crypto bills update

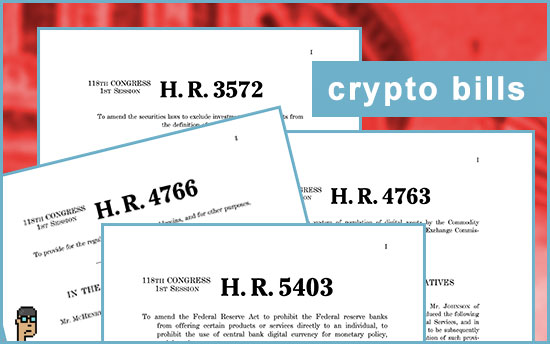

With the clock ticking on the 118th Congress, Politico’s Morning Money reported yesterday that a House floor vote – originally planned for Q4 2023 and interrupted by the Speaker switch – is now expected sometime in the current calendar quarter for the digital asset market structure bill [H.R.4763]. Majority Whip Tom Emmer (R, MN) is also trying to add elements of his “Securities Clarity Act” [H.R.3572] which Politico says “runs the risk of hurting what’s already proven to be narrow Democratic support for the underlying legislation.” And, the Whip’s “CBDC Anti-Surveillance State Act” [H.R.5403] may also complicate matters. Meanwhile, the stablecoin bill [H.R. 4766] is still in the same place it was last month -waiting for a “legislative vehicle.”

what you should know: Speaker Mike Johnson (R, LA) would appear to be a wild-card in the process. He’s not the technology advocate that former Speaker Kevin McCarthy (R, CA) was. Also, House Financial Services Chair Patrick McHenry (R, NC) has shared some criticism of Johnson which may create additional friction within the Republican caucus and with McHenry’s digital assets agenda.

“code is law” trial

“Avraham Eisenberg, a crypto trader the US says stole $110M on the Mango Markets exchange in 2022, begins his trial this week, testing ‘code is law’ claims.” – Bloomberg via Techmeme

today – Senate Banking hearing

The Senate Banking Committee hearing, “An Update from the Treasury Department: Countering Illicit Finance, Terrorism and Sanctions Evasion,” with Deputy Treasury Secretary Wally Adeyemo will take place at the Dirksen Senate Office Building today. From his pre

Get the livestream beginning at 10 a.m. ET.

today – prepared testimony

From his prepared testimony for today’s Senate Banking hearing released late yesterday, Deputy Secretary Adeyemo focuses on getting the tools he believes Treasury needs from Congress to combat illicit finance in digital – or virtual – assets. He concludes, “While we continue to assess that terrorists prefer to use traditional financial products and services, we fear that without Congressional action to provide us with the necessary tools, the use of virtual assets by these actors will only grow. We are grateful for the partnership of Congress and this Committee in helping Treasury root out illicit finance from the U.S. financial system and to hold illicit actors accountable. I look forward to today’s discussion on how we can continue this work.”

Download his prepared testimony (PDF).

In reaction to Adeyemo’s testimony on X last night, Coinbase’s chief legal officer Paul Grewal said, “One thing is clear: if we are serious about addressing the small percentage of [illicit finance] conducted with digital assets, pass stablecoin legislation now.” Read his tweet thread.

more tips:

-

- Opinion: Crypto Does Not Have an Illicit Finance Problem, Bad Actors Do – Dante Disparte, Circle on CoinDesk

what you should know: Read a hearing preview in blockchain tipsheet yesterday.

today – new AML bill

Just in time for today’s Senate Banking hearing, Senators Thom Tillis (R, NC) and Bill Hagerty (R, TN) – both members of Senate Banking – have introduced a discussion draft of a bill focused on anti-money laundering (AML) and crypto called, “Ensuring Necessary Financial Oversight and Reporting of Cryptocurrency Ecosystems (ENFORCE) Act.” See the press release.

According to a Punchbowl News which broke the news yesterday, “Tillis and Hagerty’s new crypto AML proposal would apply Bank Secrecy Act anti-money laundering rules to certain digital asset financial institutions.”

