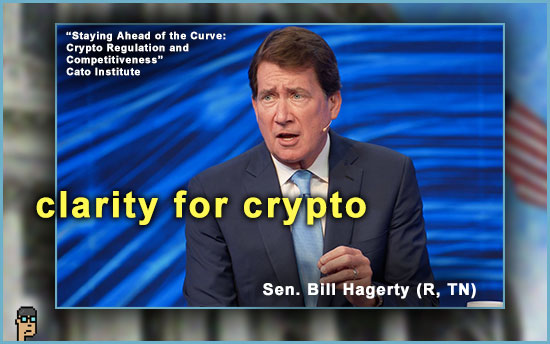

Senator Bill Hagerty (R, TN), who sits on the Senate Banking Committee, spoke to Cato Institute’s Jennifer Schulp, at Cato’s “Staying Ahead of the Curve: Crypto Regulation and Competitiveness” event in Washington, D.C. today.

View video of the event here.

Senator Hagerty addressed a number of “hot button” digital assets topics in Congress today including “choke point 2.0” (popular with the Republican caucus), Securities and Exchange Commission Chair Gary Gensler, crypto and the U.S. dollar’s co-existence, innovation and digital assets legislation momentum in Congress.

Also of note, the Senator touted his own stablecoin bill – Stablecoin Transparency Act [S.3970], which was introduced in March 2022 in the 117th Congress – saying that it’s simplicity (only 2 pages) was the way forward with digital assets legislation rather than something more all-encompassing or “fulsome” as the Senator described it.

Perhaps a re-introduction of his bill is imminent? The chances of the bill ever making it to the docket of the Senate Banking Committee controlled by the Democratic majority seems slim for now. This point was not lost on the Senator. Yet, it’s clear he wants a seat at the table of any stablecoin legislation discussion.

Also, whether Senator Hagerty intended to be directly dismissive of broader, more “fulsome” bills such as the “Lummis-Gillibrand Responsible Financial Innovation Act (RFIA)” [S.2281] in the Senate or the digital assets market structure bill in the House known as the “Financial Innovation and Technology for the 21st Century Act” [H.R. 4763] was unclear.

Nevertheless, Hagerty wants to play for singles – not home runs – when it comes to digital assets and a divided Congress.

Transcript lightly edited for clarity.

on concerns about crypto innovation moving offshore

Senator Hagerty: I certainly have the concerns because of the tremendous uncertainty that’s been created by the current administration. Basically, what you have is an environment where we cannot get the regulators to come forward with any sort of clear set of requirements. You’ve got companies that are basically being regulated in arrears, if you will. They proceed according to what they think is a legitimate business practice – [and then] the SEC, for example, deems that illegal and in retrospect. It comes back and charges [companies] for something that was never on the books as being legal or illegal. It is a terrible environment for those companies who are trying to invest and expand. It’s forcing them to look overseas to more favorable regulatory environments. That’s not where we need to be right now.

does today’s current regulatory environment affect the ability of the United States to influence international financial regulation?

“I think we need to lead. And you have the largest financial market in the world right here in America. And if we set the standards in a sufficiently clear way, the innovation will happen here. We will be the leaders. We already have the dominant currency. We need to perpetuate that rather than step back and let these other countries (…) try to step up and fill that void. They’re going to try. I’m deeply concerned about some of the statements that we’ve heard from the BRICS countries.”

“In fact, they’re expanding the BRICS consortium right now, and they’re talking about dethroning the almighty Dollar. I can understand the reason – they’re not all our adversaries, but they’re looking for an alternative. They’re looking to weaken this marketplace. I want to see us strengthen it and I think if we step into this in a way where we are forward-looking, if we apply reasonable regulatory boundaries, but allow for innovation to take place, we’ll see America thrive in this environment as well and we will lead the rest of the world.”

on crypto innovation as a compliment or threat to the American Dollar

“I see it much more as a compliment. We have a place in Nashville, Tennessee called Bitcoin Park. People are coming literally from all over the world to work in Nashville to develop the next layer of technology. They’re not there to dethrone the Dollar. They’re there to find new and better ways to achieve a given result. And cryptocurrency has its role, stablecoins have their role – but the private sector is the most important place to allow innovation to occur.”

“What concerns me is the “heavy hand” of government coming in and either creating uncertainty which is what we have now are trying to go even further and regulate the marketplace out of existence or takeover. That’s when we’re going to see all of these innovators leave the country and move someplace else.”

on the priorities for bringing clarity in the U.S.

