approps amendments

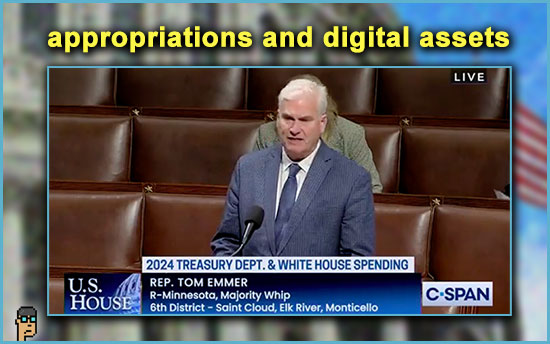

As negotiations continue on the Hill regarding appropriations, at least two digital asset-related amendments were introduced by Republicans in the House of Representatives yesterday. Reigning in the SEC and CBDCs was the focus.

Majority Whip Tom Emmer (R, MN) said, “[Gary Gensler] is as ineffective as he is incompetent. Fortunately, my nonpartisan appropriations amendment to reign in SEC enforcement abuses against the digital asset industry passed the House today with no opposition. Congress will hold unelected bureaucrats accountable.” Incidents involving Coinbase and Grayscale and the agency’s SAB 121 bulletin are all identified as examples of SEC overreach. See Emmer’s 5-minute statement on the House floor on X.

Rep. Warren Davidson (R, OH) took the opportunity to target CBDCs, a House Republican bugaboo, as an approps amendment. He said, “Central Bank Digital Currencies (CBDCs) should never be designed, developed, or established. It’s like building the Death Star and saying you won’t turn it on. Today I offered an amendment to stop the creation of [CBDCs]…” On X, see Rep. Davidson’s speech on the House floor.

Emmer’s (here) and Davidson’s (here) amendments were adopted by voice vote in the House.

more tips:

You Can’t Regulate What You Don’t Understand (2.0) – Alex Grieve, Paradigm

cop on the beat

Showing Congress that it’s the “cop on the beat,” the Commodity Futures Trading Commission (CFTC) tallied up its fiscal year 2023 enforcement actions ending September 30, 2023 in a press release yesterday. It’s lead category was “digital assets” in which the regulator “brought 47 actions involving conduct related to digital asset commodities, representing more than 49% of all actions filed during that period.” Overall (digital assets plus everything else), the CFTC said it had “over $4.3 billion in penalties, restitution and disgorgement” in the fiscal year. Read the release.

CFTC Chair Rostin Behnam has long advocated that his agency is the appropriate “cop on the beat” for digital assets cash markets since pre-FTX-implosion and the consideration of the Digital Commodities Consumer Protection Act (DCCPA) in the last Congress.

“Cop on the beat” history tip: “CFTC and Energy Markets: ‘The Cop on the Beat – Protecting Consumers'” (2007) – CFTC.gov

quick tip: “CFTC Chair Behnam admits his agency is behind other countries on crypto: ‘…it’s unfortunate but we’re a bit behind and we’re talking about the UK… Europe, Asia, the Middle East as well. And I think that becomes a competitive disadvantage…'”- @blockchaintipsheet at #DCFintechWeek

tokenization tsunami

The growing wave of tokenization added more momentum yesterday as one of the world’s largest banks – HSBC – said that it would offer institutions custody services for tokenized securities next year. Ripple will be helping facilitate the new offering after acquiring Metaco and its custody product line in May.

HSBC’s John O’Neill, who is the bank’s Global Head of Digital Assets Strategy, said in a statement: “I’m excited by the forthcoming launch of our new custody service for digital assets, which will complement HSBC Orion, our platform for issuing digital assets, as well as our recent launch of tokenised physical gold.” Read the release (PDF). And, read a summary on Bloomberg.

quick tip: House Financial Services Chair Patrick McHenry (R, NC) thinks something can be done in regards to crypto legislation in the next couple months – likely though the National Defense Authorization Act (NDAA). McHenry knows the Senate wants AML provisions and tells Politico, “Just a focus on anti-money laundering is not enough…. We have to have a broader view of this, though that’s an important component of it.” Read Politico.

tax comments

The Monday, November 13 deadline for comments on the new digital assets tax proposal by U.S. Treasury and the Internal Revenue Service is fast approaching and the decision to move back the original deadline two weeks in order to accommodate demand appears to have been a good idea. All told, over 119,000 public comments were received as of yesterday.

