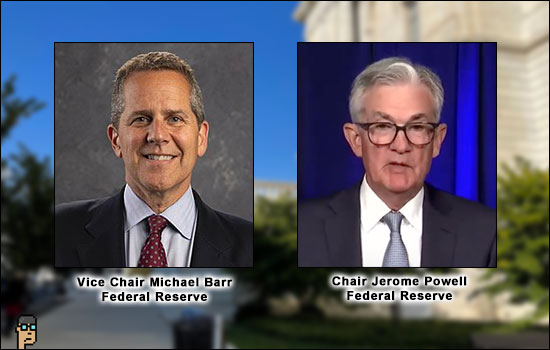

In a fireside chat at Day 2 of the Seventh Annual Fintech Conference at the Federal Reserve Bank of Philadelphia on Friday, Federal Reserve Vice Chair Michael Barr participated in a fireside chat moderated by Sunayna Tuteja, the Federal Reserve System’s Chief Innovation Officer.

Before he answered questions, Barr delivered a speech entitled, “The Federal Reserve’s Role in Supporting Responsible Innovation,” (read it here) where he discussed the Fed’s ongoing exploration of Central Bank Digital Currencies (CBDCs), the launch of FedNow as well as where stablecoins or “private money,” as Barr termed it, may fit in the U.S. financial system.

He said, “I remain deeply concerned about stablecoin issuance without strong federal oversight.” Nevertheless, Barr stressed the importance of financial innovation and that it was “absolutely essential for our economy.”

Below is an edited transcript of Vice Chair Barr’s discussion with the Fed’s Sunaya Tuteja.

on payments innovation and financial inclusion

Vice Chair Michael Barr: “…The payment system is one of these aspects of finance that is so critical for people’s everyday lives. Most of us can take for granted that we can get paid, we can store money and we can pay bills in a pretty seamless way if you’re in the higher socio-economic classes of people who have access to these kinds of financial services. But if you’re a low or moderate income person payment services actually can be a real problem. It can be hard to receive your income. A lot of people still get paid by check and have to get that check cashed somewhere. A lot of low income people 5% of Americans are outside the banking system and don’t have a bank account at all. 15% of Americans according to the FDIC are underbanked that is they have a bank account but they still use expensive alternative financial services.” Continue reading “Vice Chair Michael Barr Discusses New Novel Activities Program At Federal Reserve”