Continue reading “Congressman Flood: Stablecoins Legislation a Crossroads in Banking Policy”

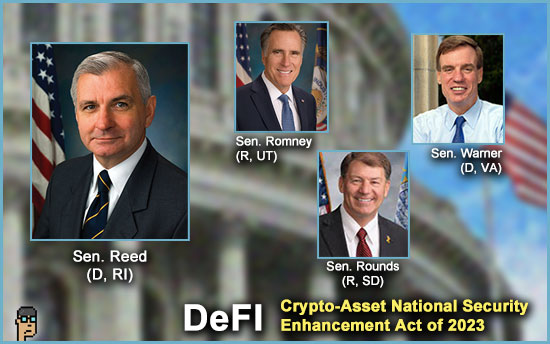

Bipartisan DeFi Bill Introduced By Senator Reed; Crypto Amendment Bill Update

new DeFi bill

A new bipartisan bill introduced on Tuesday is focused on decentralized finance (DeFi) and its combination with Anti-Money-Laundering (AML) and Know Your Customer (KYC) requirements – and concerns. There is nothing related to innovation in this bill.

Called the “Crypto-Asset National Security Enhancement Act of 2023” and introduced by Senate Banking Sen. Jack Reed (D, RI) with Senators Mark Warner (D, VA), Mike Rounds (R, SD) and Mitt Romney (R, UT) as co-sponsors.

The bill is known as “S.2355” on Congress.gov or “A bill to clarify the applicability of sanctions and antimoney laundering compliance obligations to United States persons in the decentralized finance technology sector and virtual currency kiosk operators, and for other purposes.” Visit Congress.gov.

CoinDesk reports that the bill places “requirements on ‘anyone who “controls” a DeFi protocol or makes available an application to use the protocol,’ likely a reference to groups who build user-friendly frontends for protocols’ otherwise cumbersome smart contracts, as Uniswap Labs does for Ethereum’s top decentralized exchange.”

new DeFi bill – ‘purport’

According to the Congressional Record, Sen. Reed said in introducing the bill, “Decentralized finance or ‘DeFi’ refers to cryptocurrency protocols and applications that purport to allow automated peer-to-peer transactions using blockchain technology. DeFi enables users to transact and trade cryptocurrency without requiring a traditional financial institution to broker trades, clear and settle transactions, or custody assets.”

Reed added, “Criminal syndicates, fraudsters, ransomware hackers, and rogue states have been quick to recognize how DeFi can be exploited to advance their nefarious activities. By design, DeFi provides anonymity allowing malicious and criminal actors to evade traditional tools that the government uses to enforce the AML and sanctions laws.” Read more.

The industry association, DeFi Education Fund, didn’t hesitate in offering its ‘take’ on the new bill. From its Twitter account, the Fund said in a thread, “While we are supportive of effective measures to combat the illicit use of DeFi, the bill introduced today essentially says ‘centralize, shut down, or get out of the United States.’ There are far better options that can not only help combat the illicit abuse of DeFi but also do so at a much lower cost to crypto users’ rights and to technological innovation in the United States.”

Digital Chamber of Commerce commented on the bill in a blog post. The industry organization is not impressed: “The Chamber views it as an excessive and misguided approach to addressing security issues related to decentralized finance (DeFi) and Crypto Kiosks.” Read more – including Digital Chamber policy executive Cody Carbone explaining why its a “bad bill.”

more tips:

Regarding “crypto-asset,” do we really need the hyphen?

Continue reading “Bipartisan DeFi Bill Introduced By Senator Reed; Crypto Amendment Bill Update”

Market Structure Bill May Gain Momentum; Senators Offers NDAA Amendment On Crypto

Ripple – market structure bill

Rep. Glenn “GT” Thompson (R, PA), Chair of the House Agriculture Committee, sees new hope in the District Court Judge Analisa Torres ruling last week in the SEC vs Ripple lawsuit.

According to Bloomberg, Chair Thompson said to reporters, “The Ripple decision has highlighted what we’ve been saying all along — there’s confusion about how digital assets are treated under the securities laws, and it’s up to Congress to step in and provide both certainty and clarity.”

Furthermore, Thompson said this could help Democrats come aboard the new market structure bill “and even co-sponsor the bill” which is currently shepherded by House Ag and the House Financial Services (HFS) Committee. Read it.

more tips:

Blockchain Association’s Ron Hammond published a Twitter thread noting there is currently one Republican version of the market structure bill, no Democratic version. He explains, “However, the Ripple case changes this. Some hate the outcome, others praise it. Regardless of one’s takeaway, there is a common theme of confusion after the fact and legislation is the only clarifying force.” Read it. Will Democrats engage? Continue reading “Market Structure Bill May Gain Momentum; Senators Offers NDAA Amendment On Crypto”

Markup Moving For Stablecoin, Market Structure Bills; FSB Finalizes Crypto Framework

markup moving

The long-awaited markup of the stablecoin and market structure bills by the House Financial Services Committee will been moved as Politico’s Eleanor Mueller reports, “staffers received another email Friday informing them that the markup would take place on July 26 instead.” Read a bit more.

