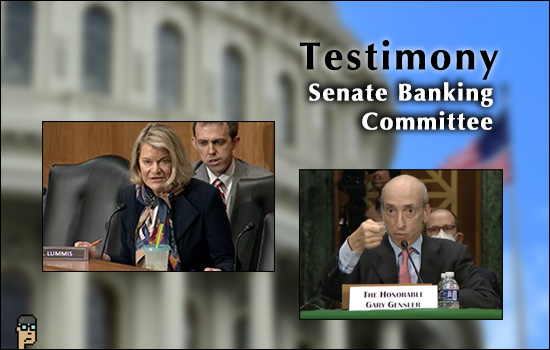

It was a relatively brief interaction, but in engaging with SEC Chair Gary Gensler at his Senate Banking Committee hearing last week, Sen. Cynthia Lummis (R, WY) provided an update on her bipartisan Responsible Financial Innovation Act (RFIA) co-sponsored with Sen. Kirsten Gillibrand (D, NY).

Senator Lummis also generated news about the SEC’s crypto disclosure requirements.

View at 1 hour 36 minutes of the video for Thursday’s hearing on oversight of the SEC.

Lummis told SEC Chair Gensler that she and Sen. Gillibrand expect to re-introduce the bill early in the new Congress next year.

In order to meet that deadline, she asked that Chair Gensler and SEC staff work with her and Gillibrand on Section 301 of the bill to understand the necessary disclosures required by digital asset companies.

Throughout the brief interaction, Sen. Lummis made multiple mentions of her Democratic colleague’s involvement appearing to signal to the Democrat Gensler, who was appointed by a Democratic administration, that this isn’t just a Republican initiative.

Gensler was open at first and said that he wants to see crypto company disclosures not just at the IPO – or ICO as the case may be – but also with periodic reporting in the secondary market. Lummis asked to clarify if Chair Gensler believed 1934’s disclosure requirements will differ from today’s potential disclosure requirements for crypto companies.

Surprisingly, he said there will be differences and explained, “I think similar in kind but probably there’s some things that might be a little bit different on the list. I mean – there might not be a board of directors and things like that. So I really do think your bill had a list – we might differ on that list. We might have other things to put on that list, but it’s not necessarily everything a multinational company is doing.”

The suggestion that there’s a disclosure list for digital asset securities at the SEC – which has been notoriously tight-lipped in public on crypto company requirements – was an opening for Senator Lummis.

So, she pounced.

“Well, I want you to know that Senator Gillibrand, and I want to continue to work with you and your staff, to make sure that to the extent that we don’t philosophically disagree that any of those sorts of gaps that you have identified in our bill can be addressed,” Lummis said. “Because I don’t see our bill having an avenue to come before this committee or the Congress before the end of the year. But we do intend to have it to reintroduce it in January. And we want to make sure that between now and January, we’ve worked with you and your staff, to make sure that we can address items that we can mutually agree, need to be in the bill.”

Sensing he was being cornered, Chair Gensler interrupted and said, “I look forward to that, and particularly, as I said earlier, in ways that we can ensure we don’t undermine the 100 trillion dollar capital market, the definition of security, that definitions of other things that really are under this committee and stay under this committee.”

Lummis pressed, “And we’ve talked about unintended consequences of our bill before with you. We want to address those unintended consequences. Obviously, you see things that maybe we don’t because of your perspective, Mr. Chairman. Thank you really appreciate your being here today.”

The Senator’s time was up. And so was Senator Gillibrand’s.