Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

probing the FDIC

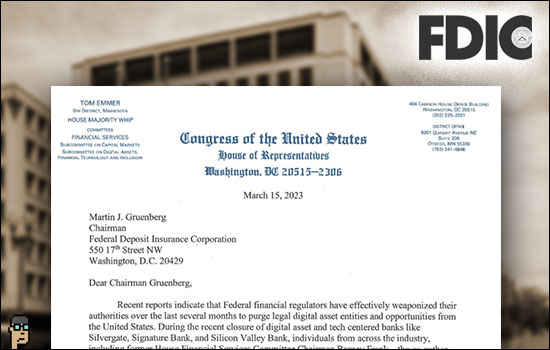

House Majority Whip Rep. Tom Emmer (R, MN) announced on Twitter that he has sent a formal letter to Federal Deposit Insurance Corporation (FDIC) Chair Martin Gruenberg, a Democrat, “regarding reports that the FDIC is weaponizing recent instability in the banking sector to purge legal crypto activity from the U.S.”

In the letter, Rep. Emmer expresses his deep concerns about a coordinated, politically-motivated effort to undermine crypto and asks Gruenberg to answer three questions beginning with: “Has the FDIC instructed banks under its supervision to not provide crypto firms banking services?”

Read the entire 2-page letter.

This isn’t the first time Emmer has sent a critical letter to the FDIC and its Chairman, Martin Gruenberg. Last year, he accused the bank regulator of “cronyism.” See that release which was supported by a large group of Republican House members.

crypto use case

Wired looks at how Ukraine and other humanitarian efforts – such as The United Nations High Commissioner for Refugees (UNHCR) – have been aided by the use of digital assets. One such use case involves stablecoin USDC: “The system works like this: The UNHCR delivers USDC, a crypto coin locked to a $1 valuation and hosted on the Stellar network, to a digital wallet that can be accessed via smartphone. The recipient then exchanges their coins for local currency at any MoneyGram facility.” Read this one.

staking: security or a commodity

Securities and Exchange Commission (SEC) Chair Gary Gensler reiterated his past comments that tokens that can be staked should be considered a security. After a Commission meeting yesterday on new SEC rule-making proposals, he said to reporters about staking , “The investing public is investing anticipating a return, anticipating something on these tokens…”

plumbing the bipartisan

Senator Thom Tillis (R, NC), a member of the Senate Banking Committee, said yesterday that both sides of the aisle are trying to figure out what they can agree on beginning with oversight when it comes to expediting digital assets legislation with bipartisan report. CoinDesk’s Jesse Hamilton quotes Tillis, “We’re completing that inventory now and hope to share it over the next couple of weeks.” Read it.

fraud rocketing

A new report from the Federal Bureau of Investigation’s Internet Complaint Crime Center (IC3) said cryptocurrency-related scams jump last year in comparison to the year prior. “In 2022, investment scams were the costliest scheme reported to the IC3. Investment fraud complaints increased from $1.45 billion in 2021 to $3.31 billion in 2022, which is a 127%. Within those complaints, cryptocurrency investment fraud rose from $907 million in 2021 to $2.57 billion in 2022, an increase of 183%.”

The good news: in 2022, according to FBI Executive Assistant Director Timothy Langan, IC3’s Recovery Asset Team (RAT), [which] streamlines communications with financial institutions and FBI field offices in order to freeze victim funds “initiated the Financial Fraud Kill Chain (FFKC) on 2,838 Business Email Compromise (BEC) complaints involving domestic-to-domestic transactions with potential losses of over $590 million. A monetary hold was placed on approximately $433 million, which represents a 73 percent success rate.”

Download “FBI Internet Crime Report 2022 (PDF)”

mixer nixed

The Justice Department announced that it has charged another cryptocurrency mixer ChipMixer and shut it down over allegations that it is responsible for over $3.6 billion in money laundering. . Deputy Attorney General Lisa Monaco says about ChipMixer in the press release, “This morning, working with partners at home and abroad, the Department of Justice disabled a prolific cryptocurrency mixer, which has fueled ransomware attacks, state-sponsored crypto-heists and darknet purchases across the globe.”

Read: “Justice Department Investigation Leads to Takedown of Darknet Cryptocurrency Mixer that Processed Over $3 Billion of Unlawful Transactions” – Justice.gov

Also, read Europe’s announcement on ChipMixer: “One of the darkweb’s largest cryptocurrency laundromats washed out”

Finally, read more in CoinTelegraph.

Tip: Another mixer, Tornado Cash, caught the eyes of U.S. Treasury in May as the the desire for anonymity collide with the government’s need for identity (AML-KYC, etc.) on the blockchain.

settlement network needed

Circle CEO Jeremy Allaire has been taking to the airwaves this week as his company scrambles to replace partner infrastructure which disappeared after the recent implosions of Silvergate and Signature Bank. Each of the two banks had a 24/7/365 settlement network (Silvergate Exchange Network or SEN and Signet) which would help facilitate the purchase of cryptocurrency such as USDC using fiat currency.

The Information reports, “The whole episode underlines how much stablecoins rely on networks built by traditional banks. So who is vying to build the next SEN or Signet? ‘There are a lot of banks that want to fill that hole,” [said Allaire.] ‘It’s a powerful capability and can attract a lot of clients.’ Still, banks are likely to proceed with caution.” Read it.

Tip #1: Watch Circle CEO Jeremy Allaire on the Bankless podcast – YouTube

Tip #2: Last night, Circle reported that “As of close of U.S. banking operations Wednesday, March 15, we have cleared substantially all of the backlog of minting and redemption requests for USD.” More on the Circle blog.

more tips

-

- Crypto feared being walled off from traditional finance. The banking crisis is fueling those worries. – Politico

- Coinbase Chief Legal Officer on SEC Crypto Approach: ‘Is This the Best We Can Do?’ – Decrypt

- Silvergate Wasn’t Cut Off From Loans, Lender Says – CoinDesk

- Crypto’s correlations to other asset classes (graphic) – Hunter Horsley, CEO, Bitwise on Twitter

- The 72-hour scramble to save the United States from a banking crisis – The Washington Post

If you would like this delivered as a newsletter, please sign up here.