veto override fails

Yesterday, the House voted again to rescind the Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin 121 via House Joint Resolution 109 sponsored by Rep. Mike Flood (R, NE) -and *this time* proponents had to override President Joe Biden’s veto in late May, too.

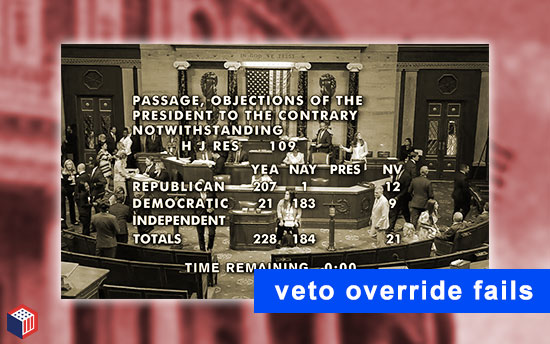

A vote with a 2/3 majority of House members was required for override – 275 total votes.

The vote was over and done in a few minutes and failed with 228 votes in favor to override the President’s veto and 184 against overriding the veto.

-

- 21 votes *for* override were Democrats. Some Dems switched sides from the May vote. More below.

- All 184 Republican votes were *for* override except for Rep. Drew Ferguson (R, GA) (Rep. Ferguson erred on his vote and later corrected it. He voted for the resolution in May and also sponsored a digital asset tax bill with Rep. Wiley Nickel (D, NC) in April).

See the override’s final tally on the House Clerk’s website.

In May, there were two fewer Members of Congress voting and the resolution passed the House 228-182.

See the May tally on the House Clerk’s website.

veto override fails – Dems

Among the Dem switchers, Rep. Jonathan Jackson (D, IL) moved his vote to “yes” and in support of the override as expected. He’s now a co-sponsor of Rep. Mike Flood’s (R, NE) “Uniform Treatment of Custodial Assets Act” [H.R.5741] – the next legislative salvo aimed at rescinding the SEC’s SAB 121.

Reps. Ro Khanna (D, CA), Tom Suozzi (D, NY) and Shri Thanedar (D, MI) switched from “no” to “yes”…

Reps. Dean Phillips (D, MN), Mikie Sherill (D, NJ) and Marc Veasey (D, TX) refused to override the President and switched from “yes” to “no.”

A previous supporter of the resolution, Rep. Jared Moskowitz (D, FL), did not vote.

what you should know: Overall, it’s clear that the vast majority of Democrats were not going to override their Democratic president in spite of recent momentum behind digital assets across both Houses of Congress.. i.e. the original vote on the resolution followed by the successful 2/3 majority passage of the “Financial Innovation and Technology for the 21st Century Act” (FIT 21) in the House.

veto override fails – next steps

Prominent “pro-crypto” Members of the House Financial Services Committee offered their views on next steps coming out of the hearing.

Rep. Mike Flood (R, NE), the House sponsor of H.J.R 109 said in a statement, “Today’s vote sent a message that a bipartisan majority of the House continues to support repealing SAB 121. Banks have long been America’s most trusted custodians, and regulators should work with them so they can provide the same services for digital assets that they have to other asset classes through the years. I will continue to work with my colleagues to pursue other pathways to end SAB 121 so that we can get government out of the way of growing our digital financial future.”

Rep. Wiley Nickel (D, NC), a co-sponsor of H.J.R. 109, also saw the bright side of “bipartisan support” in the vote and added in a statement of his own, “I once again call on Chair Gensler to listen to the American people and immediately withdraw or amend SAB 121. If he fails to do so, it’s on Congress to act. The Uniform Treatment of Custodial Assets Act that I introduced with Reps. Flood, Torres, and Hill, would prohibit the SEC from implementing SAB 121 and ensure that banks are able to safely offer digital asset custody services. I urge Chairman McHenry and Ranking Member Waters to consider marking up our bipartisan bill to get this right.”

more tips:

-

- House fails to override veto of anti-SAB 121 bill – Blockworks

what you should know: As Rep. Nickel says, next steps on rescinding the SEC’s Staff Accounting Bulletin 121 would appear to be Rep. Flood’s Uniform Treatment of Custodial Assets Act [H.R.5741]. But, the likelihood of that bill getting the signature of the President seems unthinkable given the outcome of the SAB 121 House resolution efforts. Any similar effort will most likely need to wait for the next Congress and, perhaps, a new Administration. Unless House Financial Services Committee Chair McHenry has a parliamentarian “trick” up his sleeve?

SAB 121 workaround

Late yesterday, Bloomberg Tax reported that some financial firms are working directly with the SEC to meet regulatory requirements in order to custody crypto.

According to Bloomberg’s Amanda Iacone, “Staff with the Securities and Exchange Commission have begun to dole out guidance that certain arrangements may not require a liability to be reported on the balance sheet under staff guidance issued two years ago, said an SEC source familiar with the regulator’s approach.” Read more.

On X, Uniswap Labs’ Zach Wong commented on the news and saw SEC Chair Gary Gensler’s sleight of hand: “What the SEC is now doing, according to the Chair’s own leak, is prudential regulation of banks. It is inappropriate for the SEC and should be deeply offensive to its sister regulators like the Fed, the FDIC, and the OCC.”

what you should know: Legislation is needed more than ever. A Congressional letter to SEC Chair Gensler is surely forthcoming from House Financial Services.

noms hearing

From the outset of the Q&A portion of yesterday’s Senate Banking nominations hearing, it was clear that FDIC Chair nominee and current CFTC Commissioner Christy Goldsmith Romero (D) and SEC Commissioner Caroline Crenshaw (D) were going to get most, if not all, of the attention while CFTC Commissioner Kristin Johnson (Treasury nominee) and Financial Stability Oversight Council nominee Gordon Ito sat patiently.

