Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

today – digital assets subcommittee

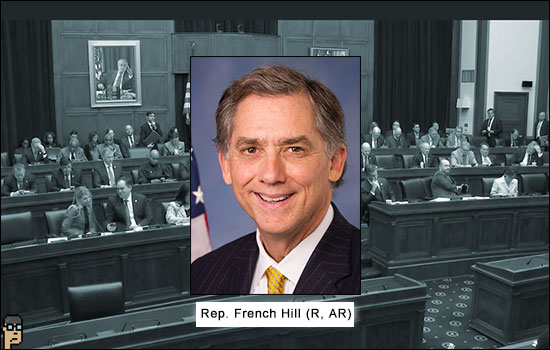

All eyes will be on Digital Assets, Financial Technology and Inclusion Subcommittee Chair French Hill (R, AR) today as he hosts his committee’s first hearing titled “Coincidence or Coordinated? The Administration’s Attack on the Digital Asset Ecosystem.” See the hearing’s event page on House Financial Services website – starts at 2 p.m. ET.

Five current digital asset bills are listed for review such as HFS Chair Patrick McHenry (R, NC) and Rep. Ritchie Torres (D, NY) “Keep Innovation in America Act” and discussion draft’s of new, 118th Congress bills from House Minority Whip Rep. Tom Emmer’s (R, MN) and Rep. Warren Davidson (R, OH).

All of today’s prepared remarks are available from the hearing’s five witnesses including:

-

- Mr. Mike Belshe, CEO and Co-Founder, BitGo (remarks (PDF))

- Ms. Tonya Evans, Professor, Penn State Dickinson Law (remarks)

- Mr. Jonathan Gould, Partner, Jones Day (remarks)

- Mr. Paul Grewal, Chief Legal Officer, Coinbase (remarks)

- Mr. Lee Reiners, Policy Director, Duke University (remarks)

Snippet from the testimony: Law professor Tonya Evans makes numerous suggestions on the way forward for digital assets regulation including: “Request the SEC to appear before Congressional oversight committees to explain how its aggressive piecemeal approach to regulation of crypto assets comports with efficient and effective regulation and in line with its legislative mandate to protect investors, to maintain fair, orderly, and efficient markets, and to facilitate capital formation.”

today – two morning events

10 am – Fed Vice Chair Michael S. Barr on cryptocurrencies – Peterson Institute for International Economics

Tip: The last time Vice Chair Barr addressed the topic of digital assets was during DC Blockchain Week in October when he spoke at length about the possibilities of stablecoins. Will he bring a hopeful message to pro-crypto fans or will he tilt toward the risks of crypto recently touted by the Fed/OCC/FDIC banking regulator triumverate?

10 am – Hearing: Rising Risks: Managing Volatility in Global Commodity Derivatives Markets – House Committee on Agriculture

Witnesses for the House Ag hearing include:

-

- Mr. Michael Gelchie, Group CEO, Louis Dreyfus

- Mr. Derek Sammann, Senior Managing Director, CME Group

- Ms. Alicia Crighton, Chair of the Board, Futures Industry Association

- Mr. Christopher Edmonds, Chief Development Officer, Intercontinental Exchange

- Mr. Dan Berkovitz, Former Commissioner, CFTC

Tip: This hearing is purposefully at 10a ET in the morning while the House Financial Services Digital Assets Subcomittee is 2p ET. Both Rep. Hill and Rep. McHenry of HFS have discussed the importance of working with House Ag and its Chair Rep. “GT” Thompson (R, PA) on digital assets especially as the commodity side of the digital asset discussion is narrowed. Rep. Thompson was also the key sponsor of the Digital Commodity Exchange Act (DCEA) in the last Congress. This bill could be back soon.

voluntary liquidation

It’s over. Bank holding company, Silvergate, a key source of crypto company liquidity, has capitulated. In a press release late yesterday the company announced, “In light of recent industry and regulatory developments, Silvergate believes that an orderly wind down of Bank operations and a voluntary liquidation of the Bank is the best path forward. The Bank’s wind down and liquidation plan includes full repayment of all deposits. The Company is also considering how best to resolve claims and preserve the residual value of its assets, including its proprietary technology and tax assets.” Read it.

CoinDesk Nikhilesh De reaches out to regulators willing to comment on the news and concludes “possibly the largest bank to fail since 2009.” More here.

Senator Elizabeth Warren (D, MA) tweeted last night, “As the bank of choice for crypto, Silvergate Bank’s failure is disappointing, but predictable. I warned of Silvergate’s risky, if not illegal, activity—and identified severe due diligence failures. Now, customers must be made whole & regulators should step up against crypto risk.”

framework imminent

Republicans on the House Financial Services Committee apparently have bigger crypto regulation plans up their collective sleeve. Politico quotes Digital Assets, Financial Technology and Inclusion Subcommitee Chair French Hill (R, AR), ““We’re working on a comprehensive regulatory framework that goes beyond the bills. We’re going to spend March and April in a significant effort on listening to stakeholders in the digital assets arena [and] considering other legislative proposals. So that’ll be our principle work plan for the next two months.” Read more.

TradFi dropping crypto

According to a source, CoinDesk reports that cryptocurrency exchange Gemini, run by Tyler and Cameron Winklevoss, has lost its TradFi banking partner, J.P. Morgan. Gemini denies it yet, so far, CoinDesk is sticking with its source and notes that Gemini and Coinbase agreed to use J.P. Morgan’s banking services starting back in May 2020 – originally covered by the Wall Street Journal here.

Coinbase confirms to CoinDesk it is still a customer of J.P. Morgan. Given the rumors of a “Choke Point“-like operation being run by the U.S. federal government against crypto companies by members of Congress such as Sen. Bill Hagerty (R, TN), this anecdote would appear to pour fuel on the fire whether it’s true or not.

central bank suspect of crypto

Federal Reserve Chairman Jerome Powell made his way to a hearing of the House Financial Services yesterday and dropped a bomb or two on the crypto universe. According to Decrypt, Powell said “it’s unclear to him why any cryptocurrency that isn’t ‘drawing on the credibility of the dollar’ like Bitcoin or Ethereum has any value at all.” On the subject of Central Bank Digital Currencies (CBDCs), he tamped down any speculation that the a Digital Dollar was imminent other than ongoing R&D, but he did say The Fed could roll out a CBDC quickly if Congress mandated it. Read more.

Tip: See Atlantic Council’s slick CBDC tracker, which tracks global adoption of CBDCs.

India’s regulation grows

In India, crypto market regulation is quickly coalescing under governmental authority. The Times of India reports, “Crypto exchanges and intermediaries dealing with virtual digital assets (VDAs) will now be required to perform KYC (Know-Your-Customer) of their clients and users of the platform. Besides, exchanges will have to report suspicious activity to the Financial Intelligence Unit India.” Read it. The latest moves are a result of the recently approved Prevention of Money Laundering Act in India. Read that one.

more tips

-

- Coinbase announces Wallet-as-a-Service product to simplify web3 onboarding – The Block

- How the Crypto Titan of Terra Became a Fugitive – The Washington Post

- Beginners Guide to Crypto Regulation (subscription) – Forbes

If you would like this delivered as a newsletter, please sign up here.