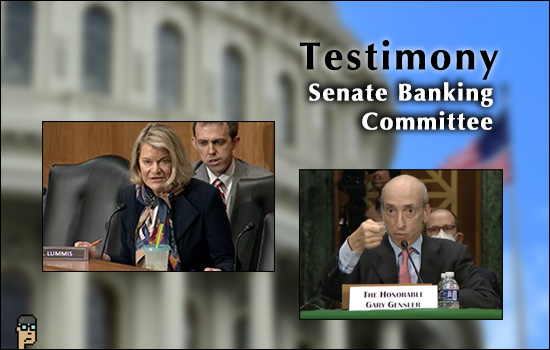

Republicans didn’t waste any time questioning the moves and motives of Securities and Exchange Commission (SEC) Chair Gary Gensler at the House Financial Services (HFS) “SEC Oversight” hearing today.

Video is here.

Minutes before the hearing commenced, a full-throated rejection by the Committee’s Republican caucus “slamming the agency for its persistent failure to conduct thorough economic analysis or consider stakeholder feedback regarding its regulatory agenda” was announced in the form of a letter to Chair Gensler. Read the release -and the letter.

Yesterday’s letter on Bitcoin spot market ETF’s sent by HFS committee member Rep. Mike Flood may have been more impressive given its bipartisan nature – both Rep. Ritchie Torres (D, NY) and Rep. Wiley Nickel (D, NC) signed on.

two things

As it turned out, during the hearing, the most revelatory moment related to digital assets was arguably provided by a Democrat (Rep. Torres (D, NY) – see below), Tokenization is a tripwire when it comes to securities laws for Chair Gensler.

And, another highlight was Rep. Mike Flood’s (R, NE) questioning of Chair Gensler about Staff Accounting Bulletin 121 (SAB 121) and, separately, Flood’s announcement about the new “Uniform Treatment of Custodial Assets Act” which would gut the SEC’s bulletin. See below.

Also: This was an uninterrupted 4.5 hour hearing that ended at 2:29 p.m. ET. Wow. April’s House SEC Oversight hearing was only 3 hours and 45 minutes. Continue reading “Reps. Torres And Flood Highlight SEC Oversight Hearing With Chair Gensler”