“People need to know what they’re buying. And that’s one one big aspect of [stablecoin] legislation I put forward is to make it very transparent in terms of what is standing behind the digital currencies. It’s been a concern that perhaps the securities that back them up aren’t worth 100 cents on the dollar. After seeing what happened with Silicon Valley Bank and others, I think that concern has become even greater. So my legislation would simply require the private firms that are developing these to post – in a regular fashion – the securities that are backing them up, so people can see exactly what is behind the assets that they’re holding.”

on what to expect from Congress in the near term regarding the digital assets space

“The perspective that I’ve taken is rather than trying to come up with a fulsome, complete package in one blow, is to try to take a step by step processes, to provide certainty, guardrails and transparency like I just described in terms of the assets that backup the currencies. That sort of incremental approach allows us to move in a way that creates certainty, allows us to learn from what we’re doing, and allows us to continue to proceed with the input of the industry.”

“My legislation is two pages, as opposed to some you know, complex behemoth that comes out of the Hill. I admire my colleagues, but it seems that they value the legislation based on how many pages are in it. And as a business person, I don’t see it that way. Simplicity has a tremendous amount of value, particularly when we’re talking about an industry that’s evolving this rapidly. And the notion that we’re going to be able to sit as legislators or regulators and anticipate where the puck is heading here – I think it is foolish. We need to just create broad enough boundaries and clarity so that the innovation can continue to happen, and we can respond accordingly.”

on reigning in the SEC

“You’ve touched at the very heart of my concern and that is the SEC has a current posture of regulating by enforcement proceedings rather than articulating a set of criteria. What they’re doing is allowing the market to evolve and then they’re just picking and choosing where they want to lay an enforcement proceeding and saying, “Well, we don’t like that and therefore it’s wrong” and level multibillion dollar fines against these corporations that are not in a position to withstand that. The net effect of all of this is to create increasing amounts of uncertainty. And at some point, the market is not going to tolerate it and they’re going to push the development of these innovative instruments and the whole ecosystem that goes with it again to other markets and will be at a competitive disadvantage. I do not want to see that happen in America.”

on SEC Chair Gary Gensler’s perspective on digital assets

“I’m having trouble with understanding how his perspective has shifted because I spoke with him before his confirmation. He was at MIT Digital Lab and reports have come that he was actually trying to become an adviser to Binance before coming into the SEC. So it seems that his perspective has shifted on this. And he seems to be echoing some of my colleagues in the Senate that seemed to have a perspective that the only use for [crypto] is some sort of malicious behavior. I don’t understand what’s created that mind shift in Chairman Gensler’s perspective, but I’ll tell you this, the posture that he’s adopting now is damaging the industry.”

“It’s damaging our potential to lead and I think it’s up to the Senate and to the to the House of Representatives to bring this into check. What we need to do is have more hearings on this. The Senate is controlled by Democrats. The Banking Committee has had far too few hearings on [digital assets]. We just had an appropriations committee hearing where Chair Gensler came before us and we need to be doing more of this oversight and having more of this discussion so I can get better insight into what’s in his mind. And also I can share with him my business person entrepreneurial perspective, and my perspective that America is best when we lead.”

on the current crypto bills before Congress and which is most likely to pass

“… that is very difficult to say. The way legislation comes together tends to be in response to a particular crisis or event. I put together legislation that I think, again, lays broad guardrails and creates certainty, but you will find very often that Congress reacts as as opposed to thinking in a forward manner.”

“I’ll bring a case in point that’s not directly related to crypto, but it’s called the Recoup Act that came to the Banking Committee that was in response to the collapse of Silicon Valley Bank. And I did not support that because I read the detail of that legislation. If you look at it carefully, and again, it was thrown together very rapidly. I think we got the text early in the morning and we had to vote on it later in the day – we just voted out of committee. It’s not been voted for on the floor of the Senate. But if you look carefully at the text, which we did, it would give the federal government the authority to step in and take over management of the bank if they deemed that that bank was undertaking risks that were unsatisfactory… I think that is very, very dangerous.”

“(…) A lot of people come to me and say, ‘What we’re seeing is another case of choke point.’ This is choke point 2.0. And that was the Obama Justice Department’s use of regulations to come in and choke off industries that were not favored by the Administration at that point in time. I think a lot of people in the crypto industry are very concerned that we’re now using supervisory powers to come in and choke off the crypto market -that is not good for America… I think they’re acting way beyond their remit to do this and Congress should step in and take take action here.”