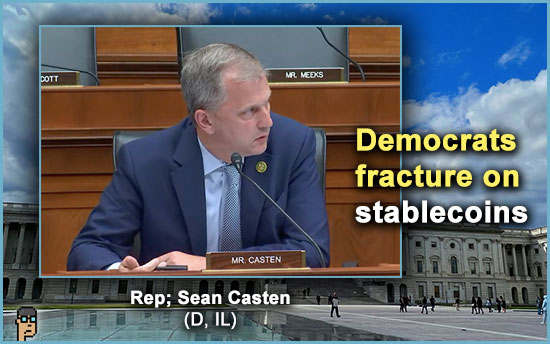

Democrats fracture on stablecoins

Is there Democratic infighting on stablecoin legislation? Seems like it. According to Politico’s morning newsletter yesterday, Rep. Sean Casten (D, IL) said: “Without naming names, there are members who are historically very thoughtful – who aren’t just sort of reflexively pro-crypto – who were supporting this and not making really good arguments about it…” Read more. So, who specifically wasn’t making good arguments according to Rep. Casten? And why – according to Rep. Casten? He did not say apparently.

But on X, Consensys Senior Counsel Bill Hughes offered his thoughts on Casten’s accusation in a tweet, “The narrative is that the supporters of these bills – especially the Dem supporters – have somehow been bought by the BIG CRYPTO lobbying effort. Note the eye-wink quote ‘how can these thoughtful people get behind this.’ You’d hope they’d get more imaginative than this, but its all they got.”

Only five House Financial Services Democrats voted for the stablecoin legislation last month at the markup: Rep. Gregory Meeks (NY), Rep. Jim Himes (CT), Rep. Josh Gottheimer (NJ), Rep. Ritchie Torres (NY) and Rep. Wiley Nickel (NC).

It would not be surprising to hear at least one of five Democrats rebuke Casten in the days to come – particularly Rep. Himes and Rep. Torres who appear frustrated with their party’s digital assets stance.

Not to be lost in the tension, Torres and Meeks are also sticking up for their New York Department of Financial Services, its robust stablecoin framework and states’ rights to facilitate the issuance and oversight of stablecoins. Torres has never minced words on the topic such as his statement at a May stablecoin hearing by House Financial Services.

more tips:

Rep. Casten questions PayPal CEO Dan Schulman on the company’s new stablecoin – casten.house.gov

Coinbase joins SRO

In what may be the first significant steps for crypto industry governance through a self-regulatory organization (SRO), Coinbase announced that its Coinbase Financial Markets subsidiary “secured regulatory approval from the National Futures Association (NFA), a CFTC-designated self-regulatory organization, to operate a Futures Commission Merchant (FCM) and offer eligible US customers access to crypto futures from our platforms.” See the company blog post.

It was back in late March that the NFA launched new digital asset “anti-fraud, just and equitable principles of trade, and supervision requirements” for Bitcoin and Ether to its membership – at least 100 of which were already engaged with digital assets at the time.

Enter the crypto native.

Coinbase said the new license “will allow eligible US customers to access regulated derivatives products through Coinbase Financial Markets.” The Company further explains, “The global crypto derivatives market represents ~75% of crypto trading volume worldwide (..). The ability to trade using margin gives customers leverage and access to the crypto market with less upfront investment than traditional spot trading. Being able to express long and short positions, investors also use derivatives to manage risk on their underlying crypto assets.”

Also, read a summary on the news from The Block.

more tips:

Read thread: “As someone who previously led one of the largest FCMs in the world, this is why it is a big deal…” – Christopher Perkins of Coinfund on X

NIST: blockchain is big

As part of a remit specified under the American Competitiveness Of a More Productive Emerging Tech Economy Act (The American COMPETE Act), the National Institute of Standards and Technology’s (NIST) – the government standard’s body overseen by the Commerce Department- was asked to prepare an exhaustive report on emerging technologies including blockchain and their potential impacts on the U.S. economy.

The report was finally released last month and is now available here: Download the 652-page report (PDF).

Blockchain gets its own section from page 315-478, and clearly financial applications and cryptocurrencies are a key part of the report. That said, the authors recognize a much broader opportunity for blockchain and share a series of recommendations at the outset of the blockchain section which recognizes that it’s still early days and the goal should be a path for unlocking rather than throttling innovation.

NIST: support, then use cases

From Recommendation #1, page 320:

“The U.S. Government should support the development of standards and promulgate regulations for blockchain technology that are inclusive of the diverse range of applications that currently exist and that consider potential future applications…”

There are many recommendations aggregated across multiple industries including the U.S. government itself.

Moving to page 329 after a series of definitions such as Blockchain itself, Decentralized Finance, U.S. Central Bank Digital Currency (CBDC) and Transaction Data Management as Asset Management (i.e. tokenization), other application areas of blockchain tech are explored such as “Supply Chain.”

For example, NIST authors see applications for the U.S. government and tamper-resistant record keeping. The U.S. Customs Department is the use case here:

“..blockchain can also potentially cut down on the time required for shipments to be processed through customs. Records entered at the time material is packed for shipping could be propagated through a distributed ledger, and available to customs for verification…” – Rep. Darren Soto (D, FL) might have liked this answer back in June at a House Energy and Commerce subcommittee hearing on blockchain.

Food quality assurance, workforce implications, protecting the energy grid and on and on.. even a handy cheat sheet is available on the reports from President Biden’s digital assets Executive Order.

This report is a feast of food for thought. Download it.

FDIC on crypto risk

In its “2023 Risk Review,” the powerful Federal Deposit Insurance Corporation (FDIC) added “crypto” to its top five risks list that the bank regulator will be watching in the banking sector. CoinDesk reports that the Review uses crypto’s turbulent 2022 as a backdrop and explains “the agency is prepared to engage in ‘robust supervisory discussions’ with the depository institutions it oversees.”

Chamber of Digital Commerce policy executive Cody Carbone tweeted, “I’m very skeptical that the promise from the FDIC to ‘provide case-specific supervisory feedback’ to banks engaging in crypto-related activities will be little more than ‘uh, don’t.'”

Download the FDIC’s “2023 Risk Review” (PDF).

see more tips

Congressman Flood raises national security questions regarding digital asset broker – Nebraska Examiner

Opinion: The FIT Act Is the Most Comprehensive Crypto Regulation Ever Voted on by Congress – Blockchain Association’s Kristin Smith on CoinDesk

CFTC Chair Behnam calls for legislation to help regulate crypto – The Block

Valkyrie files for Ether futures ETF with the SEC – Cointelegraph

PayPal to halt UK crypto sales until 2024 – Reuters

“Ripple files it’s opposition to the SEC’s anticipated motion for leave to file an interlocutory appeal.” – Former Federal prosecutor James Filan on X