SAB 121 resolution – passage

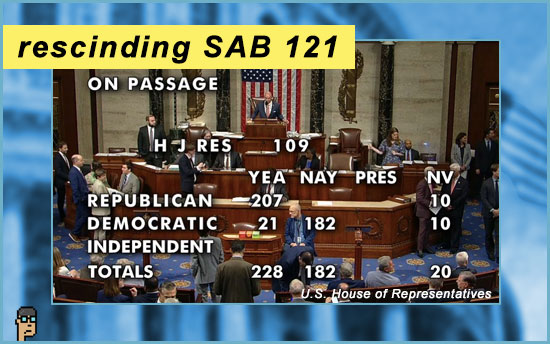

H.J.Res 109, which rescinds the Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin 121 – a “guidance” preventing regulated banks from providing crypto custody – was easily passed in the House yesterday by voice vote.

Given the Republican majority, the result was not surprising.

In the wake of the voice vote, House Financial Services (HFS) Chair Patrick McHenry (R, NC) asked for a roll call vote likely seeking to shed light on support across the aisle.

Minority Whip Katherine Clark (D, MA) told House Dems to vote “No” on the resolution.

But just as the roll call vote was to begin, Rep. Marjorie Taylor Greene (MTG) disrupted the floor proceedings with a motion to remove Rep. Mike Johnson (R, LA) as speaker.

After MTG‘s motion was tabled (killed), voting began on H.J.R.109 – Members had only 5 minutes in which to submit their preference.

Final vote was 228-182 to support the resolution to repeal SAB 121.

Visit the Clerk’s website for the complete tally.

21 Democrats voted for the resolution – prior to the vote, only three HFS Democratic members (Nickel/Gottheimer/Torres) had been known to support the resolution.

This was a win for Chair McHenry. (He celebrated.)

It was also a win for Reps. Flood and Nickel, the resolution’s sponsor and co-sponsor, respectively.

The other big news may have been President Joseph Biden‘s statement on the resolution which made clear where his Administration stands on digital assets. More below…

SAB 121 resolution – Rep. Caraveo

Of the 21 Democrats, Rep. Yadira Caraveo (D, CO) stood out with not only her vote in favor of the resolution, but what she said on X thereafter:

She tweeted, “Today I voted to override a decision by [the SEC’s] Staff Accounting Bulletin that discourages banks from serving as custodians for consumers’ crypto assets. Consumers continue to invest in crypto, and they’re safest when well-regulated entities such as banks hold their assets.”

Rep. Caraveo is Ranking Member on the House Agriculture’s Subcommittee for Commodity Markets, Digital Assets and Rural Development.

what you should know: Her statement is a clear rebuke of Democratic leadership and its guidance. She may also support FIT 21 (digital asset market structure bill) which will be up for a vote on the House Floor soon.

SAB 121 resolution – debate

In the hour of debate allowed before the vote took place yesterday, both sides of the issue made their case.

First, House Financial Services (HFS) Chair Patrick McHenry (remarks) advocated that highly regulated banks are best place for crypto custody given their compliance regime and current oversight. McHenry advocated for common sense and a “yes” vote for the resolution and said of SAB 121, “That’s a bad process and even worse policy out come.”

HFS Ranking Member Maxine Waters (D, CA) (remarks) presented the other side and said of the resolution that “it’s far broader” than what it claims. She claimed that the other side was doing the bidding of special interest groups and trying to undermine the SEC. She explained that what SAB 121 does, is respond to “the unique risks and uncertainties of crypto assets.”

Waters kept referencing a “special interest group” but never named exactly which one. In fact, it was a conglomeration of the American Bankers Association, Bank Policy Institute BPI, Securities Industry and Financial Markets Association SIFMA, Financial Services Forum – see the February letter (PDF) sent to SEC Chair Gary Gensler.

Ironically, after the House floor vote, the American Bankers Association came out in support of the resolution on X, “ABA applauds today’s bipartisan House vote disapproving [SEC’s] SAB 121…” See it.

Rep. Mike Flood (R, NE) (video), the bill’s sponsor, Rep. Frank Lucas (R, OK), Rep. Andy Barr (R, KY), Rep. John Curtis (R, UT), Rep French Hill (R, AR) (video), Rep. Warren Davidson (R, OH) and Rep. Scott Fitzgerald (R, WI) joined Chair McHenry in supporting the rescinding of SAB 121 on the House floor.

Rep. Wiley Nickel (D, NC) (video), a co-sponsor of the resolution, was the final speaker recognized by Chair McHenry.

Nickel was the sole Democrat who spoke in favor of the resolution on the House floor saying that the “experts” of banking should be allowed to custody crypto. He worried that the SEC had gone far beyond its remit with SAB 121.

Rep. Brad Sherman (D, CA) and Rep. Stephen Lynch (D, MA) joined Ranking Member Waters in rejecting the resolution.

more tips:

-

- Hill, Lucas and Barr are running for McHenry’s position atop the HFS Republican caucus in the next Congress. Rep. Bill Huizenga (R, MI), another candidate, did not appear.

