Today’s hearing of House Energy and Commerce’s Subcommittee on Innovation, Data, and Commerce titled, “Building Blockchains: Exploring Web3 and Other Applications for Distributed Ledger Technologies,” was a rare opportunity for lawmakers to discuss blockchain applications beyond the financial realm – and learn.

And though some Democrats appeared to read from a script written by Democratic party leadership – such as the Subcommittee Ranking Member Rep. Jan Schakowsky (D, IL) and Rep. Lori Trahan (D, MA) who seemed to try and paint blockchain technology as a threat – other Members from both sides of the aisle often asked substantive questions.

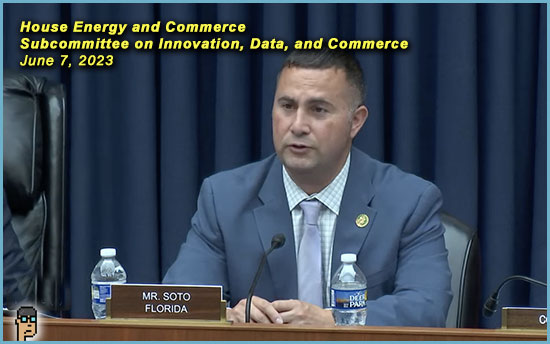

This included Rep. Darren Soto (D, FL), who took his turn during the hearing’s Q&A section with a straightforward query about blockchain use cases.

Soto is well-known on Capitol Hill for his support of the burgeoning blockchain industry with his work on several blockchain-related bills including co-sponsorship of Majority Whip Rep. Tom Emmer’s (R, MN) recent “Securities Clarity Act“. He was also a co-chair of the Congressional Blockchain Caucus in the 117th Congress.

As evidenced by the answers to Rep. Soto ‘s question, witnesses mostly wanted to talk about the need for regulation, not use cases. (Video is here.)

(Lightly edited for clarity)

REP. DARREN SOTO: In the beginning, in my opening remarks, I talked about a lot of the areas where we were already able to pass amendments into both the National Defense Authorization Act and the Appropriations Act and get a lot of the blockchain advances under federal law. It was mentioned by our colleague, [Rep. Rick Allen (R, GA)]: the food tracing with the FDA to help with public safety; helping with encrypted communications through our military; protecting veterans records, among other areas, going forward.

So, we in Congress want to make sure we’re good partners in advancing this critical technology, whether it’s for economic reasons, security, for advancing critical resources. So, I’ll start with Mr. Wyatt, but I’m going to ask all of you the same question. Mr. Wyatt, if there could be one particular partnership the federal government could help advance in some of these areas. What do you think it should be that we should work on and why? Continue reading “Lawmakers Want Use Cases, Witnesses Want Regulation: Today’s House Energy and Commerce Subcommittee Hearing”