Sen. Hagerty already has a crypto AML bill introduced with Sen. Cynthia Lummis (R, WY) which was sent to Senate Judiciary in January called, “Preventing Illicit Finance Through Partnership Act” [S.3603] which is intended to “establish an information-sharing pilot program to combat the illicit use of crypto assets.”

what you should know: Sen. Tillis has dabbled in digital asset legislation before. Back in October, Sen. Tilis and Sen. John Hickenlooper (D, CO) introduced the “Proving Reserves of Others Funds Act” or “PROOF Act” [S.3087] which they described in a press release at the time as “bipartisan legislation that would establish strong safeguards against instances of unethical co-mingling of customer funds while also requiring digital assets institutions to submit to a monthly proof of reserves (PoR) inspection by a neutral third-party auditing firm.” Read the release.

today – Bitcoin Policy Institute

Bitcoin Policy Institute will kick-off a full-day event in Washington, D.C. today with opening remarks from Sen. Kirsten Gillibrand (D, NY) as the Bitcoin ecosystem connects with lawmakers and regulators and discusses key issues of the day for its constituency. Among several gov-related appearances will be Senator Lummis, HFS Chair Patrick McHenry (R, NC), Rep. Wiley Nickel (D, NC), Lauren Boyd of the US Department of Energy and Chastity Murphy, a senior advisor at U.S. Treasury

Notably, Senator Marsha Blackburn (R, TN) will participate in a fireside chat at 4 p.m.

Blackburn has not been vocal about digital assets to date. But, according to promotional material in the lead-up to the conference, Sen. Blackburn’s discussion will be “focused on the current landscape of digital asset policy, tackling commonly-held misconceptions, regulatory challenges, as well as the future direction of Bitcoin and digital assets in the United States.” Blackburn serves on Senate Commerce, Senate Judiciary and Senate Finance in addition to the Senate’s Veteran Affairs Committee.

Get the YouTube livestream here beginning at 8:30 a.m. ET.

Agenda is here.

bitcoin mining ban

Commenting on a story about a Bitcoin mining ban in Paraguay that may have cost that country’s $200 million USD, Senator Cynthia Lummis offered her pro-crypto viewpoint on X yesterday, “If a Bitcoin mining ban will cost Paraguay’s economy $200 million per year, how damaging would a similar ban be in the United States? President Biden’s proposed 30% mining tax is so punitive it is a de facto ban. The U.S. must embrace innovation not big government mandates.” See the tweet.

ransomware hearing next

Blockchain Association policy executive Ron Hammond, a former staffer of Rep. Warren Davidson’s (R, OH), provided his weekly X update on Congress yesterday and says he’s heard rumors about a House Financial Services (HFS) hearing next week amidst this week‘s illicit finance discussion inspired, in part, by Senate Banking: “This won’t be the end of the AML narrative battle though by any means. [HFS] is expected to have a hearing next week on ransomware which will cover crypto. For crypto skeptics and supporters, time is short for any crypto bill (good or bad) to move this Congress.” Read his tweet thread.

big hire

Having represented a key enforcement arm of the U.S. Treasury, former Internal Revenue Service (IRS) criminal investigations chief Jim Lee has officially joined blockchain analytics firm Chainalysis. Lee explained a bit about his new role in a blog post yesterday: “As Global Head of Capacity Building, I’ll be working to better enable the men and women in law enforcement to thwart many threats in parallel — just like I have been for the last 29 years.” Lee had retired from federal service in February where he oversaw over 3,000 employees.

Read his “Why I’m Joining Chainalysis” post on the Chainalysis blog.

Custodia v. Fed

Last week, Cap Hill Crypto’s George Leonardo provided a detailed breakdown of the latest court decision as crypto bank Custodia pursues a master account from the Federal Reserve via the courts. Leonardo writes in part, “Because there was no dispute over material facts (e.g., that Custodia was eligible for a master account), the court ruled on the parties’ motions for judgement as a matter of law on each claim.” Custodia may have lost this court battle, but read everything you need to know about the war.

predictions

Ripple CEO predicts crypto market will double in size to $5 trillion by the end of 2024 – CNBC

Crypto survey shows less consumer skepticism, but a third expect bitcoin price fall – Reuters

still more tips

“David Planning, the floor director for House Majority Whip Tom Emmer, is leaving the Hill for Cornerstone Government Relations” – Punchbowl News

“PitchBook: VC investment in crypto startups rose 32% QoQ to $2.5B in Q1 2024, down from $2.6B in Q1 2023, after a brutal year for crypto and blockchain startups” – Bloomberg

Talking Trading With Robinhood; BlackRock’s Washington Expansion; Peirce Blasts SEC’s `Dwindling’ Public Outreach (April 6) – Capitol Account