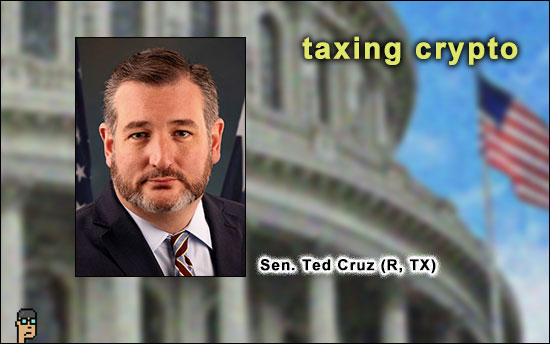

On Wednesday, Senator Ted Cruz (R, TX) re-introduced his efforts which began way back in 2021 to remove egregious taxation requirements of the Infrastructure Investment and Jobs Act of 2021 on crypto companies.

At the time, Cruz’s press release noted today’s recurring concerns about the potential for innovation moving overseas: “Let’s not be the number one economic developer for the Communist Party of China by sending cryptocurrencies overseas.”

Cruz’s 2023 version, which has been referred to Senate Finance, is known in Senate records as S.695 (see it) or “A bill to repeal the provisions of the Infrastructure Investment and Jobs Act that impose new information reporting requirements with respect to digital asset transfers.” No co-sponsors are currently listed. The bill is here (PDF).

Cruz has been signaling his interest lately about wanting a seat at the table of blockchain legislation. (Read the Houston Chronicle: “Ted Cruz is one of crypto’s true believers, even as calls for regulation grow.”) Continue reading “Senator Ted Cruz Wants A Seat At The Blockchain Legislation Table”