Separately, Politico notes that House Agriculture Chair Glenn Thompson (R, PA) wants his committee to engage in a markup of the market structure bill “before August recess.” Republicans are hoping they can get more Democratic support on the market structure bill given last week’s Ripple/XRP decision, too, says the publication.

global regulations

The Financial Stability Board (FSB) announced yesterday that it has finalized its “global regulatory framework for crypto-asset activities.” Get it.

As Cointelegraph notes, “The framework consists of two distinct sets of recommendations: ‘High-level recommendations for the regulation, supervision and oversight of crypto-asset activities and markets;’ and ‘Revised high-level recommendations for the regulation, supervision, and oversight of “global stablecoin” arrangements.'” Read more.

The FSB’s framework has likely had plenty of U.S. input from the FSB’s three U.S. board members: the Federal Reserve Vice Chair Michael Barr, Securities and Exchange Commission (SEC) Chair Gary Gensler and Treasury Undersecretary Nellie Liang. Continue reading “Markup Moving For Stablecoin, Market Structure Bills; FSB Finalizes Crypto Framework”

Bipartisan Stablecoin Bill Update From Reps. French Hill And Jim Himes Shows Progress

In a conversation with the Atlantic Council webcast earlier today, a bipartisan update on the stablecoin bill was provided by Rep. French Hill (R, AR), Chair of House Financial Services’ (HFS) Subcommittee on Digital Assets, Financial Technology and Inclusion, and Rep. Jim Himes (D, CT), a member of the HFS Committee and also Ranking Member of the House Permanent Select Committee on Intelligence.

The discussion was led by the Atlantic Council’s Josh Lipsky and Ananya Kumar. See the interview here.

Click below (or scroll down) for several highlights from the 50-minute conversation:

The following transcript has been lightly edited for clarity.

on addressing commingling

REP. FRENCH HILL (R, AR): “We’ve seen a lot of digital asset players that are holding themselves out as an exchange. Or, they’re creating digital assets or trying to build their digital ecosystem where they produce their own stablecoin and effectively make a market in it – where nobody knows what the value of it is, how it’s characterized, how it’s overseen.”

“And that was a big challenge in the FTX collapse. People loaned against something they didn’t even understand the value of -including a lot of sophisticated players too. So yes, it’s gonna rival the losses back in the dotcom boom when it’s all said and done. We tried to address that by defining first and foremost what is stable? How is it defined? They have to have an audit. They have monthly attestation. They have exposure of their liquidity. This is something that’s not the case in stablecoins today.” Continue reading “Bipartisan Stablecoin Bill Update From Reps. French Hill And Jim Himes Shows Progress”

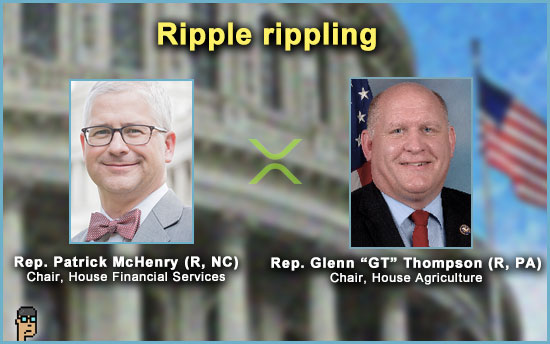

Congress Reacts To Ripple XRP Decision; Coinbase Gets Support From District Court Judge

Ripple – market structure bill

A statement late Friday from House Agriculture Committee Chair Glenn “GT” Thompson (R, PA), and House Financial Services (HFS) Committee Chair Patrick McHenry (R, NC) said that the Ripple ruling meant digital assets regulation – beginning with legislation from Congress – was needed more than ever.

From their statement: “‘This decision underscores the need for Congress to provide clear rules of the road for the digital asset ecosystem—it’s misguided to think otherwise,’ said the [two] lawmakers. The ruling gives large institutional investors greater protections than everyday Americans. Outcomes like this are what happens when regulators force courts to make policy instead of Congress. Our comprehensive market structure legislation will give all investors, customers, and market participants the same longstanding protections found in traditional financial markets.” Read the entire statement.

Later, the Republican statement looked to claim the partisan high ground, “The decision also recognizes what Republicans have said all along: there is a limit to the SEC’s reach.”

