President Biden

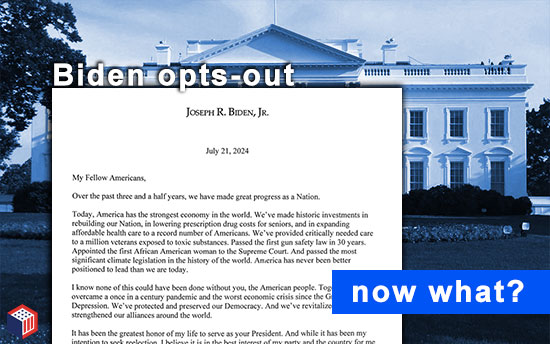

President Joe Biden formally announced his intention to step away from running for another term as President yesterday. He stated his intention to remain in office through the end of his term in January.

Republican leadership, such as House Majority Whip Tom Emmer (R, MN) who called him “unfit,” asked that the President step down immediately yesterday.

what you should know: The opportunity for substantive policy discussions on any topic before the election in November would seem to be even more unlikely. But, Brendan Pedersen delivers some hopium to the crypto universe in yesterday’s Punchbowl News’ The Vault newsletter as House Agriculture digital assets subcommittee chair Rep. Dusty Johnson (R, SD) tells him, “I wouldn’t want us to pull the shades on the 118th quite yet.”

Bitcoin conference Thursday

If having former President Donald Trump as a speaker isn’t enough, Bitcoin 2024 conference organizers on Friday suggested they’re about to unveil yet another surprise (speaker) as Fox Business’ Eleanor Terrett prognosticated on X that it could be entrepreneur Elon Musk, a prolific “donatoor” to the former President’s campaign.

Members of Congress expected to make the trip to Nashville and speak to the Bitcoin faithful include Republican Senators Marsha Blackburn (TN), Bill Hagerty (TN) and Cynthia Lummis (WY) and the increasingly-ubiquitous Rep. Ro Khanna (CA), the lone Democrat listed among the speakers.

The 3-day conference in Nashville, Tennessee, runs this Thursday to Saturday.

what you should know: Still thinking of going? In addition to more efficiently priced ticket tiers, a “VIP Whale Pass” to the event will set you back $21,000. But if you pay in Bitcoin, there’s a 21% discount.

tomorrow – AI hearing

Tomorrow, the House Financial Services (HFS) Committee will hold a hearing called “AI Innovation Explored: Insights into AI Applications in Financial Services and Housing.”

See the hearing page – starts at 10 a.m. ET in Rayburn.

what you should know: Will Democratic leadership embrace innovation opportunity or once again fall back on consumer protections as a position? “Consumer protections” reeks of “I don’t want to learn.”

tomorrow – Ether ETF approval

Spot Ether ETFs officially hit the market on July 23: What investors should know – Fast Company

House Floor – illicit finance

This week, the “Financial Technology Protection Act” [H.R.2969] sponsored by Rep. Zach Nunn (R, IA) and co-sponsored by Rep. Jim Himes (D, CT) heads to the House Floor according to the Majority Leader’s calendar.

A version of this bill [S.1340] also exists in the Senate and is co-sponsored by Senators Ted Budd (R, NC) and Kirsten Gillibrand (D, NY). See the 2023 announcement.

Sen. Budd is the originator of the bill in the House when it passed in both 2018 and 2019.

Compared to Sen. Elizabeth Warren’s Digital Asset Anti-Money Laundering Act [S.2669], this is much more digital assets industry-friendly and establishes a working group comprised of key, relevant members of government.

Trump, media and crypto

‘Almost’ Everyone in Crypto’s a Winner in a Second Trump Administration (yesterday) – Bloomberg on MSN

Crypto Industry Wants Trump to Win and Call Off the SEC (Saturday) – Bloomberg on Yahoo

Rep. Hill on podcasts

In two podcasts published last week, Rep. French Hill (R, AR), who is vice chair of the House Financial Services (HFS) Committee, continued to advocate for support of a digital assets regulation framework. In Rep. Hill’s mind, if it doesn’t happen this year, an approved framework will happen next year – especially if he is selected as Chair of HFS and Republicans win the House.

On the Bankless podcast, Rep Hill discusses bipartisan interest in digital assets and is emphatic that he sees a “pivot” in the Biden Administration on crypto coming out of the House floor vote on Financial Innovation and Technology Act for the 21st Century (FIT 21) [H.R.4763].

