big Ripple ruling

One of the standard-bearers among digital assets lawsuits is the Securities and Exchange Commission (SEC) battle with Ripple over its XRP token. Yesterday, a judge ruled that XRP was not a security in certain instances which could significantly change the dynamic for digital assets legislation in the United States. Read a summary from Decrypt.

And, read the 34-page order here (PDF).

CoinDesk, calling it a “partial win” for Ripple, summarized the court ruling and its effects: “The SEC’s motion for summary judgment was granted by the court as it applies to the institutional sale, and otherwise denied.” Read that one.

On that note, the SEC saw a bright side to the ruling and intimated the potential for an appeal in a statement: “We are pleased that the court found that XRP tokens were offered and sold by Ripple as investment contracts in violation of the securities laws in certain circumstances.” Read more about those circumstances in The Block.

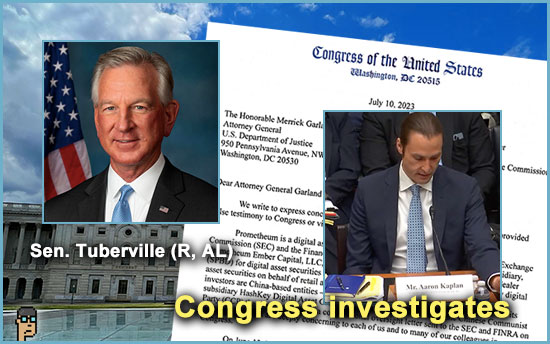

House Majority Whip Rep. Tom Emmer (R, MN) immediately took to Twitter and said, perhaps with some relief, “The Ripple case is a monumental development in establishing that a token is separate and distinct from an investment contract it may or may not be part of. Now, let’s make it law.” Digital assets has been a significant part of the Republican legislative agenda in the U.S. House of Representatives in the 118th Congress. Meanwhile, the digital assets industry has clearly been clobbered in the past year beginning with the implosions of Terra Luna and FTX and its related fraud as well as regulatory pressure.

Ripple CEO Brad Garlinghouse, who has led an unremitting campaign in defense of his company and the XRP token, quoted from the ruling on Twitter, “The most important part of this ruling: “XRP, as a digital token, is not in and of itself a ‘contract, transaction[,] or scheme’ that embodies the Howey requirements of an investment contract. This is a now a matter of law (not up for trial.).” Continue reading “Ripple Ruling Celebrated By Majority Leader Emmer; Rep. Ritchie Torres Sees ‘Political Ploy’ With Prometheum”