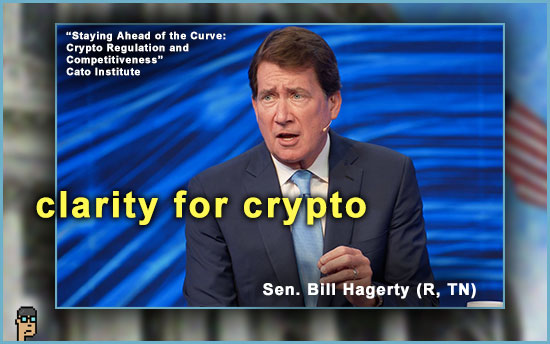

Senator Bill Hagerty (R, TN), who sits on the Senate Banking Committee, spoke to Cato Institute’s Jennifer Schulp, at Cato’s “Staying Ahead of the Curve: Crypto Regulation and Competitiveness” event in Washington, D.C. today.

View video of the event here.

Senator Hagerty addressed a number of “hot button” digital assets topics in Congress today including “choke point 2.0” (popular with the Republican caucus), Securities and Exchange Commission Chair Gary Gensler, crypto and the U.S. dollar’s co-existence, innovation and digital assets legislation momentum in Congress.

Also of note, the Senator touted his own stablecoin bill – Stablecoin Transparency Act [S.3970], which was introduced in March 2022 in the 117th Congress – saying that it’s simplicity (only 2 pages) was the way forward with digital assets legislation rather than something more all-encompassing or “fulsome” as the Senator described it.

Perhaps a re-introduction of his bill is imminent? The chances of the bill ever making it to the docket of the Senate Banking Committee controlled by the Democratic majority seems slim for now. This point was not lost on the Senator. Yet, it’s clear he wants a seat at the table of any stablecoin legislation discussion.

Also, whether Senator Hagerty intended to be directly dismissive of broader, more “fulsome” bills such as the “Lummis-Gillibrand Responsible Financial Innovation Act (RFIA)” [S.2281] in the Senate or the digital assets market structure bill in the House known as the “Financial Innovation and Technology for the 21st Century Act” [H.R. 4763] was unclear.

Nevertheless, Hagerty wants to play for singles – not home runs – when it comes to digital assets and a divided Congress.

Transcript lightly edited for clarity.

on concerns about crypto innovation moving offshore

Senator Hagerty: I certainly have the concerns because of the tremendous uncertainty that’s been created by the current administration. Basically, what you have is an environment where we cannot get the regulators to come forward with any sort of clear set of requirements. You’ve got companies that are basically being regulated in arrears, if you will. They proceed according to what they think is a legitimate business practice – [and then] the SEC, for example, deems that illegal and in retrospect. It comes back and charges [companies] for something that was never on the books as being legal or illegal. It is a terrible environment for those companies who are trying to invest and expand. It’s forcing them to look overseas to more favorable regulatory environments. That’s not where we need to be right now. Continue reading “Senator Hagerty Touts Need For Crypto Clarity And Stablecoin Transparency Act”