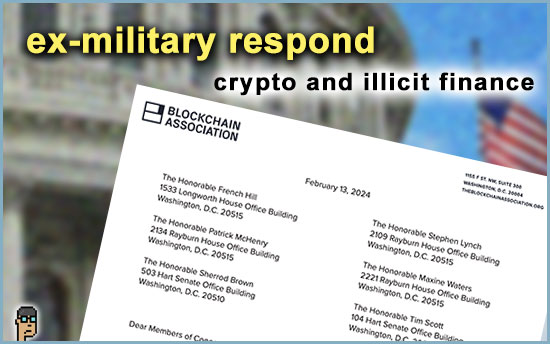

military letter #2

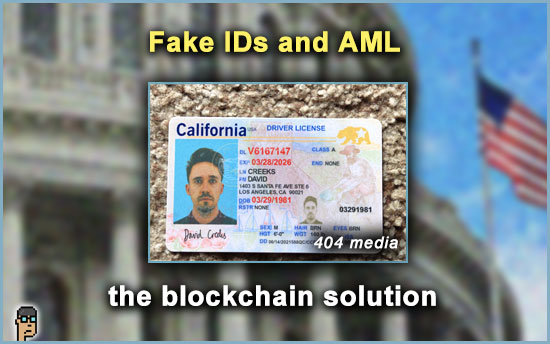

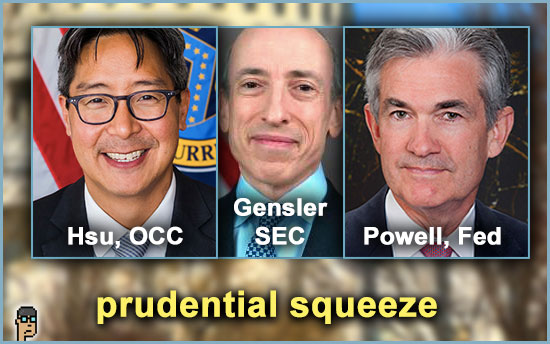

Blockchain Association’s ex-military members have sent a new letter to Congress regarding the illicit finance and crypto debate currently swirling. Yesterday’s communication doubles the signatories of the previous BA letter back in November and clearly states their opposition to legislation being floated in Congress as well as related national security concerns.

The letter states in bolded text:

“The Digital Asset Anti-Money Laundering Act (DAAMLA) risks our nation’s strategic advantage, threatens tens of thousands of U.S. jobs, and bears little effect on the illicit actors it targets.”

Back in December, Senator Elizabeth Warren (D, MA), who is the author of DAAMLA, sent a letter in response to Blockchain Association which accused the organization of, essentially, revolving door politics and undermining “bipartisan efforts in Congress and the Biden Administration to address the role of cryptocurrency in financing Hamas and other terrorist organizations” Continue reading “New Letter Responds To Warren Criticism, Bill; Porter Draws Crypto PAC Attention”