SAB 121 this week

On Friday, House Majority Leader Steve Scalise (R, LA) announced his schedule for this week and the resolution rescinding the Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin 121 “may” reappear.

The bottom of the schedule reads:

“Legislation that may be considered:

Veto message to accompany H. J. Res. 109 – Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Securities and Exchange Commission relating to ‘Staff Accounting Bulletin No. 121’. (Sponsored by Rep. Flood / Financial Services Committee)”

What is the “veto message”?

H.J.R.109 passed both House and Senate on a bipartisan basis in May only to receive the President’s veto.

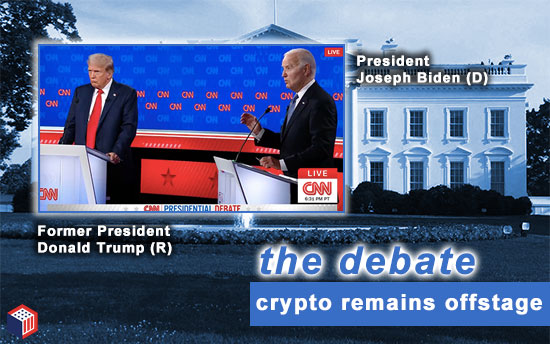

Will Republican House leaders – led by House Financial Services Chair Patrick McHenry (R, NC) – try another vote that overrides the President whose Administration seems to be reeling post-debate? Giving Democrats an opportunity to distance themselves from the President makes logical sense.

Or, will Republican House leaders simply highlight for the voting public that the Democratic President is the one who rejected the resolution which had been approved on a bipartisan basis?

Chair McHenry’s office did not respond to a request for comment.

more tips:

-

- Veto Override Procedure in the House and Senate – Congressional Research Service

Continue reading “SAB 121 ‘Veto Message’ In House This Week; Digital Assets Gets Senate Ag Hearing”

- Veto Override Procedure in the House and Senate – Congressional Research Service