custody rule concerns

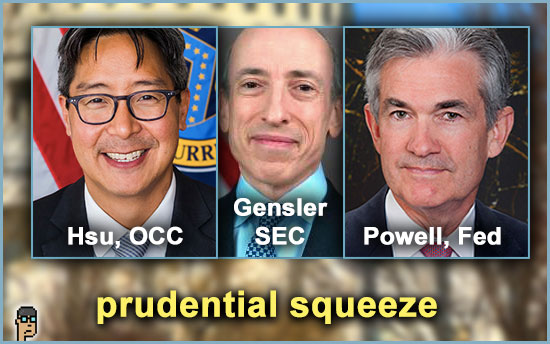

Politico’s Eleanor Mueller learned late last week that new letters were sent to Rep. Andy Barr (R, KY) from the Office of the Comptroller of the Currency’s (OCC) Acting Comptroller Michael Hsu and Federal Reserve Chair Jerome Powell which “voiced concerns over the SEC’s proposed rule (Feb, 15, 2023: ‘Safeguarding Client Assets’ – 432 pages!) that would expand custody regulations to crypto and said they’d conveyed those to the agency. ” Read more (subscription).

Barr is Chair of the House Financial Services Subcommittee on Financial Institutions and Monetary Policy.

At a House Financial Services (HFS) Oversight hearing of the prudential regulators in November, Hsu and Vice Chair Michael Barr first suggested they had issues with the proposed rule. (See 1:05:25 of the November HFS oversight hearing. Originally flagged by Punchbowl News Brendan Pedersen in November.)

more tips:

what you should know: This is NOT the same as Staff Accounting Bulletin 121 (SAB 121) which blew up last week when Senator Cynthia Lummis (R, WY) and Reps. Wiley Nickel (D, NC) and Mike Flood (R, NE) introduced a Congressional Review Act resolution to overturn SAB 121. Rather, the “Safeguarding Client Assets” rule as it is known is yet another vector meant to keep crypto custody (and arguably, crypto in general) out of the traditional financial system and prevent instability according to anti-crypto advocates.

anti-CBDC states

On Friday, Ledger Insights looked at 11 states that have pending, anti-CBDC legislation. There are three ways states are attempting to block CBDCs says the publication beginning with preventing the use of a CBDC for payment and blocking any CBDC “trials.” The third is more complicated and “relates to excluding a CBDC from the definition of money in the Uniform Commercial Code. That won’t stop consumers from using a CBDC, but it may discourage business use.” Read more – and see the 1 1 states.

what you should know: Hawaii is the only blue state on the list.

2024 general election

Scaramucci Urges Crypto Fans to Support Biden Despite Crackdown – Bloomberg

bitcoin mining and politics

Last week’s announcement by a little-known U.S. Department of Energy agency known as the U.S. Energy Information Administration (EIA) that it is going to conduct a survey on Bitcoin mining is attracting attention. The White House’s Office of Management and Budget (OMB) instigated the move in light of – among other things – the price of Bitcoin going up and it’s cold outside. The EIA is in charge of “Independent Statistics & Analysis” according to the DOE’s website.

Cap Hill Crypto’s George Leonardo dissects the news in detail and observes, “While the six-month EIA survey is significantly limited in comparison to the statutory reporting requirements in the CAETA, it provides an example of how an administration can still find ways to further policy goals even where Congressional support is lacking. ” Read this one.

more tips:

-

- DOJ charges duo for crypto mining in school district amid US energy scrutiny – Cointelegraph

- Anxiety, Mood Swings and Sleepless Nights: Life Near a Bitcoin Mine – The New York Times

what you should know: This “emergency” approval to review Bitcoin mining energy usage aligns well with the Biden Administration and Democratic leadership’s anti-crypto positioning.

not so fast, SEC

When a Federal Judge caught Securities and Exchange Commission (SEC) attorneys trying to mislead the Court in a case against crypto company DebtBox, it appeared sanctions were possible. And then last week, apparently, in light of its missteps, SEC lawyers asked the Court to dismiss the case. Not so fast, reports Capitol Account: “Mike Piazza, a former SEC trial attorney, points out that the defendants have been paying a lot of legal fees as they fight allegations that have besmirched their reputations and harmed their businesses.” DebtBox might want to be paid back for its trouble, and then some suggests Piazza. Read more.

what you should know: Was it pressure inside the SEC to convict crypto companies of crimes which caused its counsel overstep? Or was it incompetence?

This Thursday

This Thursday, The Office of the Comptroller of the Currency (OCC) will hold it’s first-ever “OCC Symposium on the Tokenization of Real-World Assets and Liabilities.” The event’s home page promise a livestream if you haven’t registered for in-person attendance.

Agenda participants are exclusively from regulators and the academic world.

An afternoon discussion called the “Regulator Panel,” brings together the regulatory agency for digital assets including:

-

- Sonja Danburg, Deputy Associate Director, Federal Reserve Board.

- Jorge Herrada, Director, Office of Technology Innovation, Commodity Futures Trading Commission (CFTC)

- Donna Murphy, Deputy Comptroller for Compliance Risk Policy and Acting Deputy Comptroller for the Office of Financial Technology, OCC

- Valerie Szczepanic, Director, Strategic Hub for Innovation and Financial Technology, SEC

new research

A new quarterly fund manager report from CoinShares provides insights on what fund managers are thinking about digital assets in relation to the overall investment “pie,” if you will. According to Coinshares’ latest survey, “Digital asset weightings rose from 0.4% of the average respondent portfolio to 1.3% indicating an increasing allocation to digital assets and representing the highest level since Q1 2023.” The survey also found that fund managers are less concerned about regulation as a risk.

more tips:

Wall Street Gets Laser Eyes in Bid for Bitcoin ETF Bucks – The Wall Street Journal

international

India CBDC Insider Reveals Current Stance of Country’s Central Bank – CoinDesk

El Salvador Will Race Ahead With Bitcoin Plans If Bukele Wins Reelection – Decrypt

lobbying

As Crypto Drops Out of the Political Discussion for Now, Lobbyists Key In on 3 Key Areas – Unchained

ByteDance, Shein sharply boost spending on lobbying in U.S. – Nikkei Asia

DEF Provides Update on our Funding – DeFi Education Fund

still more tips

McHenry, Barr, Hill Denounce FDIC’s Lack of Guidance for FinTech Firms and Financial Innovation – House.gov

Cha ching, cha ching’: How the race to replace McHenry could enrich the GOP (subscription) – Politico

Crypto Marketers Have a New Target Audience: Your Mother – The Wall Street Journal

Three people indicted in $400 million FTX crypto hack conspiracy – CNBC

The Rise and Fall of BitBoy, Once One Of The Most Popular Crypto YouTubers – The New York Times