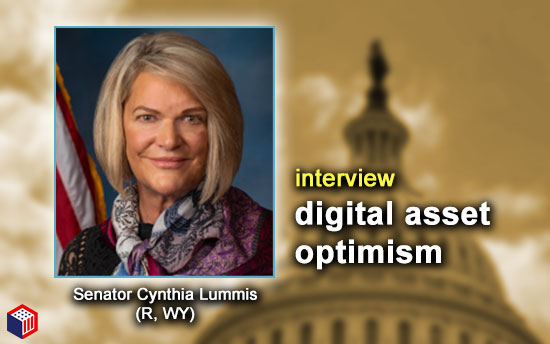

As Congress picks up speed this month in spite of election year hurdles, Senator Cynthia Lummis (R, WY) has been busy thinking about – and working on – next steps for digital assets legislation among the many initiatives and responsibilities she and her team oversee.

Her “Lummis-Gillibrand Responsible Financial Innovation Act” [S.2281] has been been a key, proposed framework for digital assets in the Senate and Congress.

The bill, first introduced in the 117th Congress, and updated for the 118th, is a comprehensive, digital assets regulatory framework co-sponsored by New York Democratic Senator Kirsten Gillibrand. “Lummis-Gillibrand,” as it is known, appears to have weathered the buffeting winds of FTX, a bear market, Congressional skepticism and the seemingly recalcitrant Securities and Exchange Commission (SEC) – to name a few.

Senator Lummis sat down with blockchain tipsheet at the Capitol today to discuss all things digital assets and Congress including:

-

- The Bitcoin ETF watershed moment

- State of digital assets legislation today

- Lummis-Gillibrand and funding regulation with “wash sale” rule

- Stablecoin bill update

- Reflections on the NDAA digital assets AML amendment

- Binance, Tether and illicit finance

- SAB 121 and next steps

The interview has been lightly edited for clarity.

blockchain tipsheet: Is the approval of Bitcoin spot market ETF’s a watershed moment for digital assets?

Senator Cynthia Lummis: I think it’s important because it gives consumers who are not ready to dive in with both feet – who are not ready to self-custody – exposure to Bitcoin through an exchange-traded fund, which is a very well known vehicle to get exposure to valuable assets.

It’s important for consumer assurance that this is an asset worth holding in a diverse asset allocation and that now they can have exposure to it without having to be an expert. [It also] helps integrate Bitcoin into the traditional asset management world. So, I do think it’s a watershed moment. Continue reading “Interview: Senator Cynthia Lummis Is Optimistic About Digital Assets In Congress This Year”