subpoena stick

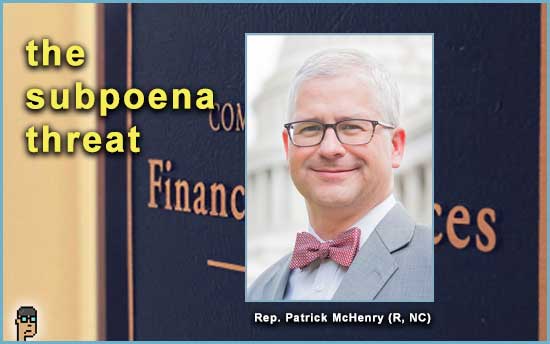

House Financial Services Chair Patrick McHenry (R, NC) made clear in a tweet on X yesterday that he’s serious about potentially issuing a subpoena to Securities Exchange Commission Chair Gary Gensler, a Democrat, if he doesn’t answer Congressional requests – primarily from Republicans. “SEC Chair [Gary Gensler] refuses to schedule a Commission vote to provide Congress with requested documents. Should Gensler continue to stonewall, Republicans will have no choice but to issue the first subpoena to the SEC from my Committee to compel their production.” See more.

McHenry first broached the subpoena at last week’s HFS SEC oversight hearing.

How serious is McHenry about using an unprecedented subpoena with an SEC Chair? Hard to say. But, the threat of a subpoena could create another lever in negotiations with Democratic leadership as Chair McHenry attempts to get key digital assets legislation (stablecoin and market structure bills) through Congress.

Senate Banking machinations

Politico reported yesterday that Senate Banking Chair Sherrod Brown (D, OH) is under pressure by Senator Elizabeth Warren (D, MA) to advance her Digital Asset Anti-Money Laundering Act (see S.2669), but he’s not convinced. Brown tells Politico, “We’re all trying to figure out what regulators can do and where the holes are that we need legislation (…) That’s the real problem. And I don’t know that Warren’s bill does that.” Read more.

Cato Institute policy analyst Nicholas Anthony commented on X about the news: “Senator Brown is right here. It was a bit bizarre when Senator Warren introduced this bill during the FTX hearing as it would do nothing to address the issues behind FTX, but it would levy a hefty blow to financial privacy for American citizens.” Read Anthony’s blog post on the Warren bill from last December on Cato’s blog. Continue reading “McHenry Threatening Subpoena For SEC Chair Gensler Again; Senator Brown Questions AML Bill”