stablecoin legislation

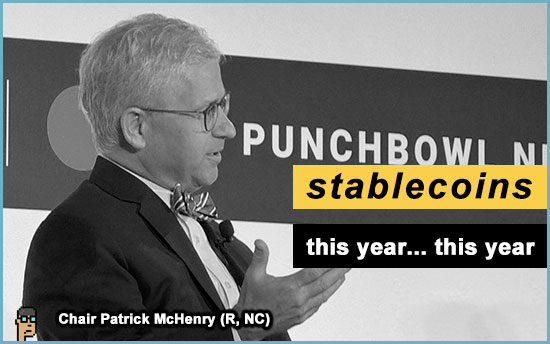

Yesterday at Punchbowl News’ “The Summit: The Digital Payments Economy” event in Washington, D.C., House Financial Services (HFS) Chair Patrick McHenry (R, NC) appeared in conversation with Punchbowl’s Jake Sherman and hinted at the way forward for the digital payment topic of the hour: stablecoins.

Chair McHenry was not overly optimistic about passage of stablecoin legislation – such as his “Clarity For Payment Stablecoins Act” [H.R.4766] – in the 118th Congress and said, “… I think we’re at an inflection point where we can land this ‘plane’ this year.. this year. But we [need] the broader context of Congress to get us that opening _ a legislative vehicle…”

McHenry continued and referenced Sen. Kirsten Gillibrand’s (D, NY) help with stablecoin legislation saying, “…the architecture is very similar for all of us… I think we would know how to resolve if given a deadline, and a way to get through the process…”

what you should know: The help of the Senate in facilitating passage of a stablecoin bill was explicit by McHenry, but the help of House Speaker Mike Johnson (R, LA) is likely needed, too.

today’s hearing – sanctions

Today’s House Financial Services (HFS) Capital Markets Subcommittee Hearing titled, “SEC Overreach: Examining the Need for Reform” will begin at 10 a.m. ET in Rayburn House Office Building.

See witnesses and livestream here.

The sanctioning of the SEC and its lawyers over the DEBT Box complaint on Monday likely changes the focus for at least part of the hearing to the SEC’s handling of digital assets, the DEBT Box case and the SEC’s “regulation by enforcement” approach.

The Republican caucus will undoubtedly be unified today and highly critical of the SEC coming out of the DEBT Box sanctions.

Will Chair Patrick McHenry finally pull the “subpoena” card to force SEC Chair Gary Gensler to respond to a variety of Congressional letter topics of the recent past? Or instead, could he use the threat of an increasingly likely subpoena as a “chit” in stablecoin passage through the reluctant Senate and on to the desk of the President for signature?

today’s hearing – sanctions, Dems

The Democratic caucus will be interesting to watch at the Capital Markets Subcommittee hearing, too.

Dem leadership led by HFS Ranking Member Maxine Waters (D, CA), Capital Markets Subcommittee Ranking Member Brad Sherman (D, CA), Reps. Steven Lynch (D, MA) and Sean Casten (D, IL) will likely be defending the SEC on behalf of the Biden Administration and emphasizing the importance of consumer protections while avoiding discussion of the sanctions.

But, how will other Dems handle the DEBT Box sanctions topic?

Democratic subcommittee members who could be critical of the SEC include Reps. Josh Gottheimer (NJ), Wiley Nickel (NC), Gregory Meeks (NY) and Vicente Gonzalez (TX).

Nickel and Gottheimer voted for the stablecoin and digital asset market structure bills during last July’s markups as well as “for” the joint resolution rescinding the SEC’s Staff Accounting Bulletin 121 (SAB 121) at last month’s HFS markup.

Rep. Meeks voted for the HFS stablecoin bill at markup last July thereby supporting his state’s regulator, the New York Department of Financial Services.

Finally, Rep. Gonzalez has reportedly (July 2023) been undecided on crypto but has been courted by crypto lobbyists. Is this hearing his “big reveal”?

also today in DC:

-

- Coinbase’s Update the System Summit, begins 12:30 p.m. ET – Coinbase

crypto mixers

Alexey Pertsev accused of laundering $1.2 billion at Tornado Cash, says Dutch indictment (yesterday) – DL News

more tips:

-

- FinCEN Proposes New Regulation to Enhance Transparency in Convertible Virtual Currency Mixing and Combat Terrorist Financing (October 19, 2023) – FinCEN.gov

digital assets 3 endgame

Tomorrow’s House Financial Services hearing by the Full Committee titled, “Importing Global Governance: Examining the Dangers of Ceding Authority Over American Financial Regulation,” has nothing to do with digital assets.

In fact, the hearing will be primarily focused on understanding U.S. prudential regulators’ responsibility (culpability, given the tone of the hearing memo?) in the adoption of global financial regulatory framework’s such as the famously-titled “Basel III Endgame.”

Nevertheless, putting it in the context of digital assets.. what if nothing happens with a digital assets regulatory framework in the United States in the next 4-5 years?

Someone else’s framework may be what the United States adopts as growing digital asset market scale and power increases in other jurisdictions and requires the U.S. financial system to adopt… something.

tokenized asset fund

After successfully launching its Bitcoin spot market ETF, financial investment giant BlackRock continues to hurtle forward in the world of tokenized assets. CoinDesk reports on a new SEC filing saying, “The BlackRock USD Institutional Digital Liquidity Fund was incorporated on the British Virgin Islands and will be launched in partnership with tokenization firm Securitize.” Read more.

more tips:

-

- BlackRock’s Form D Filing – SEC.gov

what you should know: TradFi is gaining speed in digital assets. For pro-crypto forces in the U.S., it helps that a TradFi market leader is showing significant interest.

still more tips

Paradigm Files Amicus Brief Supporting Coinbase’s Lawsuit vs. SEC – Paradigm

The most innovative blockchain, crypto, metaverse, and Web3 companies of 2024 – Fast Company

Genesis Agrees to Pay $21 Million Penalty to Settle SEC Charges – SEC.gov

How crypto exchange Backpack climbed its way to success after its major investor FTX die – TechCrunch

Goldman Sachs digital asset head says crypto rally driven by retail investors – Reuters