He said:

“It is very important for the whole ecosystem to know, that thanks to the leadership of Janet Yellen and others in the Administration, the President did not threaten to veto FIT 21. They had a Statement of Administrative Policy (see SAP in May) and it said, ‘Hey, there’s some things in it that we’d like to change, but we are not issuing a veto threat and we’d like to work constructively on a bipartisan basis toward a regulatory framework.’ I mean that.. is huge.”

Hear more on Bankless (43 minutes).

In another digital assets discussion on the Unchained podcast, Rep. Hill prognosticated post-election:

“If [Republicans] have the Senate and President Trump’s re-elected [in the White House], I hope that – if we are unsuccessful in passing a stablecoin piece of legislation and FIT 21 this year – those will be the first bills our committee can send to [President Trump’s] desk for signature in 2025.”

Hear more on Unchained (27 minutes).

what you should know: Like Senator Bill Hagerty’s (R, TN) appearance on the Validated podcast three weeks ago, Rep. Hill’s appearances remind audiences that Republicans see pro-crypto supporters as a key area for votes and donations.

Will Democrats start to be more vocal on digital assets or do the current tribulations in the White House supersede any ability to go deeper into issues – such as digital assets – at the present time?

Sen. Vance on crypto

Republican Vice Presidential candidate and current U.S. Senator J.D. Vance’s (OH) digital assets history gets a deep dive from Cap Hill Crypto’s George Leonard in light of his nomination at last week’s Republican National Convention.

Here’s one of many tidbits: “Senator Vance argued the SEC’s current approach to crypto creates perverse incentives by essentially banning tokens that have utility, while ignoring tokens that don’t have utility.”

Leonard notes that the Senator has also worried aloud about “financialization” and “whether much of the crypto stuff is fundamentally fake.”

more tips:

-

- Wall Street Takes a Back Seat With Trump’s Elevation of Vance (yesterday) – The Wall Street Journal

what you should know: Though much has been made recently of Sen. Vance’s bill proposing a digital assets regulatory framework, few in industry have seen it and it’s not clear if it will ever reach wider release in the current Congress. In general, there’s the feeling that Vance wants to assert a “seat at the table” when it comes to crypto given former President Donald Trump’s professed interest.

By the way, News 5 in Cleveland reports “state Sen. Matt Dolan, RNC Committeewoman for Ohio Jane Timken and former presidential candidate Vivek Ramaswamy” are potentially in the running to take Senator Vance’s seat if the Trump/Vance ticket succeeds. Ramaswamy is arguably the most-outspoken when it comes to crypto.

Sen. Stabenow’s bill

Senator Debbie Stabenow (D, MI), Chair of the Senate Agriculture Committee, continues to circulate her “Digital Commodity Consumer Protection Act 2.0” (unconfirmed title) – her new digital assets bill.

Politico’s Eleanor Mueller reported on X on Thursday, “The 113-page text shared with me parallels DCCPA 1.0, but with a few notable differences. That includes a bracketed section that lays out a role for the SEC.” In her article on X, Ms. Mueller sees narrower definitions among the highlights of the new bill in comparison. Read Politico (subscription).

what you should know: Another hearing? A markup this week or next? Time’s running out in the 118th Congress.

noms this week

A little over a week ago, Chair Sherrod Brown (D, OH) was pushing hard for an expedited nomination approval process for FDIC Chair Nominee Christy Goldsmith Romero as well as the other three nominees (Caroline Crenshaw, Kristin Johnson, and Gordon Ito) who attended the July 11 Senate Banking nomination hearing.

In a press release on Saturday, July 13, Chair Brown said in part, “I look forward to holding a hearing in the coming weeks to consider and then advance these highly qualified nominees.” Read the statement.

what you should know: Feels like there should be more news on “next steps” this week. The drama playing out in the Executive Branch does not help. But, it’s not clear if Senate Banking Republicans fully support the nomination of either Goldsmith Romero or re-nomination of SEC Commissioner Crenshaw. With Sen. Robert Menendez (D, NJ) potentially resigning this week in the wake of his conviction last week, the Democratic majority on the Banking Committee loses a bit of steam.

still more tips

Messari CEO steps down amidst controversial political tweets – Axios

SEC’s Crypto Accounting Workaround – Capitol Account

“80 per cent of donations from internet companies have gone to Democrats so far in this election cycle, according to Open Secrets” – Financial Times

South Korea’s inaugural crypto law goes into full effect – The Block

Crypto Super PAC spends $1.3M on media buy for Arizona Democrat – Cointelegraph