protect DeFi

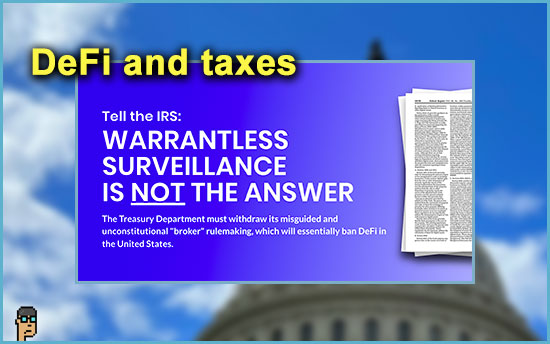

Blockchain industry advocates led by DeFi Education Fund are promoting the new “protectDeFi.org” website, which aspires to protect the interests of decentralized finance particularly as it relates to new digital asset tax rules proposed by U.S. Treasury and the Internal Revenue Service (IRS) on August 28.

The origins of industry pushback is the Infrastructure Investment and Jobs Act of 2021 as Blockchain Association CEO Kristin Smith explains in a tweet thread on X. And on the new Treasury proposal, she adds, “…the proposal includes software developers who might have worked on a front-end interface to a DeFi protocol, and [because] they did so, the IRS may consider them ‘in a position to know’ about future activity on that protocol.. These developers would then have to furnish 1099s and abide by other reporting requirements… This is untenable + would force those persons to stop work or move to more welcoming jurisdictions. As it stands, if this updated definition is adopted by the IRS, it would result in a decimation of the digital assets industry in the U.S.” Read it.

Consensys counsel Bill Hughes joins the industry chorus on X, “… the cost and time required by reporting obligations would cripple most start-up software development projects. And IRS is gravely underestimating those costs (which is typical for agencies during rulemakings).” View more on X.

Final feedback to Treasury and the IRS is due on October 30. The protectDeFi.org website offers an artificial intelligence tool for interested parties who wish to create a letter for feedback purposes.

protect DeFi – Congress

In Congress, the Keep Innovation In America Act co-sponsored by House Financial Services (HFS) Committee Chair Patrick McHenry (R, NC) and Rep. Ritchie Torres (D, NY) among many others (see H.R. 1414) is a bipartisan Congressional effort introduced in March to fix the IRS issue created in the Jobs Act. So far, the bill has not made it out of Committee.

Gensler standing in the way

On the Coin Stories podcast with Natalie Brunell, Ark Invest CEO Cathie Wood says the Securities and Exchange Commission’s (SEC’s) failure to approve a Bitcoin spot market ETF lies at the feet of Chair Gary Gensler. Wood’s firm has been among many who have applied (see the registration statement) with the SEC to start an ETF fund using Bitcoin as the underlying asset.

Wood said on the podcast, “We know the research people at the SEC, and they know what they’re talking about. They are really good. We’ve met the head of FinHub now, who reports directly to Chairman Gensler and for me, the disconnect is, they know so much, and they are so good, that I believe this was much more Gary Gensler standing in the way. I don’t know for sure because they could never say something like that. I just know from how we have discussed Bitcoin with them that they really understand it and they understand its merits – most important. So this is Gary Gensler.”

She continued, “Why he allowed – and I will say ‘he’ because I think he’s the gating factor here – a Bitcoin futures ETF, which involves counterparty risk, and not a Bitcoin [spot market] ETF, which does not involve counterparty risk…. In fact, ours would be backed by Bitcoin one for one in cold storage at Coinbase. That’s why Grayscale has won its case. It is that argument. And so, I think Gary Gensler’s personal Vietnam is coming around to haunt him. I do think the SEC is moving now. He has, in effect, said ‘Hey, I’m not the only decision maker there are five commissioners here.’ That means some of the research that we believe is percolating up to those commissioners might be getting through to them, and might be the grounds now for the approval of a Bitcoin ETF – and we don’t think that the SEC will approve just one.” See the interview on YouTube.

venturing to Arkansas

Will Rep. French Hill (R, AR) and Sen. John Boozman (R, AR) take note? No doubt Coinbase Ventures and Haun Ventures decision to underwrite a technology program, the new Bounds Accelerator, at the University of Arkansas is one such effort to reach the powerful lawmakers who have taken leading roles in digital asset legislation.

Haun Ventures policy executive Tomicah Tilleman is upfront about his crypto venture firm’s interests saying in a Coinbase press release announcing the news, “The state is home to innovative entrepreneurs, major corporations with global reach and policymakers including Rep. French Hill and Sen. John Boozman, both of whom have taken an interest in digital asset technology. All of this makes Arkansas a great place to work with the startup community,” Read the Coinbase press release.

Venture firm a16z must be jealous.

offshore – Hong Kong

Hong-Kong-as-a-crypto-haven gets more press from TechCrunch as the tech publication solicits the opinion of Kevin Goldstein, an advisor to crypto investment firm HashKey Capital. Goldstein says, “A large number of U.S.-based crypto projects have opened offices, hired local talent and moved people to Asia over the past several years but there is clear evidence many have accelerated their growth initiatives in APAC in the past year as a result of developments in the U.S.” Read more.

HashKey Capital is the investment arm of HashKey Group, a subsidiary of Wanxiang Blockchain which is an investor in U.S.-based Prometheum. Prometheum ran afoul of Congress earlier this year and was granted a first-of-its-kind Special Purpose Broker-Dealer (SPBD) for digital asset securities by the Financial Industry Regulatory Authority (FINRA).

ETF rumor mill

Yesterday, word spread that the approval of a Bitcoin spot market ETF (Exchange-Traded Fund) application had finally been approved by the SEC after a false post in the media. The rumor mill resulted in transactions of over $100 million between the liquidations of long and short positions. Read more on CoinDesk. Still no word on ETF approval – even in the wake of the SEC abandoning its appeal of the Grayscale decision.

CBDC down under

A speech by a member of The Reserve Bank of Australia (RBA) indicates the central bank may be interested in implementing a central bank digital currency (CBDC).

Called “A Tokenised Future for the Australian Financial System,” the speech by the RBA’s Brad Jones sounded similar to U.S. Federal Reserve members when speaking about a CBDC. Jones said, “Our overarching position is that we remain open-minded as to the functional forms of digital money and supporting infrastructure that could best support the Australian economy in the future. We have an active research program underway and are letting the evidence guide us.” Read a summary in Cointelegraph.

more tips:

Australia’s Treasury consults on novel approach to regulating tokenized digital assets – Ledger Insights

still more tips

Ferrari to accept crypto as payment for its cars in the US – Reuters

Tether freezes 32 crypto wallets holding $873,118 linked to terrorism and warfare in Israel, Ukraine – CNBC

FSB identifies frictions from data frameworks that pose challenges to enhancing cross-border payments – Financial Stability Board

Gary Gensler urges regulators to tame AI risks to financial stability – The Financial Times