Blockchain industry advocates such as DeFi Education Fund are publicizing their comments with the Fund’s Miller Whitehouse-Levine and Amanda Tuminelli issuing a 35-page tome rejecting the definition of “broker” used in the 84-page proposal.

The team conclude in part, “In light of the concerns raised in this report and the sheer number of comment letters already submitted raising myriad issues, the Treasury and the IRS should delay the effective date of any broker reporting obligations that would apply to digital asset middlemen.” Read the comment letter (PDF).

Meanwhile on X, Bill Hughes, who is counsel for software technology company Consensys, bemoaned a specific cohort of commentary: “I’m sorry to be a bummer but 120,000 comments submitted to Treasury where a non trivial percentage is either bloviating about HEX or doesn’t realize the Treasury is not the SEC has me feeling like this sometimes.” See “this.”

quick tip: “[Galaxy Digital CEO Mike Novogratz] says in wake of FTX, crypto needs experienced finance execs. [Uniswap] COO Mary Catherine Lader responds: ‘I don’t think the response to FTX should be that we replaced one form of social proof -endorsing someone who looks like a young innovator- with another form of [social proof] … endorsing someone who looks like a financial services executive. The history of finance is full of dozens of old men who have led people down the wrong path.'” – @blockchaintipsheet at #DCFintechWeek

hear ye, hear ya

House Financial Services Subcommittee on Digital Assets, Financial Technology and Inclusion and scheduled a hearing entitled: “Crypto Crime in Context: Breaking Down the Illicit Activity in Digital Assets.” It will take place next Wednesday, November 15, 2:00 p.m. ET. See the landing page.

stablecoins – central bankers

The Swiss-based central banker organization known as the Bank for International Settlements (a.k.a. BIS) is not a fan of stablecoins. Surprised? In a paper titled, “Will the real stablecoin please stand up?“, BIS economist Anneke Kosse finds volatility and where there’s volatility there is considerable circumspection. “…we conclude that the stablecoins in circulation today do not meet the key criteria for being a safe store of value and a trustworthy means of payment in the real economy,” she writes. Bring on the central bank digital currency (CBDC). Read a short statement from BIS . And then, download the 29-page paper.

stablecoins – EU reserves

Yesterday, the European Union’s consultations (i.e. proposals) on stablecoins tried to clarify the reserves required for the digital asset financial product. Ledger Insights distills the proposals that will impact the roll-out of the EU’s Markets in Crypto-Assets Regulation (known as MiCAR in this article). One snippet: “Smaller stablecoins must hold at least 30% of their reserves at commercial banks. In contrast, significant stablecoins must keep 60% or more at banks. Both of these requirements are already specified by MiCAR. A significant stablecoin is one with at least €5 billion in reserves or more than ten million users.” Read more on Ledger Insights. And, read the EU press release.

more tips:

“Good news for fintechs and non-bank payment firms from Brussels: The EU institutions have reached a provisional deal on instant payments during yesterday’s trilogue negotiation…” – Patrick Hansen, Circle, on X yesterday

still more tips

U.S. SEC Said to Open Talks with Grayscale on Spot Bitcoin ETF Push – CoinDesk

Opinion: “Sam Bankman-Fried and the People Who Gave Up Their Money for Nothing” – Molly White in The New York Times

Congress Must Aid Fight Against Illicit Use of Crypto, Treasury Official Says (Nov. 7) – WSJ

House Financial Services Committee: “HEARING NOTICE: Oversight of Prudential Regulators” on November 15 – financialservices.house.gov

Stablecoin Behemoth Circle Mulls 2024 IPO: Report – Decrypt