SAB 121 resolution – veto

A statement from The White House and President Joseph Biden was also entered into the Congressional record by Ranking Member Waters. The White House said that the resolution would “disrupt” the work of the Securities and Exchange Commission and concluded, “If the President were presented with H.J. Res. 109, he would veto it.” Read it (PDF).

what you should know: The sharpness of this statement over the Joint Resolution would suggest that, if the President is re-elected, his Administration will do everything in its power to stop digital assets. Dem leadership clearly sees being “anti-crypto” as winning positioning for the 2024 general election.

SAB 121 resolution – more comments

On X before the debate began, a degree of partisanship was on display in support of the House resolution which has bipartisan support.

Rep. Elise Stefanik (R, NY), who is the chair of the House Republican Conference, said on X, “I supported [Rep. Mike Flood’s (R, NE)] important resolution to overturn Joe Biden’s Securities and Exchange Commission’s illegally disguised rule SAB 121. House Republicans are holding the Biden Administration accountable, restoring Congressional oversight, and ensuring the digital asset ecosystem can thrive here in the United States.”

And while waiting for the final roll call vote in the afternoon, Majority Whip Tom Emmer (R, MN) said on X, “Today, we will vote to overturn

[Gary Gensler’s] illegal SAB 121 rule. This rule prevents banks from safeguarding digital assets for their customers, which only increases concentration risk in our market and puts American digital asset holders in a vulnerable position.”

SAB 121 resolution – Senate

The Senate version of the resolution rescinding SAB 121 – S.J.Res.59 sponsored by Senator Cynthia Lummis (R, WY) – is registering support with some Senate Republicans. Earlier this week, 14 Republicans were listed as co-sponsors.

What’s important to note is that Senator Roger Marshall (R, KS) who supports Senator Elizabeth Warren’s “Digital Asset Anti-Money Laundering Act” [S.2669] (DAAMLA) is one of the 14 co-sponsors. Also, Senator Mike Rounds (R, SD), who has supported the CANSEE Act [S.2355], has joined as a co-sponsor of the Lummis resolution.

If two Republicans might been thought to be “anti-crypto”, Sens. Marshall and Rounds may have been it.

In fact, Politico’s Eleanor Mueller reported later on X, “Lummis has 30 (all GOP) signatures on a discharge petition for the Senate’s own overturn of SEC’s crypto accounting guidance, SAB 121, I’m told.” According to Mueller, the 30 signatures mean Republicans can force a vote in the Senate later this week. Read more in Politico (subscription).

what you should know: Whether Senator Lummis can find enough support for passage still seems challenging given Democratic control of the Senate.

So, who are Senate Democrats that may support the resolution?

-

- Sen. Kirsten Gillibrand (D, NY) perhaps? She’s one-half of the Lummis-Gillibrand Responsible Financial Innovation Act [S.2281].

- How about Gillibrand’s colleague and fellow New Yorker Majority Leader Chuck Schumer (D, NY)?

- Or former DCCPA co-sponsor Sen. Cory Booker (D, NJ)?

- And on that note, would Senate Ag Chair Debbie Stabenow (D, MI), the creator of the DCCPA which gave the CFTC signifcant power over crypto before it hit the “FTX wall“, vote for the resolution?

Rep. Sean Casten’s (D, IL) new crypto mixer bill, “Blockchain Integrity Act” is available on Congress.gov. See H.R.8266. The bill’s text is here.

5 floor votes to come

The “Clarity for Payment Stablecoins Act” [H.R.4766] sponsored by House Financial Services Chair Patrick McHenry (R, NC) and “CBDC Anti-Surveillance State Act” [H.R.5403] sponsored by House Majority Whip Tom Emmer have been added to Congressional calendars as two more bills inch toward a House Floor vote.

These two bills follows three other pieces of legislation joining House calendars this week in anticipation of a floor vote: the digital asset market structure bill (FIT 21), Whip Emmer’s “Blockchain Regulatory Certainty Act” and Rep. Zach Nunn’s (R, IA) “Financial Technology Protection Act.”

earnings

Robinhood posts Q1 earnings beat, sees 224% increase in crypto trading volume – The Block

new blockchain bill

Rep. Nancy Mace (R, SC) sponsored a new bill this week intended “to require the Secretary of Homeland Security to establish a public blockchain-based system to securely store and share data related to border security, and for other purposes.” See H.R.8275. And see the text of the bill.

According to NextGov, U.S. Customs and Border Protection has been researching potential uses for blockchain. Rep. Mace, “who chairs a House Oversight subcommittee focused on IT, says that the tech could help with Department of Homeland Security activities like the tracking and management of goods at the border.” Rep. Byron Donalds (R, FL) is a co-sponsor. Read more.

The bill has been referred to the House Homeland Security Committee.

hear ye, hear ye

House Financial Services Committee will hold a hearing titled, “Oversight of Prudential Regulators” on Wednesday, May 15. See the release.

still more tips

Crypto, CBDCs and Stablecoins Are the Future, Says Former CFTC Chair Chris Giancarlo – Decrypt

FTX says it has billions more than owed to victims – BBC

Crypto media company Blockworks acquires The Breakdown – Axios