Prometheum – investigation

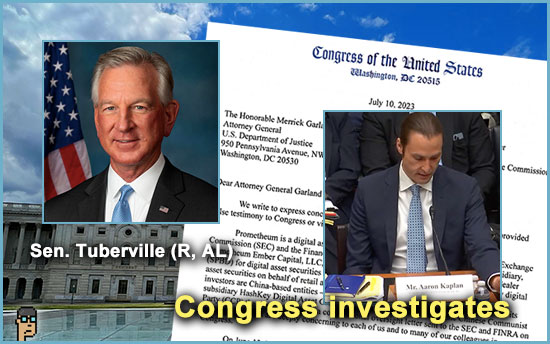

Senator Tommy Tuberville (R, AL) and 5 Republican members of the U.S. House of Representatives alleged yesterday that Prometheum co-founder and CEO Aaron Kaplan may have “provided false testimony” in front of a House Financial Services (HFS) Committee hearing on digital assets on June 13.

In a Congressional letter (see it here – PDF) addressed to U.S. Attorney General Merrick Garland and Securities and Exchange Commission (SEC) Chair Gary Gensler, the Congressional group asks for an investigation into whether or not a China-based investor named Shanghai Wangxiang Blockchain, Inc., was still supporting Prometheum well beyond the end of the 2019 time period Kaplan had suggested in written HFS testimony on June 13. “Wangxiang” as it is known is believed to have connections to the Chinese Communist Party (CCP). The Congressional Members point to Prometheum’s SEC filings which admit to Wangxiang’s continued involvement with the company’s platform beyond 2019.

CoinDesk notes that Wangxiang has a 20% stake in Prometheum today which Kaplan has admitted previously to the SEC.

FINRA, The FBI and the Director of National Intelligence are all cc’d on yesterday’s letter.

more tips:

(Opinion) U.S. Sen. Tommy Tuberville: It’s past time for the DOJ and the SEC to investigate Prometheum’s ties to China – 1819 News

Prometheum – Democrats

Tuberville had already raised concerns in early June about Prometheum’s backers in a June 5 Congressional letter to SEC Chair Gensler and FINRA, a Wall Street Journal op-ed as well as newly introduced legislation titled “S.1870: Prohibiting Foreign Adversary Interference in Cryptocurrency Markets Act” and co-sponsored by Senator Kirsten Gillibrand (D, NY).

Among the co-signers to yesterday’s letter headlined by Senator Tuberville were Republican Reps. Blake Luetkeymeyer (MO) Barry Loudermilk (GA), Ralph Norman (SC), Byron Donalds (FL) and Mark Alford (MO).

An outlying question remains: why did Democrats invite Prometheum to the June 13 HFS hearing with Tuberville and Gillibrand, a Democrat, already raising concerns the week prior -especially given that there are national security issues at the core of the allegations?

Prometheum – Chair Gensler

Beyond Prometheum, this is another Republican-led Congressional letter pointing to SEC Chair Gensler and their belief in the inadequacies of his tenure at the agency. In the case of Prometheum, the SEC’s approval of the company’s special purpose broker dealer license for digital assets securities trading in May looks increasingly dubious. Given the momentum, more public criticism of the SEC Chair by Congressional Democrats would not be surprising.

bipartisan lobbying

Reuters says that crypto lobbying groups are making new efforts to bring together bipartisan support for digital assets legislation such as the new market structure and stablecoin bills being fine-tuned by the House Agriculture and House Financial Services Committees.

“.. [Crypto] lobbyists believe other Democrats on the committees who have yet to take a stance on crypto could be persuaded that the bill would help protect American innovation and jobs, including Vicente Gonzalez and Sylvia Garcia,” reports Reuters. Reps. Gonzalez and Garcia are from Texas. Read more.

Ultimately, if these bills make it to a vote, they will likely pass given the Republican majority in the House. Beyond Gonzalez and Garcia, Democratic Members such as Richie Torres (NY), Josh Gottheimer (NJ) and Wiley Nickel (NC), have also expressed various levels of supportive interest in digital assets legislation in the past. There’s also a group of Democratic members who were a part of the last Congress’ Congressional Blockchain Caucus, such as Darren Soto (FL) and Bill Foster (IL). They still appear active on blockchain technology related issues in the 118th Congress given several recent hearings even if the Caucus has gone dark.

The level of bipartisan interest in the Senate, which the Democrats control, is the bigger question in order for these bills to make it into the law books.

And, let alone – for now – President Biden’s signature.

incoming messaging bill

The House Financial Services Committee, led by Chair Rep. Patrick McHenry (R, NC), is focusing on regulators rather than banks across a range of legislative initiatives in July that Republicans are calling “ESG month,” according to Politico.

“Big banks also largely appear to be getting a pass, with the exception of a messaging bill designed to deter lenders from cutting off firearms businesses, crypto firms and energy companies,” writes Politico’s Zach Warmbrodt. Read more.

more tips:

Government-issued digital money gets closer – Politico

TradFi evolution

Former SEC Chair Jay Clayton was on CNBC yesterday and continued his string of recent, news-making statements (also: see last Friday in WSJ).

This time he weighed in on a Bitcoin Spot Exchange-Traded Fund (ETF) and traditional finance’s evolution. Clayton said about Bitcoin on CNBC, “Let’s go back to 2015-2016: this is an offshore, retail, nothing-close-to the core of our financial markets. At that time, if you look at the trading and emergence of Bitcoin, it looked like stocks, but it was nothing like it.”

Clayton continued, “Now, we’ve seen development all the way to the point where companies whose reputation in the market matters are saying, ‘You know what.. We think that trading, the custody and those protections around this market are sufficient that we’re willing to put our name on it and offer that product.’ That’s actually an incredible development. Not one that I expected.” On a Bitcoin Spot ETF, he said it’s now “hard to resist” for the SEC. See the video clip.

see more tips

Opinion: Threads is Libra and Meta All Over Again – CoinDesk

Half a Billion Has Poured Into Bitcoin Funds in Past Three Weeks – Decrypt

Blockchain developer ranks fall 22% amid scandals – but Sui and Aptos are bucking the trend – DL News

If you would like this delivered as a newsletter, please sign up here.