Secretary Yellen – SAB 121

The annual report of the Financial Stability Oversight Council (FSOC) will bring U.S. Treasury Secretary Janet Yellen (D) in front of the House Financial Services Committee today and the Senate Banking Committee on Thursday.

The HFS Committee Majority Republicans made clear yesterday on the hearing’s web page that Staff Accounting Bulletin 121 (SAB 121) – slammed by the GAO on October 31 and now under pressure from a bicameral Congressional Review Act resolution introduced last week – will be a topic of discussion with the Secretary today.

The joint resolution signed by HFS Committee member Rep. Mike Flood (R, NE) is available for download along with the hearing’s memo.

Last week, Rep. Flood and Senator Cynthia Lummis (R, WY) and Rep. Wiley Nickel (D, NC) introduced the unsigned, bicameral joint resolution.

The hearing starts at 10 a.m. ET in the Rayburn House Office Building – livestream here.

more tips:

-

- H.J.Res.109 – Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Securities and Exchange Commission relating to “Staff Accounting Bulletin No. 121”. – Congress.gov

- S.J.Res.59 – A joint resolution providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Securities and Exchange Commission relating to “Staff Accounting Bulletin No. 121”. – Congress.gov

what you should know: The argument goes that the inability for “stable” and well-regulated traditional finance institutions to custody crypto due to SAB 121 has led to instability for crypto. And that’s fine for many anti-crypto advocates who would like to see digital assets go away.

Yellen – prepared testimony

In her prepared testimony, Secretary Yellen outlines five areas of “ongoing work” by FSOC.

AI and digital assets are #4 and #5, respectively, on her list…

On AI:

“…the Council is closely monitoring the increasing use of artificial intelligence in financial services, which brings potential benefits such as reducing costs and improving efficiencies and potential risks like cyber and model risk. Financial institutions, regulators, and market participants should continue deepening their expertise and monitoring capacity in this area.”

On digital assets:

“…the Council is focused on digital assets and related risks such as from runs on crypto-asset platforms and stablecoins, potential vulnerabilities from crypto-asset price volatility, and the proliferation of platforms acting outside of or out of compliance with applicable laws and regulations. Applicable rules and regulations should be enforced, and Congress should pass legislation to provide for the regulation of stablecoins and of the spot market for crypto-assets that are not securities. We look forward to continuing to engage with Congress on this.”

Download her short prepared testimony (PDF).

Yellen – FSOC overreach

Today’s HFS hearing has also been partially “teed” up by the HFS Digital Assets, Financial Technology and Inclusion Subcommittee hearing in early January which largely painted FSOC (by pro-crypto Members) as overreaching its authority in the digital assets space especially after its October FSOC report on digital assets and financial stability.

what you should know: Pushing the Secretary’s agenda is the existence of the Dodd-Frank Wall Street Reform and Consumer Protection Act which became law after the Great Financial Crisis back in 2008-2009. Through FSOC, the Secretary has been charged with proving to Congress that her Council has their eye on the financial stability “ball.” The Council itself is made up of all the key financial federal regulators and even some state regulators like the New York Department Financial Services (NYDFS).

Yellen – FIT 21

Just last June, the Secretary appeared in front of the HFS Committee and told Vice Chair French Hill (R, AR), that it “remains the view of FSOC that there are some gaps like spot markets for crypto assets that are not securities. We would like to see your regulatory framework over those markets.” Since that time, the Committee passed it’s digital asset market structure bill (FIT 21) out of HFS and House Agriculture markups and, by all accounts, has been working behind the scenes to get more Members on board (see Politico, Jan. 29).

what you should know: It would seem logical that the Secretary will be asked today about FIT 21 and/or its parts at the HFS hearing. On Thursday at the Secretary’s Senate Banking hearing, there will likely be no discussion of a framework except as it relates to the Senate’s illicit finance bills. One exception could be Senator Lummis may be inclined to bring up her Lummis-Gillibrand Responsible Financial Innovation Act (RFIA) [S.2281]. Or Senator Lummis may choose to discuss SAB 121 with her 5 minutes during Q&A.

Yellen – stablecoins

In anticipation of Yellen’s appearances this week, Blockchain Association policy executive Ron Hammond reviewed the path for needed stablecoin regulation yesterday among other “hot button,” digital asset issues.

Hammond said in a tweet thread that “Congress got the memo” on stablecoins from Treasury in the past and recounts, “….under [then-Chair Maxine Waters (D, CA) in 2022, Congress started working on a bill. When the House flipped, [HFS Chair Patrick McHenry (R, NC)] took the lead. In July 2023, it seemed like the House was ready to advance the bill but the White House objected taking a few D votes last sec.(…) So now it’s been over 2 years and while we’ve seen enforcement actions on BUSD and scrutiny on Tether, there hasn’t been much from the regulators in terms of crafting a clear framework for redemptions, reserves, audits and other factors which the Admin called for.” Read his thread.

what you should know: The Clarity for Payment Stablecoins Act [H.R. 4766] passed out of an HFS markup in July is seeking a bipartisan way forward which would allow Senate approval, too. The dividing line remains between parallel (states rights) and pre-emption (the “Federal floor” – i.e. The Federal Reserve has final approval on stablecoin issuance). In December, Punchbowl News Brendan Pedersen reported that Senator Kirsten Gillibrand (D, NY) was working on a potential stablecoin bill compromise along with her RFIA counterpart, Senator Lummis.

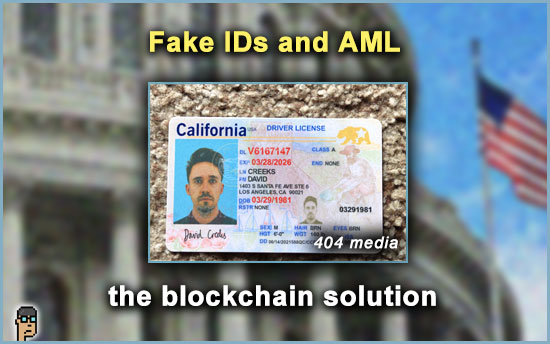

AML warning (blockchain use case)

Tech publishing company 404 media looks at a website called OnlyFake which is offering fake IDs for $15. 404’s Joseph Cox writes that OnlyFake “produces fake IDs nearly instantly, [and]could streamline everything from bank fraud to laundering stolen funds.” Read more.

Coin Center’s Peter Van Valkenburgh provided his take on the fake ID news on X and said, “Every institution crypto or trad is about to face massive ID fraud because of AI. Crypto is, in fact, the only solution, b/c physical ids and pictures of them is now a garbage fire of fake (actually has been for a long time AI makes it scale)…”

what you should know: Will lawmakers soon clamor for better anti-money laundering protocols in digital assets AND traditional finance by asking for the use of the immutable blockchain to combat fraud?

still more tips

Paradigm Files Amicus Brief in Support of KalshiEx Congressional Control Contract Case vs. the CFTC – Paradigm

McHenry, Barr Probe Federal Reserve Regional Banks’ Ties to Unaccountable Global Governance Organizations – House.gov

Opinion: Bitcoin: A New Regulatory Attack Vector – CoinDesk

Genesis Global Wants to Sell $1.4 Billion of Grayscale Bitcoin Trust – The Wall Street Journal

Tether and Solana’s Yakovenko join $25 million round for crypto payments firm Oobit – The Block