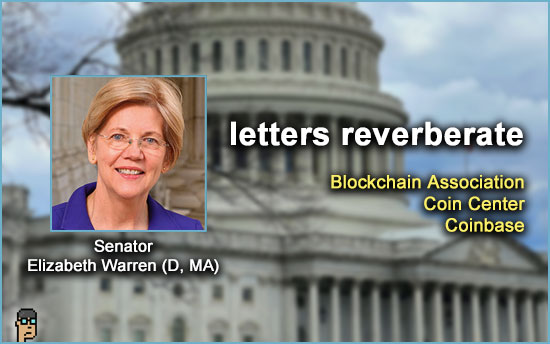

Warren letters – three

The three letters sent by Senator Elizabeth Warren (D, MA) on Monday to industry organizations Blockchain Association (see BA’s letter) and CoinCenter as well as Coinbase continued to reverberate yesterday.

Ultimately, the letters are intended to increase support for her Digital Asset Anti-Money Laundering Act (S.2669), a bill considered potentially destructive in its scope by industry. The Senator’s de facto marketing campaign of letters included a request for a list of members of government, military and law enforcement employed by each of the orgs.

CoinCenter’s Jerry Brito commented on X, “Coin Center received the same impertinent letter from Elizabeth Warren as the BA and Coinbase. Read it for yourself to see what a bullying publicity stunt it is.” See the CoinCenter letter.

Coinbase Chief Legal Officer Paul Grewal said of the letters on X, “What’s appalling is smearing the integrity of people who have served our country, in uniform and otherwise. Especially when that same “door” leads to your own office.” In the Coinbase letter, Politico notes the special attention given by the Senator to Coinbase’s Global Advisory Council which includes Defense Secretary Mark Esper (R) and former Sen. Pat Toomey (R, PA) among others. Read more from Politico’s Zach Warmbrodt. And, see the Coinbase letter.

At the end of the day yesterday, Senator Warren re-tweeted the Politico story and doubled-down on X, “Crypto companies are spending millions building an army of former defense and law enforcement officials to lobby against new rules shutting down crypto-financed terrorism. This revolving door boosts the crypto industry, but endangers our national security.”

According to CoinDesk’s Jesse Hamilton, Senator Warren’s accusations of “revolving door politics” leveled at the digital assets industry speaks to a public advocacy group’s study in 2019 which found 2/3 of former members of the 115th U.S. Congress had received jobs “influencing federal policy through lobbying or strategic consulting jobs.”

what you should know: All three letters request answers to Senator Warren’s questions by January 14, 2024. Will there be a Senate Banking hearing shortly thereafter? Senator Warren sits on the committee.

Warren letters – reaction

Paradigm policy executive Alexander Grieve offered his take on X on the Senator’s letter fusillade, “It increasingly seems as though the strategy of crypto opponents in DC is to no longer to win on the merits an argument, but to attack the credibility of the messenger.”

David Ackerman, head of compliance at MobileCoin, was a signer of the Blockchain Association “NatSec” member letter sent Congress on November 15,. Ackerman published a tweet thread in response to Senator Warren’s new inquiries concluding, “The protection of America and Americans is difficult, and reasonable minds will differ on how to achieve strategic aims; however if we vilify one another this only succeeds in weakening our defense and strengthening our enemies resolve. I will always choose America.”

In reaction to the Warren letters, industry advocate Chamber of Digital Commerce published a video of S.2669’s co-sponsor Sen. Roger Marshall (R, KS) at the December 7 Parliamentary Intelligence Security Forum (see agenda) where he calls the legislation a “light touch” and explains its evolution: “The first thing we did was we went to the American Bank[ers] Association and we said, ‘Help us craft this.'” See the Chamber’s tweet with the video. This is the first time the origins of the bill have been discussed and gives proof to today’s collision between traditional finance and decentralized finance.

what you should know: This was a well-timed series of letters by Senator Warren – there’s not a lot going on in DC with digital assets this week and these letters were substantive enough to fill a media void. (raising hand…)

still more tips

UK Finance Minister to probe banking challenges faced by country’s crypto firms – The Block

Private Credit Rebounds in the Crypto Sector With a 55% Jump in 2023 – Bloomberg

Opinion: S&P’s Stablecoin Report Is a Vote of Confidence for Crypto. But does crypto care? – CoinDesk

2023: Year In Review – DeFi Education Fund

Why This Firm Is Going All in on Venture Capital Funds Now – The Wall Street Journal