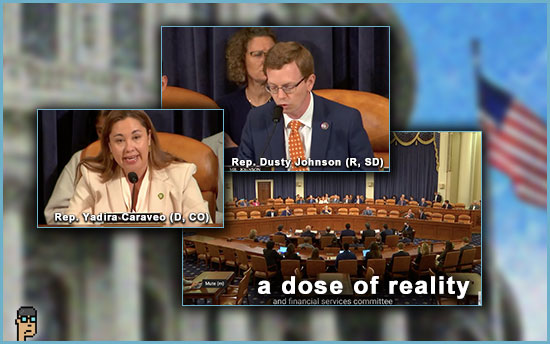

When the House Financial Services’ (HFS) Committee abbreviated markup concluded last Thursday, Rep. Mike Flood (R, NE) likely felt some well-deserved relief.

With momentum building over the past few months, the Securities and Exchange Commission’s (SEC) controversial Staff Accounting Bulletin (SAB 121) had become an increasing part of Flood’s legislative remit with his sponsorship of a standalone bill [H.R.5741] and co-sponsorship of a joint resolution [H.J.R.109] intended to rescind the controversial rulemaking-but-not-a-rule by the securities regulator.

At its heart, SAB 121 effectively prevents big banks – well-regulated banks – from taking custody of crypto assets which arguably inhibits the growth of digital assets within the U.S. financial system.

By a vote of 31-19, the joint resolution passed out of the HFS committee markup with bipartisan support and now heads to the House floor for a vote. No doubt, the SAB 121 saga is far from over. In addition to the House vote, the Senate will need to move on the resolution as will the President… and time is ticking on the 118th Congress.

Nevertheless, it’s a positive development in the eyes of Rep. Flood who is relishing his first session of Congress as part of the majority on the HFS Committee and its Subcommittee on Digital Assets, Financial Technology and Inclusion.

Flood had been a strong advocate for the creation of digital assets legislation. Overall in the 118th Congress, he has also been a robust legislator sponsoring 12 bills and co-sponsoring 175 bills according to Congress.gov.

On Friday, spinning out of last week’s HFS markup, Rep. Flood discussed SAB 121, digital assets, the SEC and his experience in Congress with blockchain tipsheet.

Topics included:

-

- Perspective and the Banking Crisis

- Reviewing SAB 121, Next Steps

- Uniform Treatment of Custodial Assets Act

- Members Need Education… Now

- Congressional Staff

- CFPB’s Wallet Proposal

- Looking Ahead & 119th Congress

The interview has been lightly edited for clarity. Continue reading “Rep. Mike Flood Readies For The Long Haul With Digital Assets Legislation”