To be sure, some Democrats, such as Senator Kirsten Gillibrand (D, NY), Rep. Ritchie Torres and Rep. Josh Gottheimer (D, NJ), to name a few, might also claim this high ground with their own various SEC criticisms. It will be curious to see if or how the Biden Administration and, therefore, Democratic leadership adjust their digital assets position.

Ripple – SEC future

The impact of the Ripple ruling on the SEC has generally been seen by the pro-digital assets community as a new dawn – pending appeals – for the agency and its digital assets approach. Unsurprisingly, Stu Alderoty, who is Ripple’s Chief Legal Officer told Politico late last week, “[The SEC’s] regulation-by-enforcement strategies that have crippled the crypto economy in the U.S. have been humbled by this decision.” Read it. Continue reading “Congress Reacts To Ripple XRP Decision; Coinbase Gets Support From District Court Judge”

Ripple Ruling Celebrated By Majority Leader Emmer; Rep. Ritchie Torres Sees ‘Political Ploy’ With Prometheum

big Ripple ruling

One of the standard-bearers among digital assets lawsuits is the Securities and Exchange Commission (SEC) battle with Ripple over its XRP token. Yesterday, a judge ruled that XRP was not a security in certain instances which could significantly change the dynamic for digital assets legislation in the United States. Read a summary from Decrypt.

And, read the 34-page order here (PDF).

CoinDesk, calling it a “partial win” for Ripple, summarized the court ruling and its effects: “The SEC’s motion for summary judgment was granted by the court as it applies to the institutional sale, and otherwise denied.” Read that one.

On that note, the SEC saw a bright side to the ruling and intimated the potential for an appeal in a statement: “We are pleased that the court found that XRP tokens were offered and sold by Ripple as investment contracts in violation of the securities laws in certain circumstances.” Read more about those circumstances in The Block.

House Majority Whip Rep. Tom Emmer (R, MN) immediately took to Twitter and said, perhaps with some relief, “The Ripple case is a monumental development in establishing that a token is separate and distinct from an investment contract it may or may not be part of. Now, let’s make it law.” Digital assets has been a significant part of the Republican legislative agenda in the U.S. House of Representatives in the 118th Congress. Meanwhile, the digital assets industry has clearly been clobbered in the past year beginning with the implosions of Terra Luna and FTX and its related fraud as well as regulatory pressure.

Ripple CEO Brad Garlinghouse, who has led an unremitting campaign in defense of his company and the XRP token, quoted from the ruling on Twitter, “The most important part of this ruling: “XRP, as a digital token, is not in and of itself a ‘contract, transaction[,] or scheme’ that embodies the Howey requirements of an investment contract. This is a now a matter of law (not up for trial.).” Continue reading “Ripple Ruling Celebrated By Majority Leader Emmer; Rep. Ritchie Torres Sees ‘Political Ploy’ With Prometheum”

Responsible Financial Innovation Act Reintroduced By Lummis-Gillibrand; Google Adds Digital Assets

Lummis-Gillibrand returns

At long last, the Lummis-Gillibrand Responsible Financial Innovation Act (RFIA) has been re-introduced. RFIA is a comprehensive bill for digital assets that, at the very least, continues the digital assets conversation on the Senate side of Congress in the 118th Congress.

Read the release. And, see the bill (PDF).

Senator Cynthia Lummis (R, WY) told CNBC’s Squawk Box (see the interview), “We need a regulatory framework that integrates crypto assets into our economy in a way that ensures consumer protection. This legislation is needed to protect consumers but also so there are rules for the road for companies.” In the interview, Lummis emphasized the need for consumer protections which is perhaps an effort to appeal to Democrats.

Senator Kirsten Gillibrand (D, NY) did not appear in the media other than the press release, but her co-sponsorship of the bill remains an important signal – a Democrat in the Democratically-controlled Senate – for the success of any crypto-related bills making it through the Senate. Gillibrand didn’t appear in the media when she co-sponsored Senator Tommy Tuberville’s (R, AL) “Prohibiting Foreign Adversary Interference in Cryptocurrency Markets Act” in early June, either. That bill addressed shortcomings which Senator Tuberville identified in the Prometheum license obtained through FINRA and the Securities and Exchange Commission (SEC).

Lummis-Gillibrand – what’s new

An 8-point “What’s New” document from the Senators sets the stage for what the 118th Congress version of RFIA entails. As discussed in Senator Lummis’ TV interview, consumer protection leads, “The customer protection title of the bill is nearly double the size of the 2022 version, with added requirements on enforcement, mandatory proof of reserves, advertising, plain language customer agreements and a role for the Federal Trade Commission.” Download “What’s New.” Continue reading “Responsible Financial Innovation Act Reintroduced By Lummis-Gillibrand; Google Adds Digital Assets”