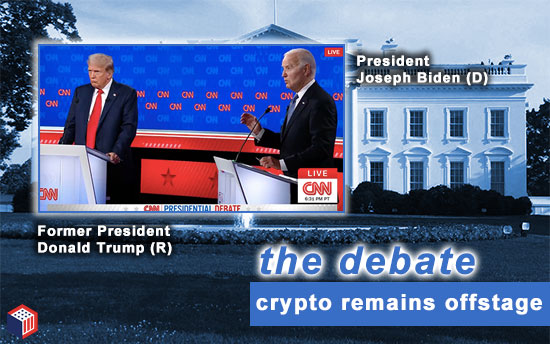

the debate

There was no crypto mention in the debate. It was just as well.

The story of the presidential debate between President Joe Biden (D) and former President Donald Trump (R) – which was visible to all – made crypto and the many serious issues raised seem insignificant. President Biden experienced difficulty articulating his opinions -particularly at the beginning of the night.

After all the prognostication and hope expressed by crypto industry and media (including this newsletter) that a question about digital assets might seep into the first presidential debate, CNN moderators chose not to raise anything tech-related.

Perhaps ABC News producers will choose differently for the currently-scheduled September 10 debates .

It’s also possible the topic could come up at a vice presidential debate if a date/time is agreed upon by the two parties. Former President Trump is expected to announce his nominee shortly and his running mate would debate current Vice President Kamala Harris.

Problem Solvers on crypto

.At a Punchbowl News event in Washington D.C. yesterday, Rep. Josh Gottheimer (D, NJ) said that post-election, digital assets legislation will be a priority for his bipartisan Problem Solvers Caucus which he co-chairs.

Rep. Gottheimer said: “I think on crypto… we’re heading to a point on crypto where you saw good movement in the House on market structure and in our [House] Financial Services Committee, [and on] stablecoins.” “I think we’ve got to get rules of the road set up there. It is a huge opportunity for our economy. But we got to move on it. Right, just like removing *maybe* on privacy… but I think the crypto stuff. We don’t have time to delay there. We’ve got to get that done, I could see that.” See video starting at 37:01.

what you should know: Rep. Gottheimer’s support for digital assets legislation pre-dates the current Congress and has never wavered in spite of Dem leadership’s strong “anti-crypto” positioning in the 118th Congress. Gottheimer supported FIT 21, the House’s SAB 121 resolution and voted in support of the “Clarity for Payment Stablecoins Act” [H.R.4766] at the rancorous July 2023 House Financial Services markup.

new Sen. Vance legislation

Senator J.D. Vance (R, OH), who is a member of Senate Banking and considered a candidate for vice president on former President Trump’s ticket, is working on digital assets legislation of his own according to Politico’s Eleanor Mueller on Tuesday. The bill’s introduction is expected next month.

Ms. Mueller reports that Vance staff have begun sharing a bill on Capitol Hill that “hopes to improve on Republican-led legislation that the House passed last month with support from 71 Democrats.” It also simplifies in an “industry friendly” way how the CFTC and SEC divide and conquer on digital assets oversight, according to Mueller. Read more.

what you should know: Zooming out, it’s astonishing to consider that Vance may be pushing digital assets legislation to give himself a leg-up among his VP competitors – digital assets has come a long way in a relatively short amount of time in D.C. But, given the dwindling schedule, the need for bipartisanship and competitive products (FIT 21, Lummis-Gillibrand, DCCPA 2.0).. this bill seems destined for the 119th Congress at best. Stablecoins and fixing the broker rule would be huge accomplishments for the 118th Congress, at this point.

Ether ETF

US regulators could approve spot ether ETFs for launch by July 4, sources say – Reuters

Coinbase sues re: Choke Point

In an effort to ferret out a Choke Point 2.0-like strategy by the Securities and Exchange Commission (SEC) and Federal Deposit Insurance Corporation (FDIC) to undermine the digital assets industry, crypto platform Coinbase has filed a new lawsuit against the regulators.

Paul Grewal, Coinbase’s chief legal officer, commented on X, “This is no way to regulate. And this is no way to operate a transparent government. Today we demand better from our financial regulators. We appreciate the Court’s attention to these important issues and look forward to sharing updates in the future.” See the tweet thread.

Fox Business covers the news and summarizes, “According to the lawsuits filed Thursday in a Washington, D.C., district court, the U.S.’s largest crypto exchange is suing both regulators to gain access to internal records to shed light on what it describes as a ‘deliberate and concerted effort by the SEC, FDIC and other financial regulators’ to pressure banks to deny crypto firms access to the federal banking system.” Read more.

more tips:

what you should know: Given the scope of all the legal entanglements in which the company is currently engaged with the federal government, Coinbase’s legal operation could someday be the basis of a textbook on the defense of an emerging industry. Being able to tap public markets for funding helps the pay the legal bills, too.

Coinbase advisor joins Biden

Acccording to The Hill yesterday, former Atlanta Mayor Keisha Lance Bottoms (D), who is a Coinbase Global Advisory Council member, is joining the Biden campaign as a “senior adviser.”

Ms. Bottoms had just appeared on Wednessday at a Coinbase “Stand With Crypto” event when the news broke. She’s indicated that she’ll remain with Coinbase’s Council, says the Hill. Read more.

But, joining the Biden campaign is feeling a bit different than joining the Biden Administration these days.

As the Hill notes, “An inaugural member of the global advisory council, Rep. Sean Patrick Maloney (D, NY) stepped down from his position earlier this year amid concern from Sen. Elizabeth Warren (D, MA) about a potential conflict of interest (read progressive publication ‘American Prospect’ in January) after he was nominated by Biden as U.S. representative to the Organization for Economic Cooperation and Development (OECD).”

more tips:

-

- Coinbase’s Global Advisory Council – Coinbase

what you should know: There are two glasses of interpretation.

glass half-empty: The Biden campaign wants to align with pro-crypto voices – in the interest of capturing pro-crypto votes – that can be easily jettisoned once the election is held in November. Administration appointments are “another level.”

glass half-full: The Biden Administration and campaign are becoming more pro-crypto. See Carole House appointment.

opinions

Why Crypto Voters Will Likely Not Decide The 2024 Presidential Election – Forbes

U.K.’s Next Government Must Act Fast to Regulate (and Retain) Crypto Firms – CoinDesk

nomination skepticism

-

- “Probably good time to flag that Biden admin has nominated another crypto-skeptic [CFTC Commissioner Christy Goldsmith Romero] for FDIC Chair, and is re-nominating the currently most-anti-crypto SEC commissioner (hint: it’s not actually Gary) [SEC Commissioner Caroline Crenshaw]. Hearing will be July 11 in Senate Banking.” – Alexander Grieve, policy executive at venture firm Paradigm, on X yesterday

still more tips

Trump and Biden’s visions for 21st-century tech – Politico’s Digital Future Daily

Dems mocked crypto, now a $160M bitcoin war chest could ruin their November: ‘Our Founding Fathers would have been bitcoiners’ – New York Post

Coinbase + Stripe team up to expand global adoption of crypto – Coinbase blog

Cryptocurrency Solana Soars After VanEck Files for Spot ETF – The Wall Street Journal

Crypto catches M&A frenzy as bitcoin miners chase AI boom – CNBC