Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

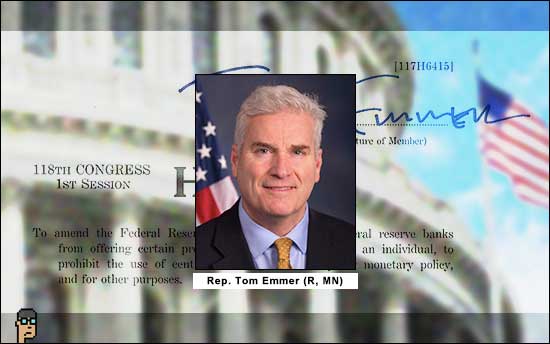

CBDC Anti-Surveillance State Act

Majority Whip Rep. Tom Emmer (R, MN) will introduce new legislation which seeks to limit the U.S. Federal Reserve’s ability to roll out a Central Bank Digital Currency (CBDC). Titled “CBDC Anti-Surveillance State Act,” Punchbowl News’ Brenden Pedersen reports there is broad support among Republicans – especially on the House Financial Services Committee. But he adds, “even with slim odds of passing in a Democratic Senate for now, we think it would be a mistake to wave this off as a simple messaging bill from House Republicans.” Among concerns for Republicans with CBDCs is giving government the ability to see consumer transaction data, i.e. no privacy. See a copy of the bill (PDF).

Rep. Emmer summarized the bill’s key points on Twitter:

-

- “Prohibits the Fed from issuing a CBDC directly to anyone.”

- “Bars the Fed from using a CBDC to implement monetary policy and control the economy.”

- “Requires the Fed’s CBDC projects to be transparent to Congress and the American people.”

Punchbowl’s Pedersen tweeted later, “Some folks like to imagine the GOP could come around to a US digital dollar for [National Security] reasons. We’re not there yet!”

The tug of war between private stablecoins and CBDCs is taking another step as US Dollar dominance as the World’s reserve currency hangs in the balance.

CBDCs “yes,” stablecoins “no”

Speaking in Singapore, Bank for International Settlements (BIS) General Manager Agustín Carstens said, “Many crypto proponents argue that stablecoins should be the future of money. But what this view forgets is that what sustains fiat money is not the application of novel technologies but all the institutional arrangements and social conventions behind it. And it is precisely these arrangements and conventions that make money reliable for the public.” Carsten argues that the power of the ledger for CBDCs is very compelling. Read the speech.

Tip: What is BIS? (Wikipedia)

stablecoins – Reves test

Securities lawyers are chiming in on the SEC’s claim of jurisdiction over Paxos and its Binance stablecoin, BUSD. Is BUSD a security? The Wall Street Journal explains how the “Reves test” may undermine the SEC’s argument: “The Reves test considers the parties’ motivations but also asks whether another regulatory system applies to the asset, which would make SEC oversight unnecessary. New York financial regulators authorized the issuance of BUSD, and Paxos Trust is overseen by the state agency.” Read it.

stablecoins – euro coin

Coinbase said that Euro Coin began trading yesterday at noon ET through its exchange. According to Circle who issues the token, Euro Coin is similar to its $43 billion USDC stablecoin product: “Euro Coin is 100% backed by euros held in euro-denominated banking accounts so that it’s always redeemable 1:1 for euros.” Learn more.

stablecoin roundtables (Twitter)

“Getting lots of questions re stablecoins & SEC: Facts & circumstances of course, but SEC should defer to Congress, which is actively considering the issue. In the meantime, we & other regulators could hold public roundtables. Enforcement actions aren’t the way to write the rules.” – from SEC Commissioner Hester Peirce on Twitter yesterday

custody – TradFi’s opportunity

Bloomberg reports that given question marks raised by the Securities and Exchange Commission (SEC) around how crypto custody rules will shake out, and the attractive custody fees, entrenched traditional banks may win out over crypto startups.”Several of old-school finance’s biggest names including Brevan Howard Asset Management, State Street and Standard Chartered currently own, invest in or hold major partnerships with crypto custodians like PolySign’s Standard Custody, Copper Technologies Ltd. and Zodia Custody.” TradFi buys DeFi could be ahead. Read more.

SEC – Gensler under Republican fire

Letter #1 (see it) – Rep. Ann Wagner (R, MO), Chair of the House Financial Services’ Capital Markets subcommittee has reproached the Securities Exchange Commission’s Democratic Chair Gary Gensler again in a congressional letter about “needlessly overhauling equity market structure.” Sent last Friday, Rep. Wagner asks a number of questions and concludes emphatically, “It is not the government’s role to pick winners and losers among issuers or investors, but that is exactly what you are doing.” Read her press release, too.

Here’s Rep. Wagner’s letter on the same subject back in November – see it.

Letter #2 (see it) – Yesterday afternoon, House Financial Services Chair Rep. Patrick McHenry (R, NC), HFS Oversight and Investigations Subcommittee Chair Rep. Bill Huizenga (R, MI) and Senate Banking Ranking Member Senator Tim Scott (R, SC) announced that they had questions about Chair Gensler’s climate disclosures proposal. Read their joint press release.

Republican SEC Commissioner Hester Peirce and former Senator Phil Gramm (R, TX) expressed similar overreach concerns about Chair Gensler in a Wall Street Journal op-ed in January.

Treasury’s blockchain kudos

Journalist Kollen Post reported in a Twitter thread on Tuesday that after Deputy Secretary of the U.S. Treasury Wally Adeyemo gave a speech defending the Treasury’s record on Russia sanctions, he had something positive to say about part of the blockchain industry.

According to Post, in answer to a question from Circle’s head of global policy Dante Disparte, Adeyemo replied, “We’ve taken actions against those in the blockchain ecosystem that we feel are not taking those appropriate steps to protect the system from illicit actors and we’re committed to continuing to do so, but to your point, we think that there are responsible actors within the system who are building systems that help to protect against these types of illicit activities going forward and we look forward to continuing to work with them.”

You want more

-

- NBA-Branded ‘Top Shot’ Moment NFTs May be Securities, Judge Rules in Dapper Labs Case – CoinDesk

- Binance aggressively converted rivals’ stablecoins in a massive cash grab. It didn’t always tell its customers – Fortune

- The Bitwise/VettaFi 2023 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets (PDF)

- Hear me out: what’s a hearing and why are there so many on crypto? – Crypto Council for Innovation

- New York Attorney General sues CoinEx crypto exchange over registration – The Block

If you would like this delivered as a newsletter, please sign up here.