President Biden

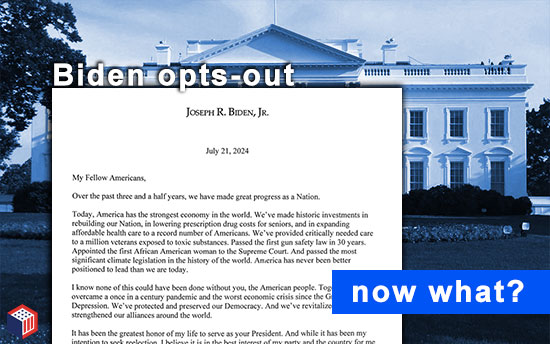

President Joe Biden formally announced his intention to step away from running for another term as President yesterday. He stated his intention to remain in office through the end of his term in January.

Republican leadership, such as House Majority Whip Tom Emmer (R, MN) who called him “unfit,” asked that the President step down immediately yesterday.

what you should know: The opportunity for substantive policy discussions on any topic before the election in November would seem to be even more unlikely. But, Brendan Pedersen delivers some hopium to the crypto universe in yesterday’s Punchbowl News’ The Vault newsletter as House Agriculture digital assets subcommittee chair Rep. Dusty Johnson (R, SD) tells him, “I wouldn’t want us to pull the shades on the 118th quite yet.”

Bitcoin conference Thursday

If having former President Donald Trump as a speaker isn’t enough, Bitcoin 2024 conference organizers on Friday suggested they’re about to unveil yet another surprise (speaker) as Fox Business’ Eleanor Terrett prognosticated on X that it could be entrepreneur Elon Musk, a prolific “donatoor” to the former President’s campaign. Continue reading “President Biden Opts-Out Of Re-Election Bid; Trump To Appear At Bitcoin Conference This Week”