Senator Marshall relents

With pressure likely building after former President Donald Trump’s embrace of crypto in recent weeks, Senator Roger Marshall (R, KS) quietly removed his name as a co-sponsor of Senator Elizabeth Warren’s (D, MA) “Digital Asset Anti-Money Laundering Act” [S.2669] on Wednesday according to Congress.gov.

The Warren/Marshall bill had originally been introduced (post-FTX) late in the 117th Congress and then reintroduced in February 2023 in the 118th Congress.

Previously, conservative organizations such as Club for Growth (see the March 2023 letter) challenged the Senator on his decision to co-sponsor and may have also played a part in Marshall’s change of heart.

Sen. Marshall was seen engaging in a Senator Cynthia Lummis (R, WY) Senate Innovation Caucus meeting in April with a16z crypto investor and author Chris Dixon.

h/t @alexandergrieve

what you should know: Senator Lindsey Graham (SC), a strong Trump supporter, is the only Republican co-sponsor left. It would not be surprising to see his name drop off next.

Senate – Majority Leader

Senate Democratic leadership continued to position yesterday that they want a digital asset regulatory framework.

Politico’s Eleanor Mueller reported on X yesterday that Senate Majority Leader Chuck Schumer (D, NY) told her that “he hopes to pass a crypto bill this year. ‘We’d like to get something done,’ he said. ‘We’d like to have appropriate guardrails.'” Read more (subscription).

Ms. Mueller also confirms that Senate Agriculture Chair Debbie Stabenow (D, M) is still aiming for a markup of a new version of the “Digital Commodities Consumer Protection Act” (DCCPA 2.0) next Wednesday – while Senator Warren doesn’t approve of the bill’s illicit finance provisions on money laundering.

more tips:

-

- Today, we announce that Chris Lehane, Paul Clement, and Christa Davies are joining Coinbase’s Board of Directors – Coinbase

Senate – donations

Leader Schumer’s comments speak to the fact that Dem leadership may want to call off the “donation dogs,” too.

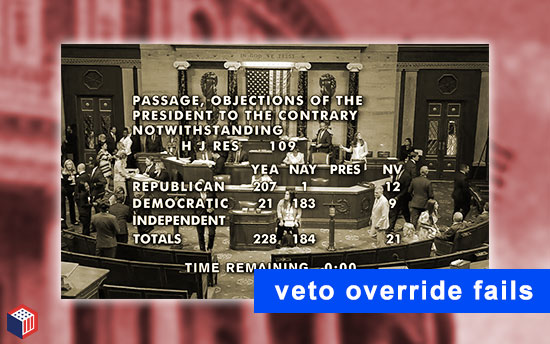

The voluminous, crypto campaign “donation dogs” appear to be having impact on Congressional races and even the race for the White House -see former President Donald Trump at Bitcoin 2024 tomorrow. Meanwhile, Dems are led at the conference by Reps. Wiley Nickel (D, NC) and Ro Khanna (D, CA) – Khanna voted to keep SAB 121 in the initial vote and then was one of only a couple of Dems who switched to supporting an override of President Biden’s veto in the vote earlier this month. Continue reading “Majority Leader Schumer Wants Digital Asset Guardrails; Sen. Marshall No Longer Co-Sponsors DAAMA”