offshore expansion

Coinbase said yesterday that it was expanding its global product mix as its Coinbase International Exchange had “received regulatory approval from the Bermuda Monetary Authority (BMA) to enable perpetual futures for eligible non-US retail customers.” Read more.

Back in May, Coinbase had announced it was setting up shop in Bermuda and looking to fill a hole in crypto derivatives market that Bahamas-based FTX had dominated until its demise last November.

Between the lines, the challenging regulatory environment in the United States which may have forced Coinbase to move beyond its home base’s borders.

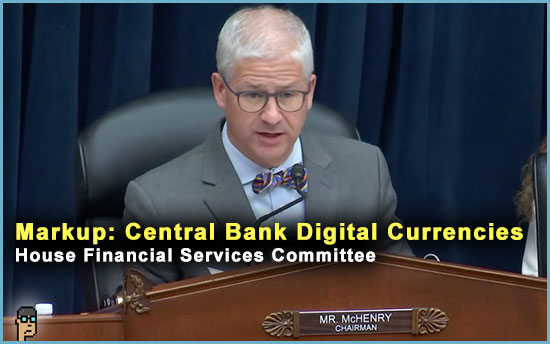

cross-border CBDCs

A new test of cross-border wholesale Central Bank Digital Currencies (CBDCs) was trumpeted yesterday by the Bank of International Settlements. Read the press release from one of the partners – the Monetary Authority of Singapore.

The test known as Project Mariana was “a proof of concept [and] successfully tested the cross-border trading and settlement of hypothetical euro, Singapore dollar and Swiss franc wCBDCs between simulated financial institutions.” Read more about Project Mariana and its findings on the BIS website here.

Many countries are undertaking a CBDC “Project” these days. In the United States, “Project Hamilton” has been a U.S. project coordinated by the Federal Reserve Bank of Boston and the Massachussetts Institute of Technology.

more tips:

Wholesale CBDCs and automatic market makers could be the perfect pair, BIS finds – Blockworks Continue reading “Coinbase Builds Offshore Presence For Derivatives; Wholesale CBDCs Get A Global Test”