See the video on the hearing page.

Republicans, such as Senators Bill Hagerty (TN) and John Kennedy (LA), were aggressive in their questioning of Commissioner Crenshaw, in particular, who likely embodies for them the broad overreach of rulemaking by her regulatory agency currently influenced by 3-2 Democratic majority on the Commission.

Choke Point 2.0 – and Commissioner Goldsmith Romero’s views related to it – were lurking, too. An Operation Choke Point targeting crypto has been suspected by certain Members of Congress as well as many in industry.

CoinDesk’s Jesse Hamilton reported, “Sen. Cynthia Lummis (R, WY) asked Goldsmith Romero about her view on banks handling customers’ cryptocurrency and doing other business with digital assets firms. [Commissioner Goldsmith Romero said,] ‘I don’t think it’s the FDIC’s role to tell banks what industries or companies banks should be providing services to.'” Read his summary.

what you should know: At the end of the hearing, Senate Banking Chair Sherrod Brown (D, OH) reiterated the urgency of pushing through the nominations. But, it’s clear Republicans are reluctant on at least some of the nominations (Goldsmith Romero and Crenshaw).

pig butchering

First Interagency Fraud Disruption Conference Focuses on Combatting Crypto Schemes Commonly Known as “Pig Butchering” – CFTC.gov

stablecoins are not securities

Fortune’s Leo Schwartz broke the news yesterday that New York State’s Paxos is in the clear as the SEC notified the stablecoin issuer on Tuesday (see the letter) that it was dropping its investigation of the company. At the heart of the matter was the consideration of whether or not stablecoins were securities.

Schwartz reports, “This retreat by the SEC comes days after the agency suffered a partial defeat in a lawsuit against the top crypto exchange Binance. While Congress continues to stall on legislation to regulate the growing asset class, the SEC’s decision offers an unexpected win to the stablecoin sector…” Read Fortune on Yahoo.

Willkie Farr counsel Mike Selig commented on X, “SEC’s seemingly walking back its frankensteined theory that stablecoins are securities after a big loss in the Binance litigation. Its attempt to seize jurisdiction over crypto markets by subjecting industry participants to expensive legal battles is backfiring tremendously.”

Brown on Stabenow

Senate Banking Chair Sherrod Brown (D, OH), who is in a hotly-contested race with pro-crypto Bernie Moreno (R) for his Senate seat, tells Punchbowl News’ The Vault that he’s open to a new crypto bill from Senate Agriculture Chair Debbie Stabenow (D, MI). Brown tells Punchbowl, “I’m not automatically saying no… I’m not going to let, through my committee, an industry-written bill. But I’m not automatically going to say no if consumers and investors are protected.” Read more from Punchbowl News.

what you should know: It’s easy to say you’re “open” to a bill that has no shot making it through a divided Congress at a late date in the Congressional calendar AND in a presidential election year.

new chainalysis data

Blockchain analytics firm Chainalysis is shedding more light on areas of suspected money laundering including stablecoins in a new report titled, “Money Laundering and Cryptocurrency: Trends and new techniques for detection and investigation.”

See a brief summary here from Chainalysis and sign up for the download here.

Bloomberg covers the Chainalysis data and writes, “Suspect digital wallets have distributed close to $100 billion in illicit funds across the cryptocurrency market since 2019, flows that often touch popular stablecoins and centralized exchanges.” Read more.

what you should know: Perhaps this is already happening, but it would be great to see blockchain analytics firms taking more of a lead role in educating Members of Congress and their staffs. Given blockchain analytics firms’ strong U.S. government client list, lawmakers and their staffs would likely welcome the opportunity to learn more about what they do for the U.S. government and why.

A perfect example happened this week when Sen. Ben Ray Luján (D, NM) asked CFTC Chair Rostin Behnam at the Senate Ag hearing on digital commodities about drug cartels and money laundering. Chair Behnam struggled with a crisp answer regarding Treasury and FinCEN. From here, it would seem blockchain analytics firms are on the front lines of this knowledge and the laws around them – Members and their staffs would eat it up.

Time is money for these businesses, so legislation creating budget for such a Member and Staff education program might be required.

new co-sponsors

Rep. Zach Nunn (R, IA) is now the latest co-sponsor among a bipartisan list of 12 Members for Rep. Flood’s “Uniform Treatment of Custodial Assets Act” [H.R.5741] which aims at rescinding the SEC’s SAB 121.

podcasts

The CBDC Debate (Part I) With Majority Whip Tom Emmer (R, MN) – Validated podcast from Solana Foundation

The CBDC Debate (Part II) With Congressman Bill Foster (D, IL) – Validated podcast from Solana Foundation

correction

Yesterday, blockchain tipsheet mis-identified the GOP X account throwing flames at Senate Ag Chair Debbie Stabenow (D, MI) after the Senate Agriculture Committee’s digital commodities hearing on Wednesday.

The House GOP Ag X account was the flame thrower, not the Senate GOP Ag X account.

still more tips

Biden officials open crypto line – The Hill

Despite some losses, the SEC continues to fight crypto – The Block

Goldman Sachs to launch three tokenization projects by end of year, says digital assets chief – Fortune on Yahoo

Coinbase Germany head on the real reason the country dumped $2.3 billion in Bitcoin – DL News