill before us today would stifle that research and prevent us from moving forward, even if it means that the dollar loses its status as the world’s reserve currency. And even if it means that US citizens lose out on faster, cheaper and simpler payments. I’m disappointed that Republicans have taken such a deeply anti-innovation stance.”

The “anti-innovation” accusation is an about-face to Democratic leadership’s positioning against the recent stablecoin and digital asset market structure bills which could be considered “pro-innovation.” Continue reading “House Financial Services CBDC Markup Sends Emmer Bill To House Floor”