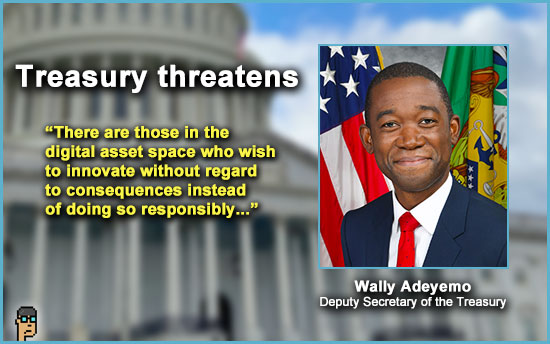

Treasury threatens crypto

Last Friday, a speech to be delivered by U.S. Deputy Treasury Secretary Wally Adeyemo at foreign-policy think tank Royal United Services Institute in London warned “cryptocurrency firms against allowing their platforms to be used to finance terrorist organizations, as scrutiny mounts of how Hamas may have used digital currency to fund its attack on Israel,” reported The Washington Post.

The Post published an excerpt from Adeyemo’s Friday speech the day before: “There are those in the digital asset space who wish to innovate without regard to consequences instead of doing so responsibly, including protecting against illicit financing. (…) Let me be clear: We will use every tool available to go after any person or platform that is facilitating the movement of resources for terrorists.” The theme speaks to an October 19 rulemaking proposal by Treasury’s FinCEN around mixers which has implications for decentralized finance (DeFi). Read more.

what you should know: The fact the speech was shared by the Administration ahead of time with WaPo is telling. The speech feels like a new level as the speech increases the pressure on the digital assets industry while also showing clear support for legislative efforts in Congress which seek tough or draconian efforts to shut down cryptocurrency, in particular, in the United States. Adeyemo also spoke to CNN on the same day as the speech with a similar tone about crypto and illicit financing.

-

- Correction: The above story has been updated to reflect that the speech happened on October 27 rather than Friday, November 3.

It’s not about one report

Chair Sherrod Brown (D, OH) and Sen. Elizabeth Warren (D, MA) of the Senate Banking Committee are not impressed with the digital assets industry’s efforts to dispute the connection between crypto and illicit financing portrayed by an October 10 article in The Wall Street Journal.

Punchbowl News Brendan Pedersen provides an overview of the latest and quotes Sen. Warren who says, “It’s not about one report… It’s about the whole structure of crypto that attracts some of the worst people around the world to move value around in a way that they cannot do through the ordinary banking system.” Fellow Banking Committee member Senator Cynthia Lummis (R, WY) chimes in and expresses concern about the damage done by the WSJ article. Read more.

Warren’s “Digital Asset Anti-Money Laundering Act [S.2669]” and recent Congressional letter has received strong support from Democrats in both Houses as well as some Senate Republicans including Sen. Roger Marshall (R, KS).

what you should know: Perhaps Sen. Lummis wasn’t satisfied by the characterization of her comments in Punchbowl News because later in the day on X, she unleashed a thread on inaccuracies related to crypto’s share of terrorist financing. She concluded emphatically, “Make no mistake, crypto assets are NOT the problem. Bad actors, who exist in every sector, are. The future for crypto assets in America is brighter than ever.”

GAO on SAB 121

A controversial April 2022 accounting bulletin issued by the Securities and Exchange Commission’s (SEC) Chief Accountant, Paul Munter, and known as Staff Acccounting Bulletin (SAB 121) was called out yesterday by the Government Accountability Office, who said, in so many words, the SEC overstepped its bounds with the rule.

The GAO writes, “The Bulletin provides interpretive guidance regarding how covered entities should account for and disclose their custodial obligations to safeguard cryptoassets held for their platform users. SEC did not submit a report pursuant to the Congressional Review Act (CRA) to Congress or the Comptroller General on the Bulletin.” And the SEC should have. Read the announcement.

And then, read the GAO’s 10-page report on the findings.

In an interview in July 2022, SEC Chair Gary Gensler expressed not an inkling of concern about SAB 121’s creation, “And this is the same process that we’ve gone into before and and gives issuers – public company issuers – advice, and in this case, we had a number of companies coming to us saying, ‘How do you think this should be accounted for?’”

what you should know: This loss by the SEC couples with the increasing number of court cases that the securities regulator has lost such as Ripple, Grayscale, and even a Uniswap case, where it may not have been the complainant, but it arguably had a horse in the race.

GAO on SAB 121 – reaction

Senator Cynthia Lummis (she was busy yesterday!) and Rep. Patrick McHenry (R, NC), Chair of House Financial Services, responded to the news in the late afternoon yesterday with a press release. Sen. Lummis said in part, “Ensuring well-regulated financial institutions are able to provide safe custody for Americans’ hard-earned financial assets is my top priority. [SAB 121] sets an incredibly dangerous precedent. I plan to use the Congressional Review Act to block this rule in the coming weeks.” McHenry concluded his statement by saying, “SAB 121 was drafted with zero input from prudential regulators and the public, and now Congress must step in to block this harmful rule.”

Also yesterday, House Financial Services Committee member Mike Flood (R, NE) linked to the GAO decision on X and said, “The GAO has spoken. Staff Accounting Bulletin 121 is a rule, not mere guidance as the [SEC] claims. Rest assured, Congress will act to rein in Chair[Gary Gensler]’s overreach on this issue.” Read it.

Flood questioned Chair Gensler on SAB 121 in a September HFS SEC oversight hearing and has his own bill targeting the bulletin.

