In an historic joint hearing in the U.S. House of Representatives, digital assets and its market structure impressively took center stage.

Titled “Joint Financial Services-Agriculture Subcommittee Hearing Entitled: The Future of Digital Assets: Measuring the Regulatory Gaps in the Digital Asset Markets,” the two digital assets subcommittees convened at the Longworth House Office Building. More here.

When all was said and done, the fact two House Congressional subcommittees met for over 3 hours on digital assets was the victory for pro-crypto forces as bipartisan interest in crypto is – at best – shared behind closed doors.

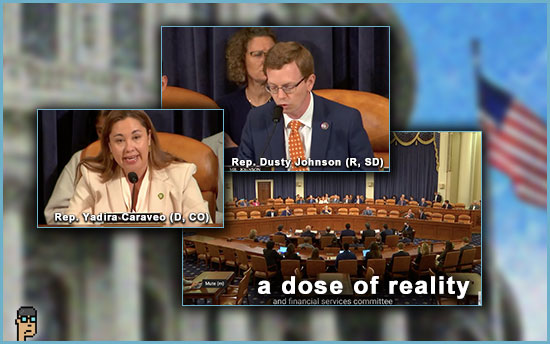

Beginning with a sanguine opening statement by House Agriculture Digital Assets Subcommittee Chair Rep. Dusty Johnson (R, SD), a skeptical Democratic point-of-view was expressed by Ranking Member Rep. Yadira Caraveo (D, CO). on digital assets. It was a familiar political cadence for much of the day and since the FTX implosion…

interest in legislation

Chair Rep. French Hill (R, AR) of House Financial Services (HFS) Subcommittee on Digital Assets, Financial Technology and Inclusion made clear in his opening statement that he thinks Democrats are interested in creating a digital assets framework.

Hill said, “The reason I know that this can’t be a partisan exercise is because my Democratic colleagues have been telling me they support common sense legislation for months. For example, just last November, Ranking Member of House Financial Services Committee [Rep. Maxine Waters (D, CA)] said we need legislative action to ensure that digital asset entities cannot operate in the shadows, outside of robust federal oversight and clear rules of the road.”

Meanwhile, on the Democratic side, Ranking Member Rep. Stephen Lynch (MA) reiterated a common theme by the Dems and Securities Exchange Commission (SEC) Chair Gary Gensler that the digital ecosystem is filled with “mass non-compliance.”

(In fact, Fox Business Eleanor Terrett reports on the Democratic talking points for the hearing issued by Dems leadership here.)

Rep. Lynch said, “[The digital assets industry] often argue that they lack guidance or their products aren’t what they clearly are. in closing, I welcome the conversation that explores the potential of these products. but given that the majority of the industry has failed, I find it difficult to understand the benefits without proper regulatory compliance.”

After brief statements by HFS Chair Rep. Patrick McHenry, Ranking Member Rep. Maxine Waters (D, CA) offered a withering olive branch, “I hope this Congress, we can quickly return to developing legislation together.” Read her perfunctory statement.

statements and thereafter

The five-minute opening statements teased the prepared testimony for six witnesses:

-

- Andrew Durgee, Head of Republic Crypto, Republic

- Matthew Kulkin; counsel at Wilmer Hale; former Director, CFTC Division of Swap Dealer and Intermediary Oversight

- Marco Santori, Chief Legal Officer, Kraken Digital Asset Exchange

- Daniel Schoenberger, Chief Legal Officer, Web3 Foundation

- Timothy Massad, Research Fellow, Harvard Kennedy School for Business and Government

- Michael Blaugrund, Chief Operating Officer, New York Stock Exchange

Over the course of the next 3 hours, questions and answers between committee members and witnesses ping-ponged. Witnesses offered insightful answers that will likely educate Members and their staffs over the long run.

But, the legislation… the framework for anything related to digital assets seems a Congress or two away.

You can see video of the hearing here.