new DeFi bill

A new bipartisan bill introduced on Tuesday is focused on decentralized finance (DeFi) and its combination with Anti-Money-Laundering (AML) and Know Your Customer (KYC) requirements – and concerns. There is nothing related to innovation in this bill.

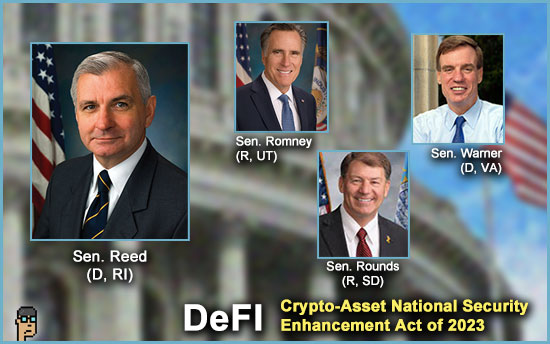

Called the “Crypto-Asset National Security Enhancement Act of 2023” and introduced by Senate Banking Sen. Jack Reed (D, RI) with Senators Mark Warner (D, VA), Mike Rounds (R, SD) and Mitt Romney (R, UT) as co-sponsors.

The bill is known as “S.2355” on Congress.gov or “A bill to clarify the applicability of sanctions and antimoney laundering compliance obligations to United States persons in the decentralized finance technology sector and virtual currency kiosk operators, and for other purposes.” Visit Congress.gov.

CoinDesk reports that the bill places “requirements on ‘anyone who “controls” a DeFi protocol or makes available an application to use the protocol,’ likely a reference to groups who build user-friendly frontends for protocols’ otherwise cumbersome smart contracts, as Uniswap Labs does for Ethereum’s top decentralized exchange.”

new DeFi bill – ‘purport’

According to the Congressional Record, Sen. Reed said in introducing the bill, “Decentralized finance or ‘DeFi’ refers to cryptocurrency protocols and applications that purport to allow automated peer-to-peer transactions using blockchain technology. DeFi enables users to transact and trade cryptocurrency without requiring a traditional financial institution to broker trades, clear and settle transactions, or custody assets.”

Reed added, “Criminal syndicates, fraudsters, ransomware hackers, and rogue states have been quick to recognize how DeFi can be exploited to advance their nefarious activities. By design, DeFi provides anonymity allowing malicious and criminal actors to evade traditional tools that the government uses to enforce the AML and sanctions laws.” Read more.

The industry association, DeFi Education Fund, didn’t hesitate in offering its ‘take’ on the new bill. From its Twitter account, the Fund said in a thread, “While we are supportive of effective measures to combat the illicit use of DeFi, the bill introduced today essentially says ‘centralize, shut down, or get out of the United States.’ There are far better options that can not only help combat the illicit abuse of DeFi but also do so at a much lower cost to crypto users’ rights and to technological innovation in the United States.”

Digital Chamber of Commerce commented on the bill in a blog post. The industry organization is not impressed: “The Chamber views it as an excessive and misguided approach to addressing security issues related to decentralized finance (DeFi) and Crypto Kiosks.” Read more – including Digital Chamber policy executive Cody Carbone explaining why its a “bad bill.”

more tips:

Regarding “crypto-asset,” do we really need the hyphen?

crypto amendment – latest

Yesterday, Senator Kirsten Gillibrand (D, NY) issued a press release on the new crypto amendment to the National Defense Authorization Act which offered quotes from the three of the four co-sponsoring Senators: Gillibrand, Cynthia Lummis (R, WY), and Roger Marshall (R, KS).

The olive branch which Lummis-Gillibrand appear to offering Senator Elizabeth Warren (D, MA) and Senator Marshall – let alone any anti-crypto Senator – is clear from the press release: “Senators Lummis and Gillibrand reintroduced the Lummis-Gillibrand Responsible Financial Innovation Act in July 2023 and included several new provisions inspired by Senator Warren and Senator Marshall’s Digital Asset Anti-Money Laundering.” Read the release.

Whether the amendment efforts will be enough to create a pathway for broader digital assets legislation in the Senate – like Lummis-Gillibrand’s Responsible Financial Innovation Act (RFIA) – remains to be seen.

Punchbowl News added color around the new amendment yesterday noting its political complexity adding, “All of this makes this NDAA amendment fascinating, even if it hasn’t been included in the [NDAA] manager’s package. The senators are pushing for the measure to be included in amendment votes and are working behind the scenes now to shore up support from colleagues.” Read more.

ConsenSys counsel Bill Hughes tweeted his reaction to the amendment yesterday: “Knee-jerk reaction: actually not all that unreasonable. I’m sure stablecoin issuers are going to take serious issue with any notion that they will be held responsible for downstream illicit use of their stablecoins, but that’s the only thing that jumps out as controversial here.”

custody ain’t easy

Another public company is dealing with reality of the SEC’s Staff Accounting Bulletin 121 (SAB 121) as NASDAQ is stepping back from trying to custody crypto due to the bulletin/rule due and regulatory concerns. BNY Mellon has reportedly stepped back for similar reasons.

According to CNBC, NASDAQ CEO Adena Friedman told participants on the company’s earnings call on Wednesday, “Considering the shifting business and regulatory environment in the U.S., we have made the decision to halt our launch of the U.S. digital assets custodian business and our related efforts to pursue relevant license.” Read more.

Also, see yesterday’s news’ on House Appropriations efforts to have the SEC re-assess SAB 121.

Ripple’s effect

Rep. Ritchie Torres (D, NY), a House Financial Services Committee member, doesn’t see the Ripple decision changing the momentum in Washington anytime soon when it comes to a digital assets regulatory framework – even it’s a legal “game-changer.” He tells Fortune’s Leo Schwartz in an article published yesterday, “It is not clear to me that the legal implications of the SDNY decision are widely understood. It should have an impact, but I’m not convinced it will.” Read it.

G20 on crypto

G20 Finance Ministers gave approval to the global Financial Stability Board’s (FSB’s) efforts to offer a global crypto regulation framework according to a “Chair Summary” saying, “We continue to closely monitor the risks of the fast-paced developments in the crypto-asset ecosystem. We endorse the Financial Stability Board’s high-level recommendations for the regulation, supervision and oversight of crypto-assets activities and markets and of global stablecoin arrangements. We ask the FSB and standard-setting bodies (SSBs) to promote the effective and timely implementation of these recommendations in a consistent manner globally to avoid regulatory arbitrage. We welcome the shared FSB and SSBs workplan for crypto assets.”

Read yesterday’s 18-page summary by the G20 (PDF).

And, get “FSB Global Regulatory Framework for Crypto-asset Activities” released on Monday by the FSB.

still more tips

Team behind crypto privacy protocol Manta Network is now valued at $500M – TechCrunch

VC Firm CoinFund Raises $158 Million to Back Crypto Startups – Bloomberg

Vitalik Buterin Explains How Ethereum Plans to Make Crypto Wallets as Simple as Email – Decrypt