Here’s today’s blockchain tipsheet… Want it by email? Sign up here.

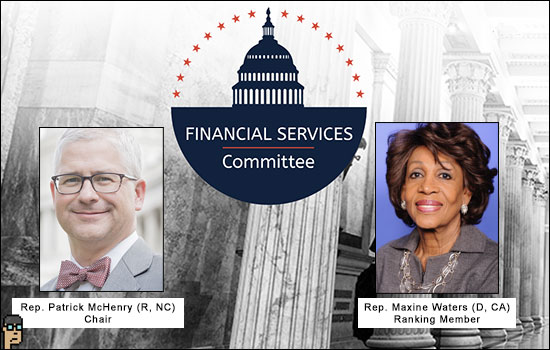

McHenry and Waters return

Rep. Patrick McHenry (R, NC) has scheduled the first meeting of the House Financial Services (HFS) Committee under his leadership as Chair. Taking place on Wednesday (2/1) beginning at 1 p.m., the session will be focused on 118th Congress organizational housekeeping. Live webcast will be here. Agenda items include appointing Democratic HFS committee members to subcommittees by Ranking Member Rep. Maxine Waters (D, CA) including the “Digital Assets, Financial Technology and Inclusion” – a new HFS committee. Majority members have already been appointed by the Chair.

The jurisdiction of the Subcommittee on Digital Assets, Financial Technology and Inclusion, chaired by Rep. French Hill (R, AR), is broad according to the rules resolution and begins with “digital assets, including but not limited to cryptocurrencies, stablecoins, and central bank digital currencies (CBDCs)”. Read all the proposed Digital Assets Subcommittee rules (PDF) – even artificial intelligence (AI) takes a bow.

not FDIC insured

Back in October, then Acting-Chair Martin Gruenberg of the Federal Deposit Insurance Corporation (FDIC) openly expressed concern at a Brookings event about crypto companies: “…false and misleading statements, either direct or implied, by crypto–asset entities concerning the availability of federal deposit insurance for a given crypto–asset product, violate the law.” Fast forward to yesterday when Axios reported cryptocurrency exchange Gemini is alleged to have told some customers that it’s Earn product was FDIC-insured when it was not. Axios’ Emily Peck and Matt Phillips note, “Some 340,000 Earn customers now have had almost $1 billion worth of assets frozen on the platform. It’s unclear if they’ll ever get it back.” Read more. The article notes that the language used by Gemini may not be illegal.

Emmer on legislative possibilities

House GOP Whip Rep. Tom Emmer (R, MN) discusses his priorities as it relates to digital assets in the 118th Congress on “The Scoop” podcast hosted by The Block’s Frank Chaparro. Emmer offers an array of opinions including his belief that “crypto will actually insure the status of the U.S. Dollar if we do this right.” But, he admits that among the naysayers, the defense hawks on the Republican side are a challenge to his vision. On digital asset legislative possibilities, Rep. Emmer tempers expectations, “There will be a series of clarifying bills on the laws that we’re talking about: there will be data privacy stuff that we’ll work on related to this; there will be clarifying language so you can categorize digital assets, so you know who the regulator is, the jurisdiction that you’re underneath – -trying to give people more clarity – I think those are realistic. But people out there should not expect that there’s going to be this explosion of new legislation that is suddenly going to solve all these problems.” Hear the podcast (48 minutes).

four principles for regulation

Two startup founders advocate for the way forward they see in crypto regulation in an op-ed in The Hill. Dainamic CEO Christos Makridis, who is also an AI Research and Partnership Officer the Department of Veteran Affairs according to his CV, and Sei Labs CEO Jay Jog, a former Robinhood software engineer, argue for addressing four key issues beginning with “Impose licensing requirements on centralized cryptocurrency exchanges and other digital currency services that behave like banks.” Read the other three. (tl;dr: regulatory clarity on web3, international standards, foster dialogue with industry)

yesterday’s Congress.gov updates

-

- H.R.370 – To amend title 31, United States Code, to modernize the research, development, information sharing, and acquisition process of the Financial Crimes Enforcement Network, and for other purposes. Excerpt: “…ensure that FinCEN has the necessary technology to monitor cryptocurrencies and other emerging financial technologies for their potential use in money laundering and cyber and data security breaches”

Twitter wants crypto payments

Twitter is acquiring the regulatory licenses it needs to start offering fiat payment capabilities says The Financial Times. Fiat currencies may be first, but insiders say crypto is second. Addressing the burden of payments-related regulation, Lisa Ellis, an analyst at research company MoffettNathanson, tells the FT, “[Tech companies] find it to be a burden to ultimately bear the long-term investment and risk — where you can get fined if there’s an issue and you have to have a whole compliance infrastructure that has to be constantly licensed.” More lawyers, please – read it.

big flows

FSinsight analyst Sean Farrell reads the tea leaves of Coinshare’s weekly Digital Asset Fund Flow report yesterday and says things are looking up in crypto: “Digital asset investment products witnessed an influx of $117 million last week, the most significant inflow since July 2022. These inflows brought total assets under management to $28 billion, a 43% increase compared to November 2022 lows.” Most of the flows were bitcoin – see the Coinshares report.

you want more

-

- Federal Reserve: Policy Issues in the 118th Congress – Congressional Research Service

- Stablecoin Regulation Is First on New Subcommittee’s To-Do List, Says Chairman (1/26) – Coindesk

- BlockFi Approved to Set up Auction for Crypto Mining Business – Bloomberg