In a Congressional letter last May, HFS Chair McHenry asked House Appropriations committee Chairwoman Kay Granger (R, TX) and Ranking Member Rosa DeLauro (D, CT) to “prohibit funding for Staff Accounting Bulletin 121” in that it “precludes banking organizations from serving clients seeking digital asset safeguarding services…” McHenry continued at the time, “Moreover, such policy decisions made by staff circumvent the notice and comment requirements set forth in the Administrative Procedure Act and should not be funded.” Read the May 2023 letter (see page 4).

what you should know: In Congress, the House Financial Services’ digital assets market structure bill sponsored by House Agriculture Committee Chair Glenn “GT” Thompson (R, PA) and co-sponsored by HFS Digital Assets Subcommittee Chair French Hill (R, AR), among others, takes aim at SAB 121. Rep. Flood’s bill is a standalone option introduced later. The GAO may have beaten them all to it.

52, 40, 16, 13

Better Markets, a lobbying firm run by Dennis Kelleher and closely aligned with Democratic policy perspectives in financial markets (Kelleher and SEC Chair Gensler were members of the Biden transition team in 2020), continues to take aim at Coinbase’s “52 million” cryptocurrency user number in the United States. Yesterday, a tweet from Better Markets referred to the Coinbase number as “rigged” and “bogus” though it doesn’t suggest what the actual number is.

In a speech last week and reported by Politico on Monday, Internal Revenue Service Director Julie Foerster suggested 40 million crypto buyers and sellers as the agency received feedback on its new crypto reporting proposal.

Digging deeper last week, accounting publication Tax Notes shared Foerster’s discussion of the details of the proposed new digital assets reporting: “IRS and Treasury estimate that between 13 million and 16 million taxpayers will account for the deluge of the new Forms 1099-DA.”

Also from Tax Notes: “The IRS plans to soon release a draft Form 1099-DA to be used by brokers to report transactions after the form’s instructions are completed, according to Foerster.” Read more (sign up required).

what you should know: 50 million, 40 million, 16 million, 13 million… the real question is: how many of those crypto users are single issue voters who will vote for or against a candidate – President – in 2024? In a polarized voting environment, where a small slice of undecided voters in the middle could decide the election, the impact could be significant.

hear ye, hear ye

Coming November 7, House Financial Services has called together a hearing for Financial Institutions and Monetary Policy Subcommittee called “The Tangled Web of Global Governance: How the Biden Administration is Ceding Authority Over American Financial Regulation.” Rep. Andy Barr (R, KY) is the Chair – and was also McHenry’s chosen replacement at last week’s Capitol Account event where Barr spoke about digital assets legislation.

No agenda information is available on the hearing’s web page – yet. But, digital assets could be a part of this given the topic.

a lobbying update

The grassroots “Stand With Crypto” lobbying organization – with help from Coinbase – is getting some traction. Stand With Crypto executive Nick Carr tells CoinDesk’s Jesse Hamilton that 80,000 people have donated over $2 million to date. The group also claims at least 16,000 calls to lawmaker offices.

Hamilton concludes, “Though Stand With Crypto is meant to gather crypto enthusiasts at all levels, the biggest digital asset companies could benefit if the group starts making progress with lawmakers.” Read more.

what you should know: That’s a lotta calls. If you’re curious, read how Amazon Web Services says it’s helped Congress deal with high call volume.

Chair Gensler tweet

A tweet from SEC Chair Gary Gensler‘s X account yesterday (Halloween):

“If Satoshi Nakamoto went as Satoshi Nakamoto for Halloween, would we be able to tell?”

“Happy 15th anniversary to Satoshi’s famous white paper that started crypto.”

“Any crypto companies that are tricking investors should start treating them to compliance with the securities laws.”

more tips:

Satoshi Nakamoto – Wikipedia

tokenized deposits vs. stablecoins

The upcoming Singapore Fintech Festival from November 15-17 is bringing together world financial leaders for a discussion on the latest and greatest in financial technology including blockchain. See agenda.

Dante Disparte, Chief Strategy Officer and Head of Policy for Circle, issuer of the USDC stablecoin, promoted on X yesterday his upcoming appearance along with executives of JP Morgan, UBS and BNY Mellon in a panel called, “Digital Currency Showdown: Stablecoins Vs Tokenised Deposits.”

The panel’s description teases, “… the key question looms: Which contender can maximise payment utility while minimising associated risks? Tokenised deposits enjoy stronger trust from established systems, but can they guard against new capabilities like programmability and interoperability? Fiat-backed stablecoins could offer more inclusive reach but are still playing catch-up on the regulatory race – can it hit critical mass in time to realise its full potential?” Read more.

more tips:

The Digital Pound Foundation in the UK breaks down the differentiation in a self-published bulletin in September with a Central Bank Digital Currency (CBDC) a part of the mix.

what you should know: In the United States, Congressional Republicans are adamantly against CBDCs with Majority Whip Tom Emmer’s (R, MN) CBDC Anti-Surveillance State Act [H.R. 1122] emblematic of the pushback. A House Financial Services Subcommittee on Digital Assets, Financial Technology and Inclusion hearing in September on CBDCs showed division including some reticence against Democrats, too. Read that one.

still more tips

Biden AI plan is one step in avoiding crypto trap – Reuters

Grayscale’s Ethereum ETF just entered a 240-day review process. Its Bitcoin cousin is expected in January – Fortune

Crypto mogul looks to seize control of company that publishes Sports Illustrated – NY Post